Question

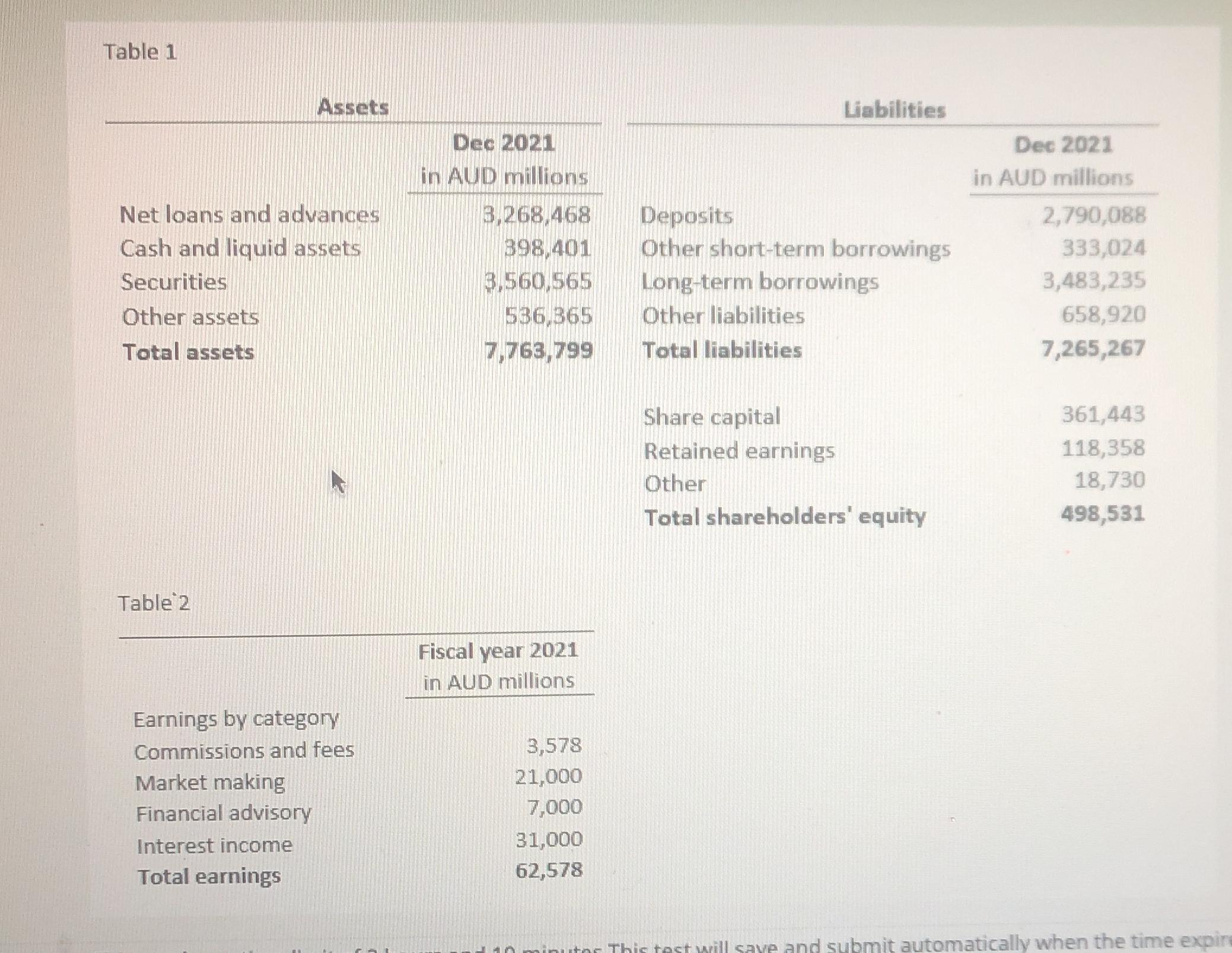

Q1) is ABC bank a commercial bank, an investment bank, or a universal bank? Why? Q2) what is AbC bank's return on equity (ROE) ratio?

Q1) is ABC bank a commercial bank, an investment bank, or a universal bank? Why?

Q2) what is AbC bank's return on equity (ROE) ratio?

Q3) what is ABC Bank's return on assets (ROa) ratio?

Q4) suppose the average ROE and ROA of banking industry are the following: Industry- average ROE=7; Industry- average ROE=5. Consider this additional information, is AbC bank more likely or less likely to take risk relative to the infustru average? Why?

Q5) ABC bank is issuing a 6- year zero coupon bond with a face value of 1000$ at a price of 700$. What is the current yield to maturity rate for similar bonds?

Q6) abc bank issued perpetual preference shares some years ago. The bank pays an annual dividend of 3,2$ and the required rate of return is 11%. If this share is currently sold at 27$, would it be a good buy and why?

Table 1 Net loans and advances Cash and liquid assets Securities Other assets Total assets Table 2 Assets Earnings by category Commissions and fees Market making Financial advisory Interest income Total earnings Dec 2021 in AUD millions 3,268,468 398,401 3,560,565 536,365 7,763,799 Fiscal year 2021 in AUD millions 3,578 21,000 7,000 31,000 62,578 Liabilities Deposits Other short-term borrowings Long-term borrowings Other liabilities Total liabilities Share capital Retained earnings Other Total shareholders' equity Dec 2021 in AUD millions 2,790,088 333,024 3,483,235 658,920 7,265,267 361,443 118,358 18,730 498,531 minutos This test will save and submit automatically when the time expire

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To answer your questions lets break them down one by one 1 Type of Bank ABC Bank appears to be a universal bank A universal bank offers a wide range o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started