Question

Q1: Microsoft and Sony just started selling the next generation of Xbox and Playstation consoles. They both announced that the respective top version (Sony Playstation

Q1:

Microsoft and Sony just started selling the next generation of Xbox and Playstation consoles. They both announced that the respective top version (Sony Playstation 5 & Microsoft Xbox Series X) are priced at $ 750 in Australia (ok, $749, but just round it up). There was speculation that they might charge a higher price, for example $900, for these models. And assume that both had to lock in these prices with stores before any of them made a public announcement about the respective price of their console.

Although a substantial number of buyers pick the brand they prefer, there are a few that purchase based on price. If both charge $750, then they split the market and make $50 Million ($50m) profit, if they charge $900, then Sony cashes in and makes $100m profit, while Microsoft gets $55m.

Because some fans are more price sensitive, Sony reaps $80m when it charges a lower price than Microsoft, which makes $25m less than Sony. If Sony is more expensive, it losesa lot of customers and earns only $40m, while Microsoft is able to increase its profits by $10 over the situation where it is more expensive.

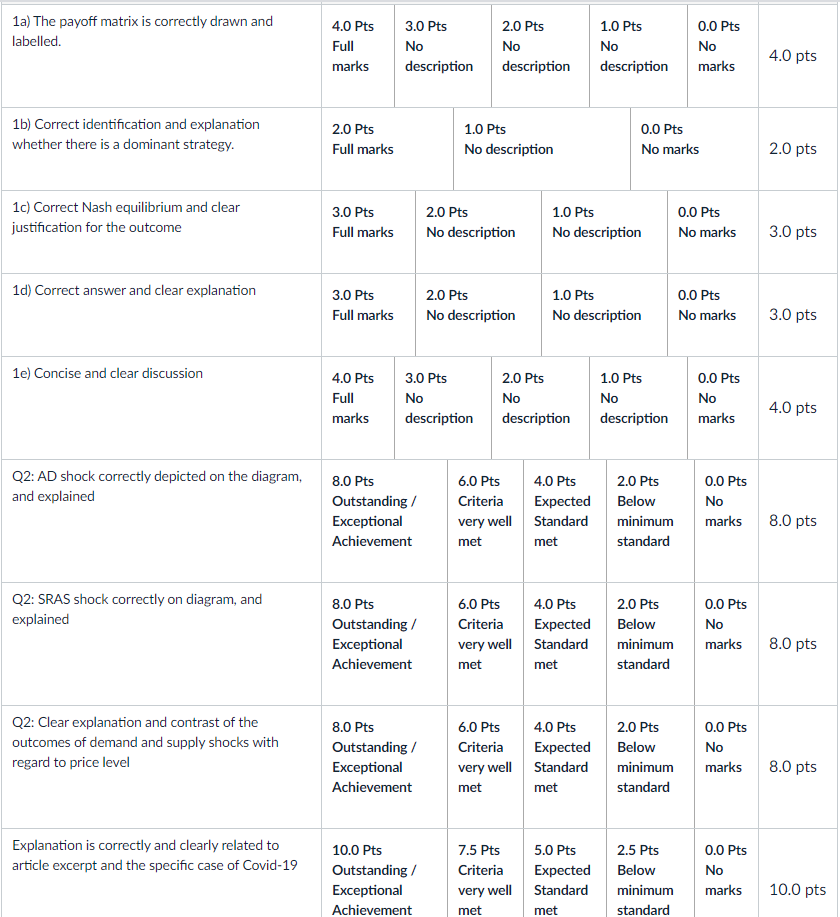

a)Draw a complete & fully labelled payoff matrix for this situation.

b)Does Microsoft have a dominant strategy? If so what is it, and why is it one? And if not, explain why not.

c)Find the Nash equilibrium and explain why it is the likely outcome for this situation.

d)Sony does not have a dominant strategy. Is it possible to have a dominant strategy for Sony when you change one of the firm's payoff (without changing the Nash equilibrium)? If so, which payoff needs to be changed and by how much?(it's enough to list one payoff in case they are multiple possibilities). If not, why not?

e)Sony actually announced its price a few days after Microsoft. Explain whether it mattered for Sony's choice of a price whether it had to lock in the price before Microsoft's announcement or not, given the payoff matrix above.

(and please focus on those two consoles only, for the purpose of this assignment the cheaper ones do not exist and the two firms only had the choice between charging $750 or $900)

Q2:

The COVID-19 pandemic, and associated public health responses such as shutdowns, can be thought to include both a negative supply shock, and a negative demand shock.

Excerpt from article

Three macroeconomic issues and Covid-19

BY:LEONARDO CADAMUROANDFRANCESCO PAPADIA,DATE:MARCH 10, 2020

https://www.bruegel.org/2020/03/three-macroeconomic-issues-and-covid-19

Supply and demand and the COVID-19 shock

COVID-19 has had clear supply effects: quarantines, closed factories, supply chain disruptions and impaired mobility obviously affect production[1]. The effects on demand are more difficult to gauge but it is critical from an economic policy point of view to get a sense of them because we have more confidence about how to deal with demand (through monetary and fiscal tools) than with supply deficiencies.

Changes in real goods prices can indicate whether COVID-19 is causing major demand effects. Specifically, if aggregate supply effects dominate demand effects, we should see prices going up as activity goes down, in a kind of repeat of the stagflation of the 1970s. At that time, central banks were in a dilemma about whether to increase rates to fight inflation or to reduce rates to support economic activity. If prices remain largely unchanged, we can conclude that aggregate demand has also been substantially negatively affected by the spread of the virus.

Your Task:

Read the excerpt above (you may want to read the full article for context or for your own interest, but you do not need to refer to the additional content there).

Use the AD-AS model, including your own diagram/s, to explain why looking at prices would be a useful way to compare the relative magnitudes of the supply shock and demand shock.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started