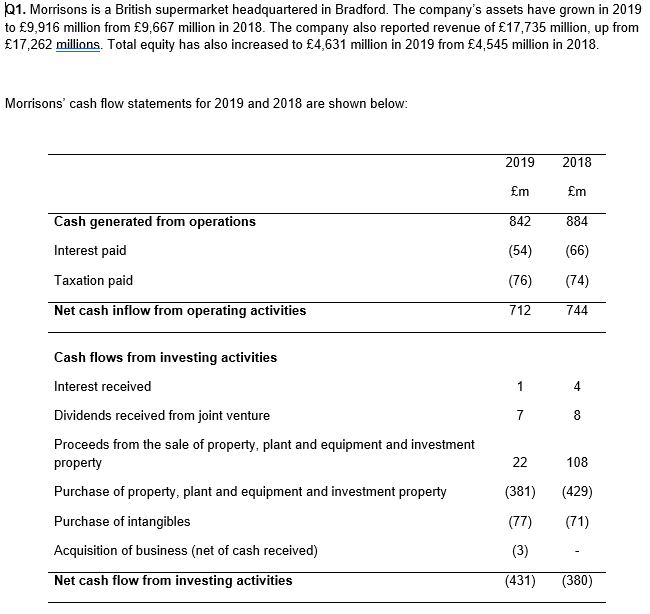

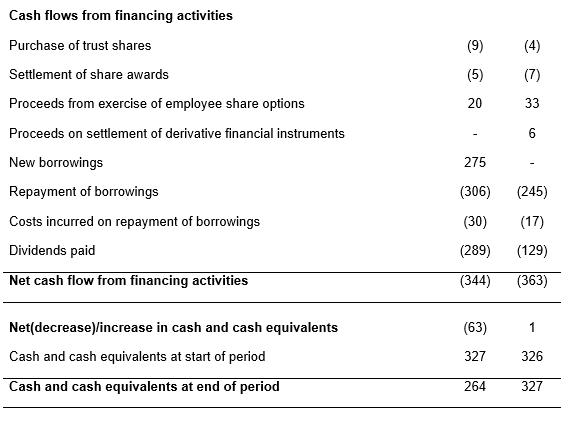

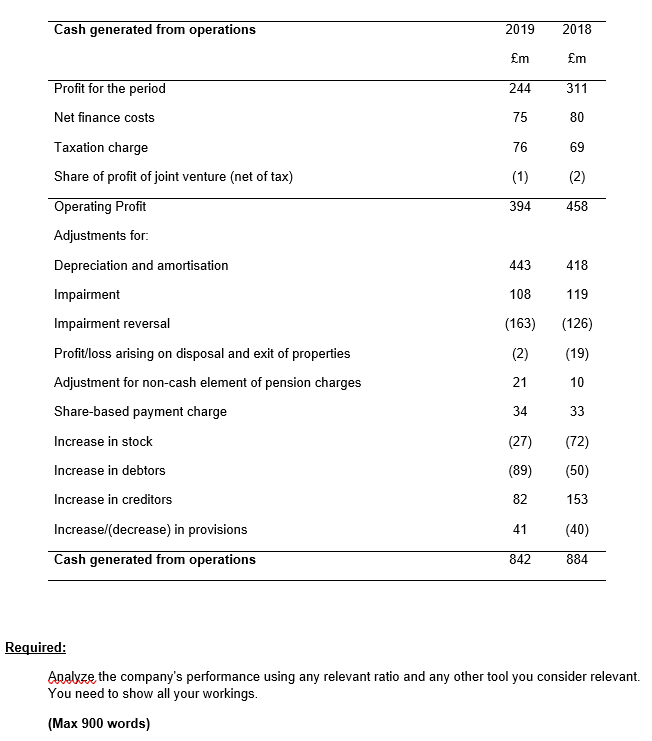

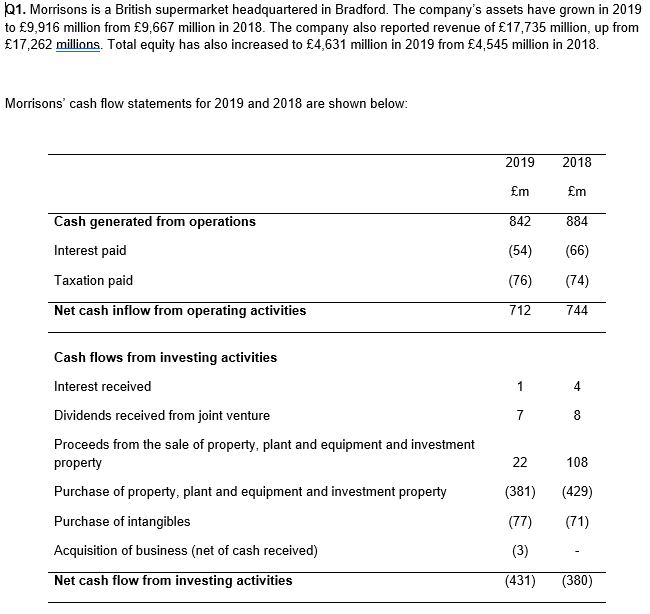

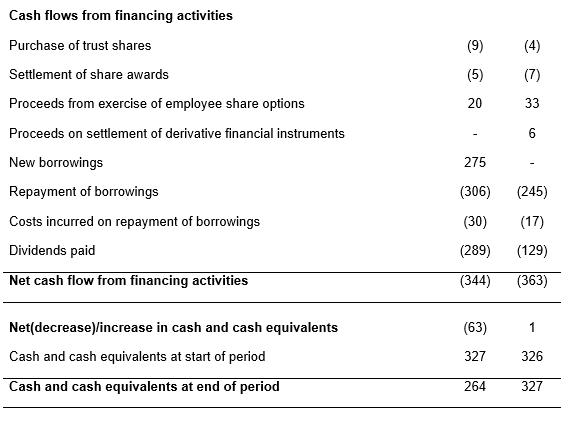

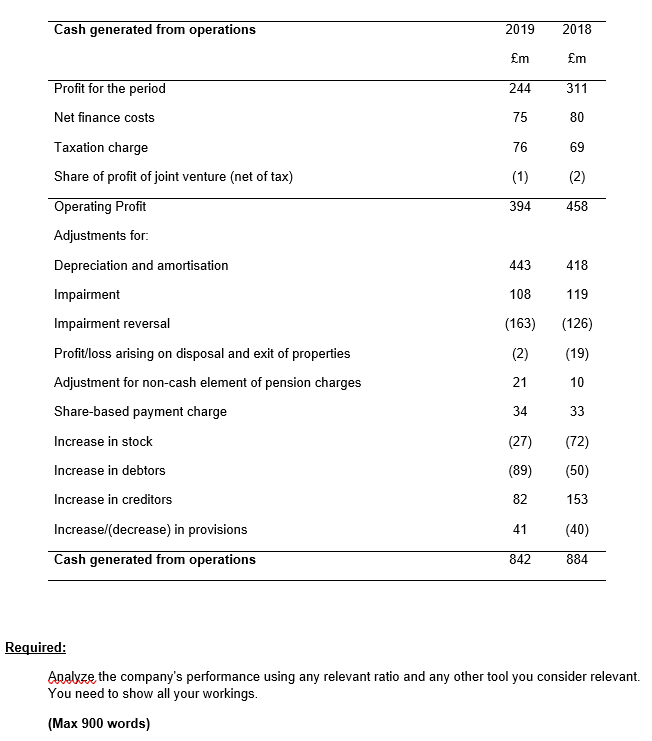

Q1. Morrisons is a British supermarket headquartered in Bradford. The company's assets have grown in 2019 to 9,916 million from 9,667 million in 2018. The company also reported revenue of 17,735 million, up from 17,262 millions. Total equity has also increased to 4,631 million in 2019 from 4,545 million in 2018. Morrisons' cash flow statements for 2019 and 2018 are shown below: 2019 2018 m m Cash generated from operations 842 884 Interest paid (54) (66) (76) (74) Taxation paid Net cash inflow from operating activities 712 744 1 4 7 8 Cash flows from investing activities Interest received Dividends received from joint venture Proceeds from the sale of property, plant and equipment and investment property Purchase of property, plant and equipment and investment property Purchase of intangibles Acquisition of business (net of cash received) 22 108 (381) (429) (77) (71) (3) Net cash flow from investing activities (431) (380) (9) (5) (7) Cash flows from financing activities Purchase of trust shares Settlement of share awards Proceeds from exercise of employee share options Proceeds on settlement of derivative financial instruments New borrowings Repayment of borrowings 20 33 6 275 (306) (245) Costs incurred on repayment of borrowings (30) (17) Dividends paid (289) (129) Net cash flow from financing activities (344) (363) (63) 1 Net(decrease)/increase in cash and cash equivalents Cash and cash equivalents at start of period 327 326 Cash and cash equivalents at end of period 264 327 Cash generated from operations 2019 2018 fm fm 244 311 Profit for the period Net finance costs 75 80 76 69 Taxation charge Share of profit of joint venture (net of tax) (1) (2) Operating Profit 394 458 443 418 Adjustments for: Depreciation and amortisation Impairment Impairment reversal 108 119 (163) (126) (2) (19) Profit/loss arising on disposal and exit of properties Adjustment for non-cash element of pension charges 21 10 Share-based payment charge 34 33 Increase in stock (72) (27) (89) (50) 82 153 Increase in debtors Increase in creditors Increasel(decrease) in provisions Cash generated from operations 41 (40) 842 884 Required: Analyze the company's performance using any relevant ratio and any other tool you consider relevant. You need to show all your workings. (Max 900 words)