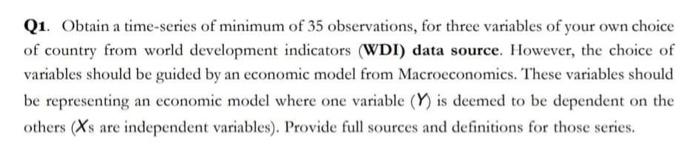

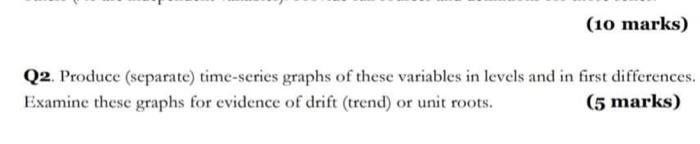

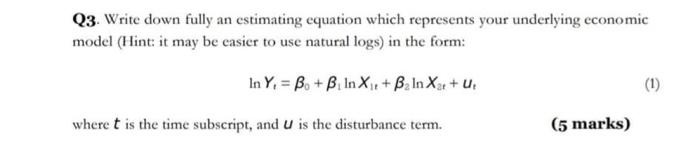

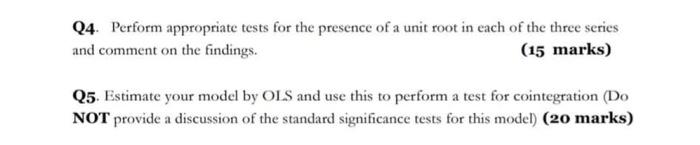

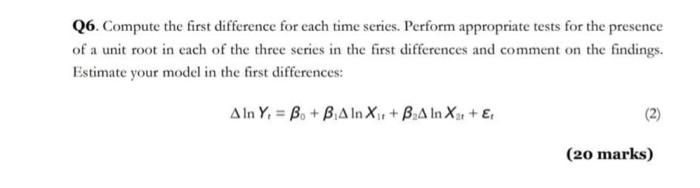

Q1. Obtain a time-series of minimum of 35 observations, for three variables of your own choice of country from world development indicators (WDI) data source. However, the choice of variables should be guided by an economic model from Macroeconomics. These variables should be representing an economic model where one variable (V) is deemed to be dependent on the others (Xs are independent variables). Provide full sources and definitions for those series. (10 marks) Q2. Produce (separate) time-series graphs of these variables in levels and in first differences. Examine these graphs for evidence of drift (trend) or unit roots. (5 marks) Q3. Write down fully an estimating equation which represents your underlying economic model (Hint: it may be easier to use natural logs) in the form: In Y, = B.+B. In Xin + B. In Xxx + U. (1) where t is the time subscript, and u is the disturbance term. (5 marks) Q4. Perform appropriate tests for the presence of a unit root in each of the three series and comment on the findings. (15 marks) Q5. Estimate your model by OLS and use this to perform a test for cointegration (Do NOT provide a discussion of the standard significance tests for this model) (20 marks) Q6. Compute the first difference for each time series. Perform appropriate tests for the presence of a unit root in each of the three series in the first differences and comment on the findings. Estimate your model in the first differences: Aln Y, = B. + B A In X1 + B A In Xa + x (20 marks) Q7. Given your answers in Q4-Q6, explain whether Model (1) or Model (2) is more ap- propriate. Discuss the findings in your preferred equation with respect to the sign, size and statistical significance of the individual coefficients and the overall performance of the model represented by your chosen equation (25 marks) Q1. Obtain a time-series of minimum of 35 observations, for three variables of your own choice of country from world development indicators (WDI) data source. However, the choice of variables should be guided by an economic model from Macroeconomics. These variables should be representing an economic model where one variable (V) is deemed to be dependent on the others (Xs are independent variables). Provide full sources and definitions for those series. (10 marks) Q2. Produce (separate) time-series graphs of these variables in levels and in first differences. Examine these graphs for evidence of drift (trend) or unit roots. (5 marks) Q3. Write down fully an estimating equation which represents your underlying economic model (Hint: it may be easier to use natural logs) in the form: In Y, = B.+B. In Xin + B. In Xxx + U. (1) where t is the time subscript, and u is the disturbance term. (5 marks) Q4. Perform appropriate tests for the presence of a unit root in each of the three series and comment on the findings. (15 marks) Q5. Estimate your model by OLS and use this to perform a test for cointegration (Do NOT provide a discussion of the standard significance tests for this model) (20 marks) Q6. Compute the first difference for each time series. Perform appropriate tests for the presence of a unit root in each of the three series in the first differences and comment on the findings. Estimate your model in the first differences: Aln Y, = B. + B A In X1 + B A In Xa + x (20 marks) Q7. Given your answers in Q4-Q6, explain whether Model (1) or Model (2) is more ap- propriate. Discuss the findings in your preferred equation with respect to the sign, size and statistical significance of the individual coefficients and the overall performance of the model represented by your chosen equation (25 marks)