Answered step by step

Verified Expert Solution

Question

1 Approved Answer

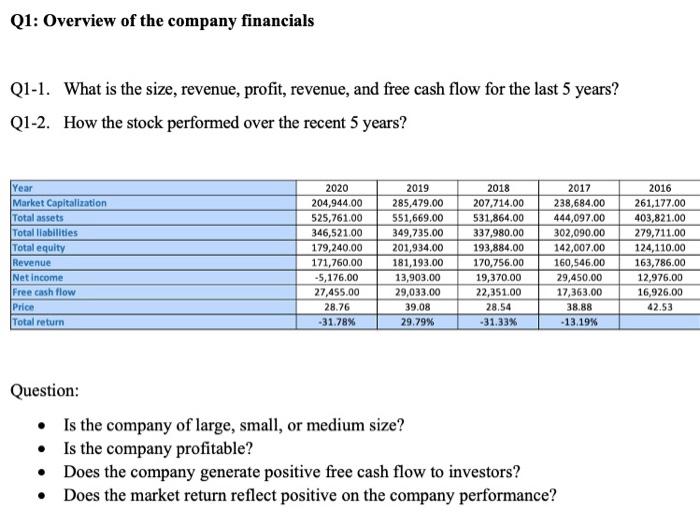

Q1: Overview of the company financials Q1-1. What is the size, revenue, profit, revenue, and free cash flow for the last 5 years? Q1-2.

Q1: Overview of the company financials Q1-1. What is the size, revenue, profit, revenue, and free cash flow for the last 5 years? Q1-2. How the stock performed over the recent 5 years? Year Market Capitalization Total assets Total liabilities Total equity Revenue Net income Free cash flow Price Total return 2020 204,944.00 525,761.00 346,521.00 179,240.00 171,760.00 -5,176.00 27,455.00 28.76 -31.78% 2019 285,479.00 551,669.00 349,735.00 201,934.00 181,193.00 13,903.00 29,033.00 39.08 29.79% 2018 207,714.00 531,864.00 337,980.00 193,884.00 170,756.00 19,370.00 22,351.00 28.54 -31.33% 2017 238,684.00 444,097.00 302,090.00 142,007.00 160,546.00 29,450.00 17,363.00 38.88 -13.19 % Question: Is the company of large, small, or medium size? Is the company profitable? Does the company generate positive free cash flow to investors? Does the market return reflect positive on the company performance? 2016 261,177.00 403,821.00 279,711.00 124,110.00 163,786.00 12,976.00 16,926.00 42.53

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The size of the company has somewhat been mixedly increased over the years and this is due to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started