Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1 part b Prepare the owner's equity statement for the year. BLOSSOM COMPANY Owner's Equity Statement $ $ The adjusted trial balance for Blossom Company

Q1 part b

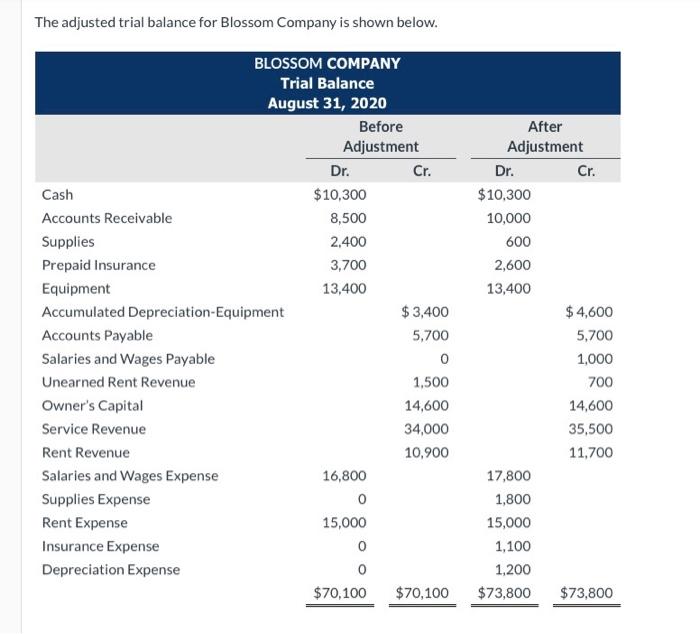

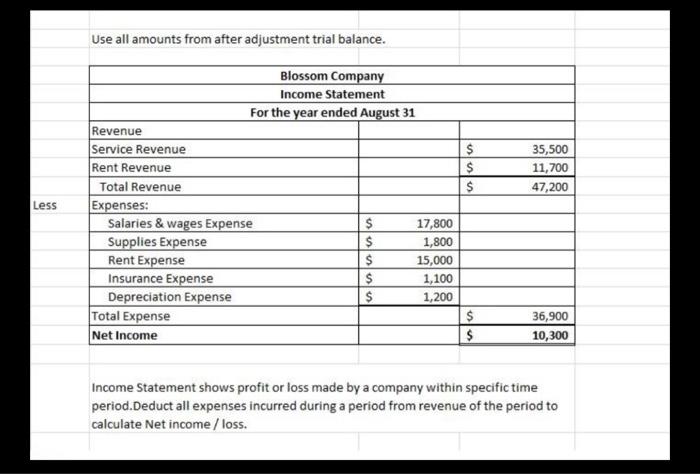

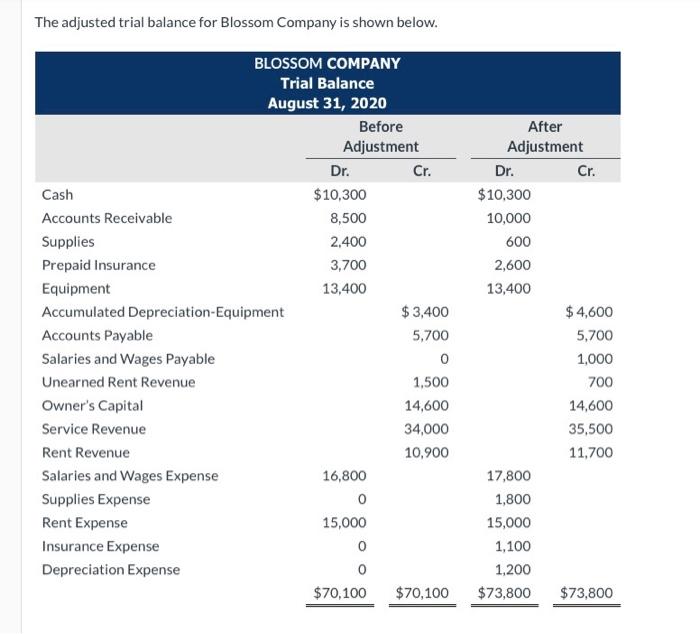

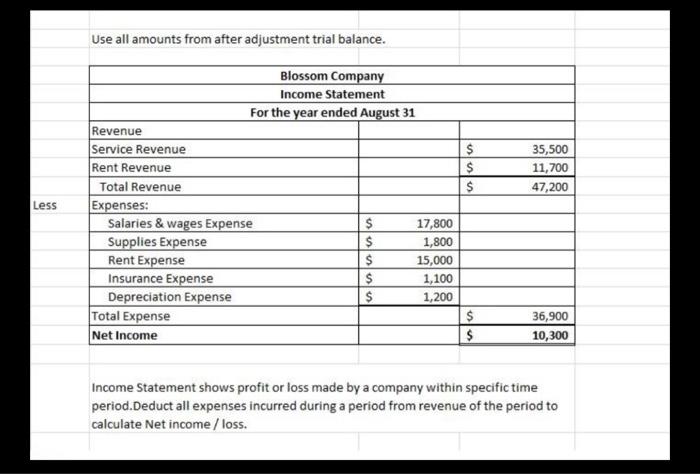

Prepare the owner's equity statement for the year. BLOSSOM COMPANY Owner's Equity Statement $ $ The adjusted trial balance for Blossom Company is shown below. BLOSSOM COMPANY Trial Balance August 31, 2020 Before Adjustment Dr. Cr. Cash $10,300 Accounts Receivable 8,500 Supplies 2,400 Prepaid Insurance 3,700 Equipment 13,400 Accumulated Depreciation-Equipment $3,400 Accounts Payable 5,700 Salaries and Wages Payable 0 Unearned Rent Revenue 1,500 Owner's Capital 14,600 Service Revenue 34,000 Rent Revenue 10,900 Salaries and Wages Expense 16,800 Supplies Expense O Rent Expense 15,000 Insurance Expense 0 Depreciation Expense 0 $70,100 $70,100 After Adjustment Dr. Cr. $10,300 10,000 600 2,600 13,400 $ 4,600 5,700 1,000 700 14,600 35,500 11,700 17,800 1,800 15,000 1,100 1,200 $73,800 $73,800 Use all amounts from after adjustment trial balance. $ $ $ 35,500 11,700 47,200 Less Blossom Company Income Statement For the year ended August 31 Revenue Service Revenue Rent Revenue Total Revenue Expenses: Salaries & wages Expense $ 17,800 Supplies Expense $ 1,800 Rent Expense $ 15,000 Insurance Expense $ 1,100 Depreciation Expense $ 1,200 Total Expense Net Income $ $ 36,900 10,300 Income Statement shows profit or loss made by a company within specific time period.Deduct all expenses incurred during a period from revenue of the period to calculate Net income / loss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started