Question

Q.1 . Prepare Cash Flow Statement of Star Pharmaceuticals Ltd., based on Balance Sheet as on 31.03.2021 and Income Statement for the year 2020-21: Additional

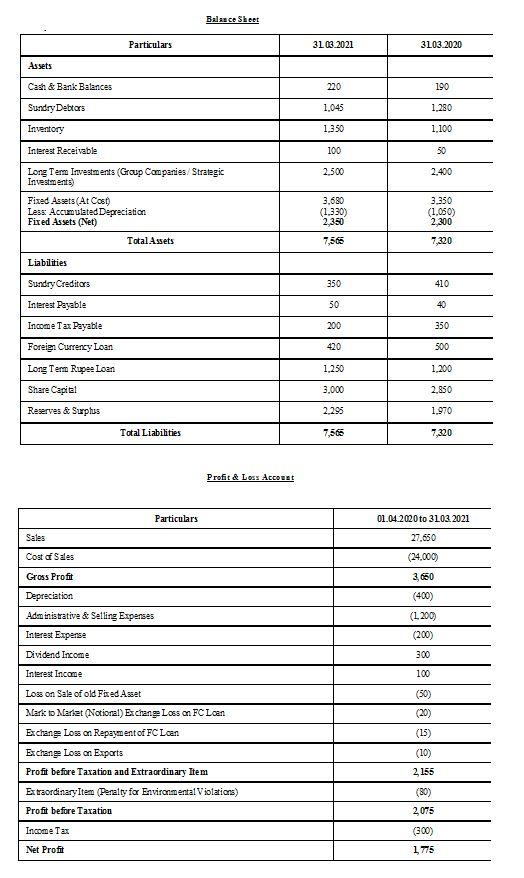

Q.1 . Prepare Cash Flow Statement of Star Pharmaceuticals Ltd., based on Balance Sheet as on 31.03.2021 and Income Statement for the year 2020-21: Additional Information: An amount of 100 was raised from fresh Long Term Rupee Loan An old Fixed Asset with Original Cost of 200 and Accumulated Depreciation of 120 was sold for 30 Dividend of 1,450 was paid during the year On the Dividend Income received, an amount of 30 was deducted by the investee company as TDS, which is considered in the amount of Tax Expense as well as Income Tax payable as on 31.03.3021 [10 Marks]

Balance Sheet Particulars 31.03.2021 31.03.2020 Assets Cash & Bank Balances 220 190 Sundry Debtors 1.045 1.280 Inventory 1.350 1.100 Interest Receivable 100 50 2.500 2,400 Long Tem Investments (Group Companies/ Strategic Investments) Fixed Assets (At Cost Less: Accumulated Depreciation Fixed Assets (Net) Total Assets 3.680 (1.330) 2,350 3.350 (1.050) 2.300 7,365 7,320 Liabilities Sundry Creditors 350 410 Interest Payable 50 40 Income Tax Payable 200 350 Foreign Currency Loan 420 500 Long Tem Rupee Loan 1,250 1,200 3,000 2.850 Share Capital Reserves & Suplus 2.295 1.970 Total Liabilities 7,565 7,320 Profit & Loss Account Particulars 01.04.2020 to 31.03.2021 Sales 27.650 (24.000) Cost of Sales 3650 Gross Profit Depreciation Administrative & Selling Expenses Interest Expense (400) (1 200) (200) Dividend Income 300 Interest Income 100 Los on Sale of old Faed Asset (50) (20) (15) Marko Market (Notional) Exchange Loss on FC Loan Exchange Loss on Repayment of FC Loan Exchange Loss on Exports Profit before Taxation and Extraordinary Item Extraordinary Item (Penalty for Environmental Violations) Profit before Taxation (10) 2 155 (80) 2,075 Income Tax (300) Net Profit 1.775 Balance Sheet Particulars 31.03.2021 31.03.2020 Assets Cash & Bank Balances 220 190 Sundry Debtors 1.045 1.280 Inventory 1.350 1.100 Interest Receivable 100 50 2.500 2,400 Long Tem Investments (Group Companies/ Strategic Investments) Fixed Assets (At Cost Less: Accumulated Depreciation Fixed Assets (Net) Total Assets 3.680 (1.330) 2,350 3.350 (1.050) 2.300 7,365 7,320 Liabilities Sundry Creditors 350 410 Interest Payable 50 40 Income Tax Payable 200 350 Foreign Currency Loan 420 500 Long Tem Rupee Loan 1,250 1,200 3,000 2.850 Share Capital Reserves & Suplus 2.295 1.970 Total Liabilities 7,565 7,320 Profit & Loss Account Particulars 01.04.2020 to 31.03.2021 Sales 27.650 (24.000) Cost of Sales 3650 Gross Profit Depreciation Administrative & Selling Expenses Interest Expense (400) (1 200) (200) Dividend Income 300 Interest Income 100 Los on Sale of old Faed Asset (50) (20) (15) Marko Market (Notional) Exchange Loss on FC Loan Exchange Loss on Repayment of FC Loan Exchange Loss on Exports Profit before Taxation and Extraordinary Item Extraordinary Item (Penalty for Environmental Violations) Profit before Taxation (10) 2 155 (80) 2,075 Income Tax (300) Net Profit 1.775Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started