Q1

Q2

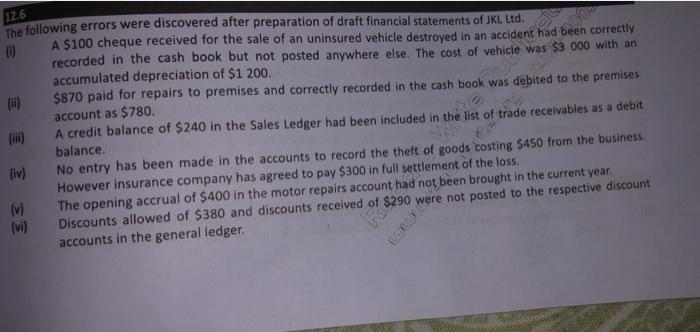

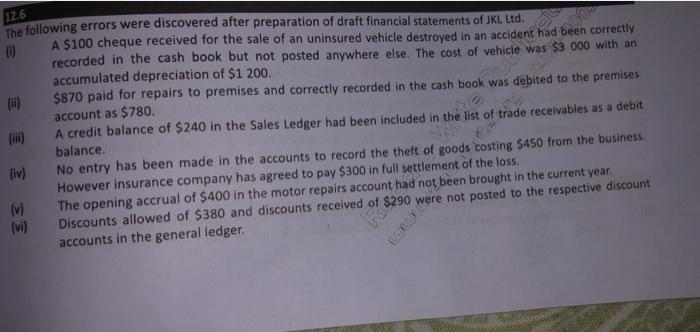

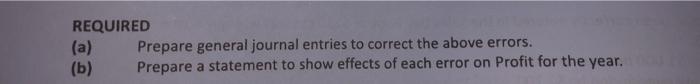

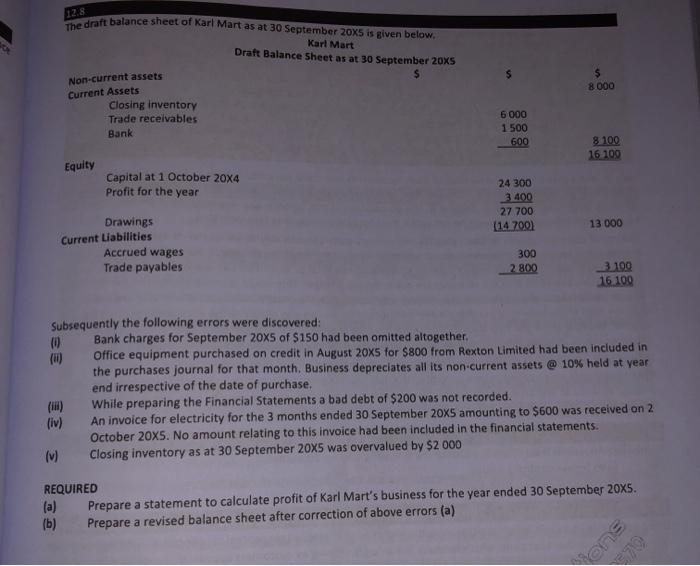

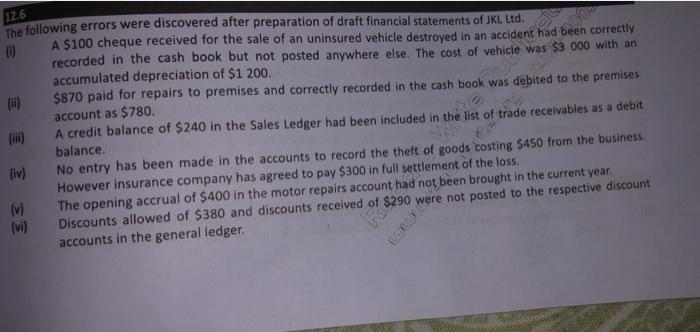

12.6 A $100 cheque received for the sale of an uninsured vehicle destroyed in an accident had be The following errors were discovered after preparation of draft financial statements of JKL ltd. recorded in the cash book but not posted anywhere else. The cost of vehicle was $3 000 with an correctly accumulated depreciation of $1 200. $870 paid for repairs to premises and correctly recorded in the cash book was debited to the premises account as $780. A credit balance of $240 in the Sales Ledger had been included in the list of trade receivables as a debit balance. iv) No entry has been made in the accounts to record the theft of goods costing $450 from the business. However insurance company has agreed to pay $300 in full settlement of the loss, v) The opening accrual of $400 in the motor repairs account had not been brought in the current year, (vi Discounts allowed of $380 and discounts received of $290 were not posted to the respective discount accounts in the general ledger. REQUIRED (a) Prepare general journal entries to correct the above errors. (b) Prepare a statement to show effects of each error on Profit for the year. The draft balance sheet of Karl Mart as at 30 September 2005 is given below 12.8 Karl Mart Draft Balance Sheet as at 30 September 2005 Non-current assets Current Assets $ 8 000 Closing Inventory Trade receivables Bank 6 000 1500 600 8 100 16 100 Equity Capital at 1 October 2004 Profit for the year 24 300 3400 27 700 (147001 13 000 Drawings Current Liabilities Accrued wages Trade payables 300 2 800 3.109 16 100 Subsequently the following errors were discovered: 10 Bank charges for September 20x5 of $150 had been omitted altogether. office equipment purchased on credit in August 20x5 for $800 from Rexton Limited had been included in the purchases journal for that month. Business depreciates all its non current assets @ 10% held at year end irrespective of the date of purchase, While preparing the Financial Statements a bad debt of $200 was not recorded. (iv) An invoice for electricity for the 3 months ended 30 September 20X5 amounting to $600 was received on 2 October 20X5. No amount relating to this invoice had been included in the financial statements. (w) Closing inventory as at 30 September 20X5 was overvalued by $2 000 REQUIRED (a) Prepare a statement to calculate profit of Karl Mart's business for the year ended 30 September 20X5. (b) Prepare a revised balance sheet after correction of above errors (a) ens