Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1 Q2 PLEASE SHOW ALL WORK/UNDERSTANDING THROUGH WORD, EXCEL, OR WRITTEN! THANK YOU! - She received a scholarship to pay for her undergraduate studies for

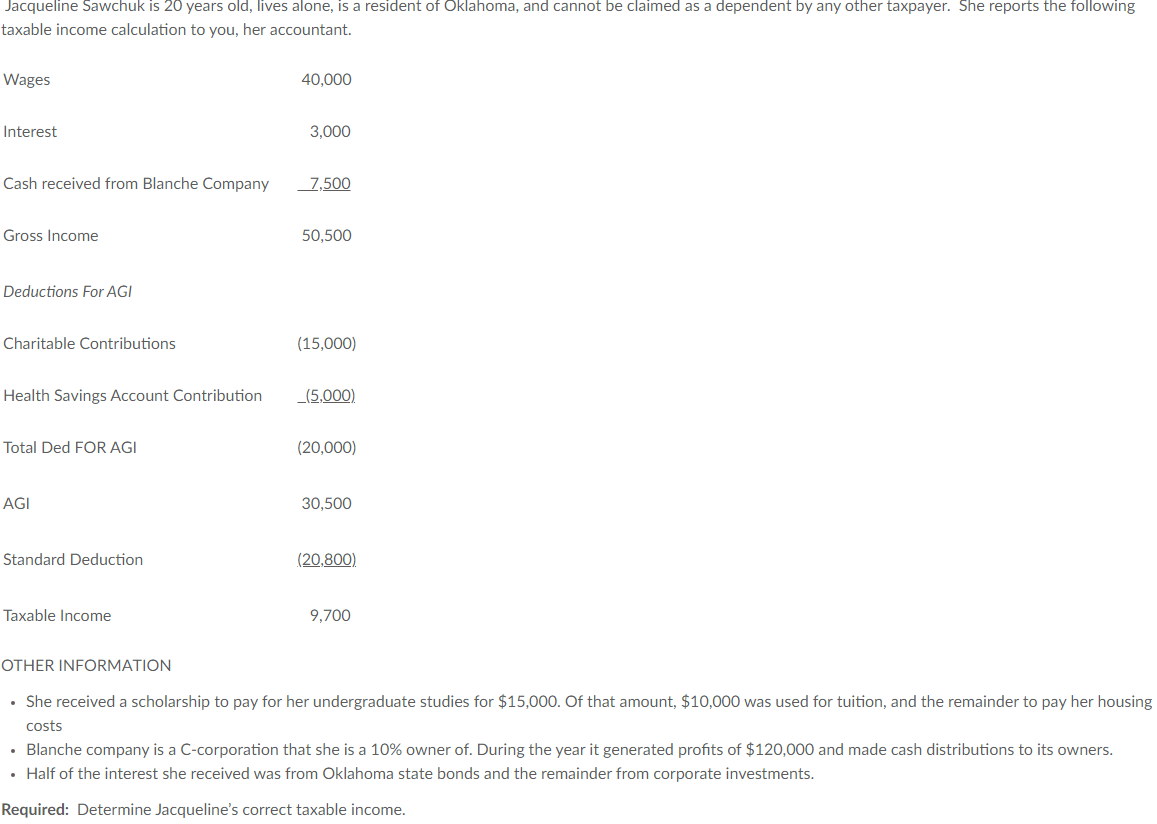

Q1

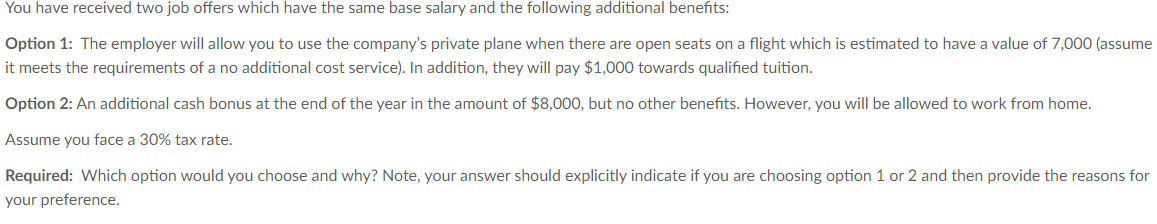

Q2

PLEASE SHOW ALL WORK/UNDERSTANDING THROUGH WORD, EXCEL, OR WRITTEN! THANK YOU!

- She received a scholarship to pay for her undergraduate studies for $15,000. Of that amount, $10,000 was used for tuition, and the remainder to pay her housing costs - Blanche company is a C-corporation that she is a 10% owner of. During the year it generated profits of $120,000 and made cash distributions to its owners. - Half of the interest she received was from Oklahoma state bonds and the remainder from corporate investments. Required: Determine Jacqueline's correct taxable income. You have received two job offers which have the same base salary and the following additional benefits: Option 1: The employer will allow you to use the company's private plane when there are open seats on a flight which is estimated to have a value of 7,000 (assume it meets the requirements of a no additional cost service). In addition, they will pay $1,000 towards qualified tuition. Option 2: An additional cash bonus at the end of the year in the amount of $8,000, but no other benefits. However, you will be allowed to work from home. Assume you face a 30% tax rate. Required: Which option would you choose and why? Note, your answer should explicitly indicate if you are choosing option 1 or 2 and then provide the reasons for your preferenceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started