Q1.

Q2.

Q3.

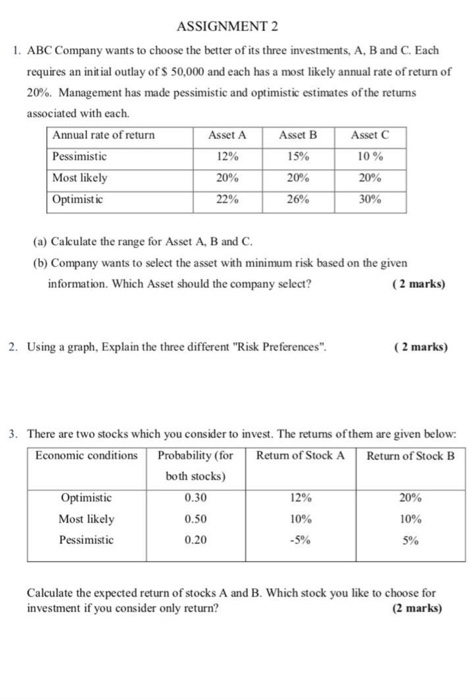

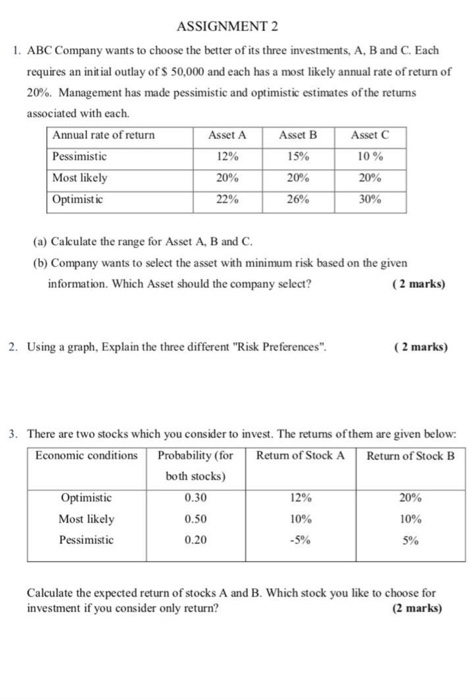

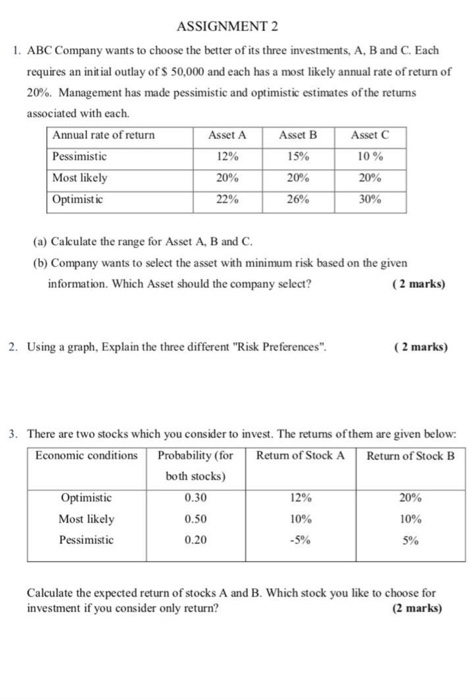

ASSIGNMENT 2 1. ABC Company wants to choose the better of its three investments, A, B and C. Each requires an initial outlay of S 50,000 and each has a most likely annual rate of return of 20%. Management has made pessimistic and optimistic estimates of the returns associated with each. Annual rate of return Asset A Asset B Asset C Pessimistic 12% 15% 10% Most likely 20% 20% 20% Optimistic 22% 26% 30% (a) Calculate the range for Asset A, B and C. (b) Company wants to select the asset with minimum risk based on the given information. Which Asset should the company select? (2 marks) 2. Using a graph, Explain the three different "Risk Preferences". (2 marks) 3. There are two stocks which you consider to invest. The retums of them are given below: Economic conditions Probability (for Retum of Stock A Return of Stock B both stocks) Optimistic 0.30 12% 20% Most likely 0.50 10% 10% Pessimistic 0.20 5% Calculate the expected return of stocks A and B. Which stock you like to choose for investment if you consider only return? (2 marks) ASSIGNMENT 2 1. ABC Company wants to choose the better of its three investments, A, B and C. Each requires an initial outlay of S 50,000 and each has a most likely annual rate of return of 20%. Management has made pessimistic and optimistic estimates of the returns associated with each. Annual rate of return Asset A Asset B Asset C Pessimistic 12% 15% 10% Most likely 20% 20% 20% Optimistic 22% 26% 30% (a) Calculate the range for Asset A, B and C. (b) Company wants to select the asset with minimum risk based on the given information. Which Asset should the company select? (2 marks) 2. Using a graph, Explain the three different "Risk Preferences". (2 marks) 3. There are two stocks which you consider to invest. The retums of them are given below: Economic conditions Probability (for Retum of Stock A Return of Stock B both stocks) Optimistic 0.30 12% 20% Most likely 0.50 10% 10% Pessimistic 0.20 5% Calculate the expected return of stocks A and B. Which stock you like to choose for investment if you consider only return? (2 marks)