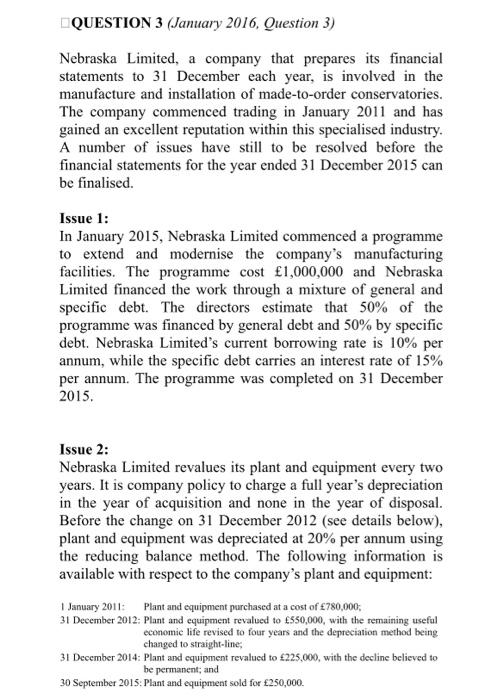

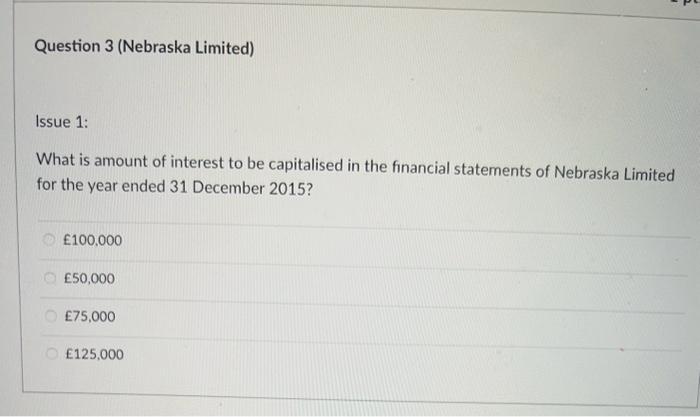

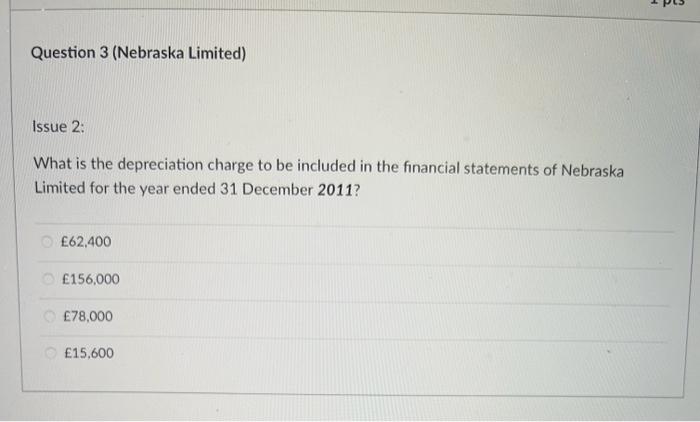

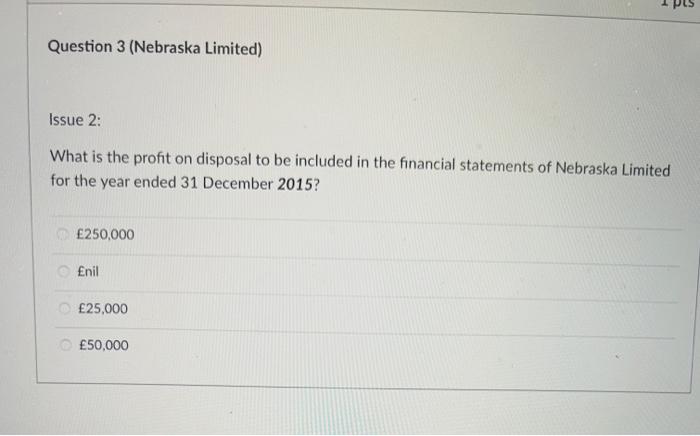

Nebraska Limited, a company that prepares its financial statements to 31 December each year, is involved in the manufacture and installation of made-to-order conservatories. The company commenced trading in January 2011 and has gained an excellent reputation within this specialised industry. A number of issues have still to be resolved before the financial statements for the year ended 31 December 2015 can be finalised. Issue 1: In January 2015, Nebraska Limited commenced a programme to extend and modernise the company's manufacturing facilities. The programme cost 1,000,000 and Nebraska Limited financed the work through a mixture of general and specific debt. The directors estimate that 50% of the programme was financed by general debt and 50% by specific debt. Nebraska Limited's current borrowing rate is 10% per annum, while the specific debt carries an interest rate of 15% per annum. The programme was completed on 31 December 2015. Issue 2: Nebraska Limited revalues its plant and equipment every two years. It is company policy to charge a full year's depreciation in the year of acquisition and none in the year of disposal. Before the change on 31 December 2012 (see details below), plant and equipment was depreciated at 20% per annum using the reducing balance method. The following information is available with respect to the company's plant and equipment: 1 January 2011: Plant and equipment purchased at a cost of 780,000; 31 December 2012: Plant and equipment revalued to f550,000, with the remaining useful economic life revised to four years and the depreciation method being changed to straight-line; 31 December 2014: Plant and equipment revalued to $225,000, with the decline believed to be permanent; and 30 September 2015: Plant and equipment sold for 250,000. What is amount of interest to be capitalised in the financial statements of Nebraska Limited for the year ended 31 December 2015? 100,000 50,000 75,000 125,000 Issue 2: What is the profit on disposal to be included in the financial statements of Nebraska Limited for the year ended 31 December 2015? 250,000 Enil 25,000 50,000 Issue 2: What is the depreciation charge to be included in the financial statements of Nebraska Limited for the year ended 31 December 2011? 62,400 156,000 78,000 15,600