Answered step by step

Verified Expert Solution

Question

1 Approved Answer

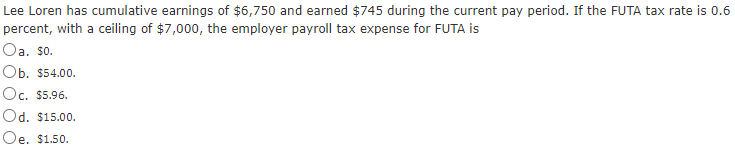

Q1 Q2 Q3 PLZ ANSWER ALL THE QUESTIONS I WILL LEAVE GOOD COMMENT AND RATINGS Payments for state taxes are submitted to the state agency

Q1

Q2

Q3

PLZ ANSWER ALL THE QUESTIONS I WILL LEAVE GOOD COMMENT AND RATINGS

Payments for state taxes are submitted to the state agency involved. True O False Lee Loren has cumulative earnings of $6,750 and earned $745 during the current pay period. If the FUTA tax rate is 0.6 percent, with a ceiling of $7,000, the employer payroll tax expense for FUTA is Oa. $0. Ob. $54.00. Oc. $5.96. Od. $15.00. Oe. $1.50. A Form W-3 must be submitted to the Social Security Administration by February 28, following the end of the calendar year. True O FalseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started