Answered step by step

Verified Expert Solution

Question

1 Approved Answer

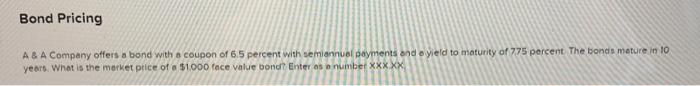

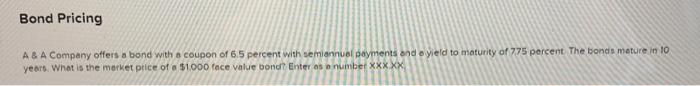

q1 q2 q3 q4 i need these ans asap A. 8 A Company offers a bond with a coupon of 6.5 percent with semiannual payments

q1

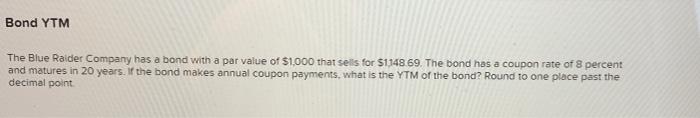

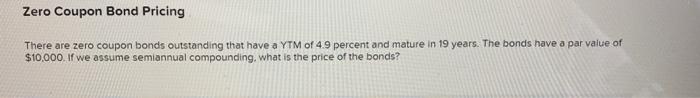

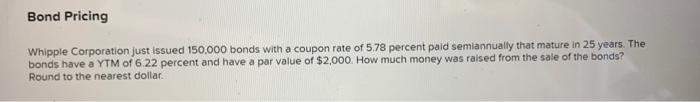

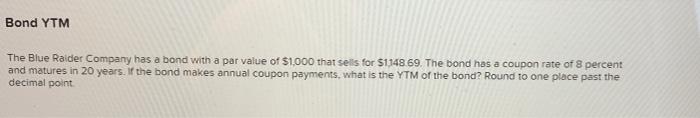

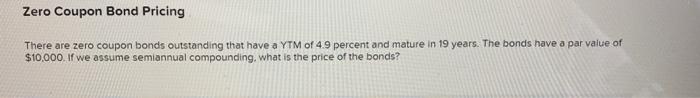

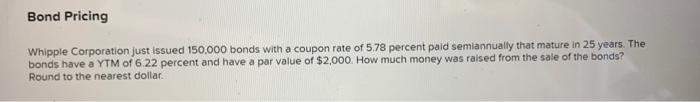

A. 8 A Company offers a bond with a coupon of 6.5 percent with semiannual payments and oyleld to maturity of 775 percent The bonds meture in 10 years. What is the merket pitice of a $1.000 face value bond Enter as a number The Blue Raider Company has a bond with a par value of $1,000 that sells for $1,148.69. The bond has a coupon rate of 8 percent and matures in 20 years. If the bond makes annual coupon payments, what is the YTM of the bond? Round to one place past the decimal point. Zero Coupon Bond Pricing There are zero coupon bonds outstanding that have a YTM of 4.9 percent and mature in 19 years. The bonds have a par value of $10,000. If we assume semiannual compounding. what is the price of the bonds? Whipple Corporation just issued 150,000 bonds with a coupon rate of 5.78 percent paid semiannually that mature in 25 years. The bonds have a YTM of 6.22 percent and have a par value of $2,000. How much money was raised from the sale of the bonds? Round to the nearest dollar

q2

q3

q4

i need these ans asap

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started