Answered step by step

Verified Expert Solution

Question

1 Approved Answer

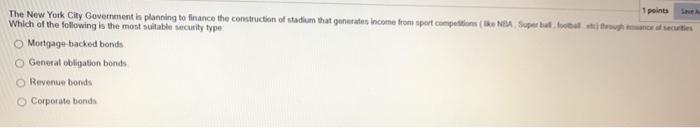

Q1: Q2: Q3: Q4: Q5: Q6: 1 points Save A The New York City Government is planning to finance the construction of stadium that generates

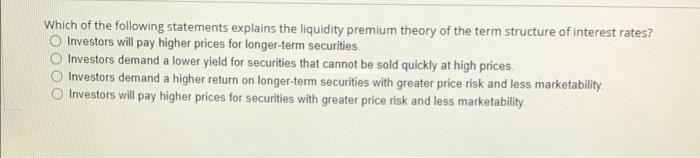

Q1:

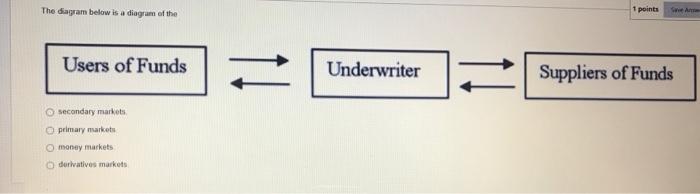

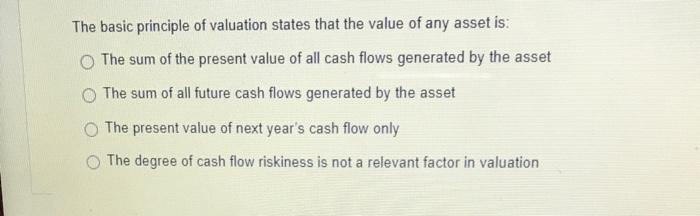

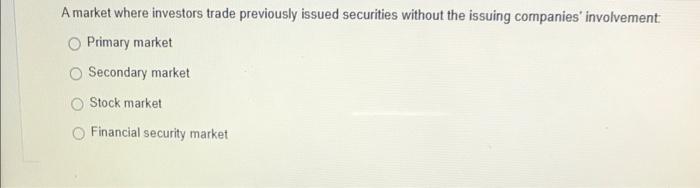

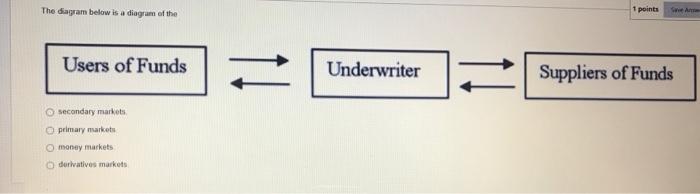

1 points Save A The New York City Government is planning to finance the construction of stadium that generates income from sport competitions (ke NBA, Super bal football at through mance of securities Which of the following is the most suitable security type: O Mortgage-backed bonds. O General obligation bonds O Revenue bonds O Corporate bonds A market where investors trade previously issued securities without the issuing companies' involvement: Primary market Secondary market Stock market Financial security market. The diagram below is a diagram of the Users of Funds O secondary markets. O primary markets Omoney markets O derivatives markets. 2 Underwriter H 1 points Suppliers of Funds Save Ane Ahmed has a right to buy a security at a specific price on a specific date if he O sold a futures contract bought a call option bought a put option sold a call option on this security: Which of the following statements explains the liquidity premium theory of the term structure of interest rates? Investors will pay higher prices for longer-term securities. Investors demand a lower yield for securities that cannot be sold quickly at high prices. Investors demand a higher return on longer-term securities with greater price risk and less marketability. Investors will pay higher prices for securities with greater price risk and less marketability. The basic principle of valuation states that the value of any asset is: O The sum of the present value of all cash flows generated by the asset The sum of all future cash flows generated by the asset The present value of next year's cash flow only The degree of cash flow riskiness is not a relevant factor in valuation

Q2:

Q3:

Q4:

Q5:

Q6:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started