Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1 Q2 Q3 Q4 Q5 Q6 PLZ ANSWER ALL THE QUESTIONS SINCE THEY ARE MULTIPLE CHOICES, I WILL FOR SURE LEAVE A GOOD COMMENT AND

Q1

Q2

Q3

Q3

Q4

Q5

Q5

Q6

Q6

PLZ ANSWER ALL THE QUESTIONS SINCE THEY ARE MULTIPLE CHOICES, I WILL FOR SURE LEAVE A GOOD COMMENT AND RATING!!!!!!! PLZ DO NOT ANSWER IF U DONT WANNA ANS ALL THANK YOU

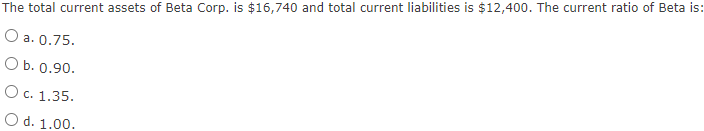

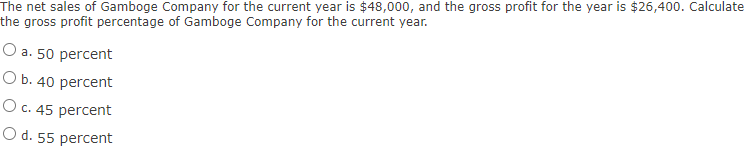

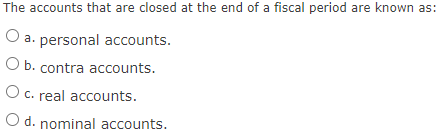

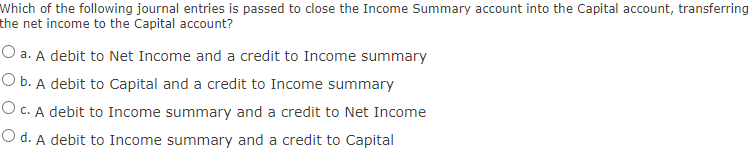

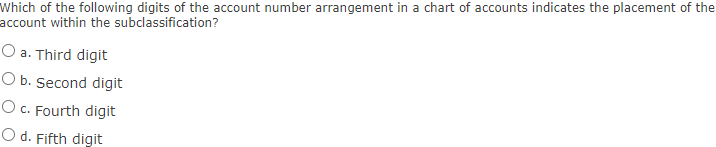

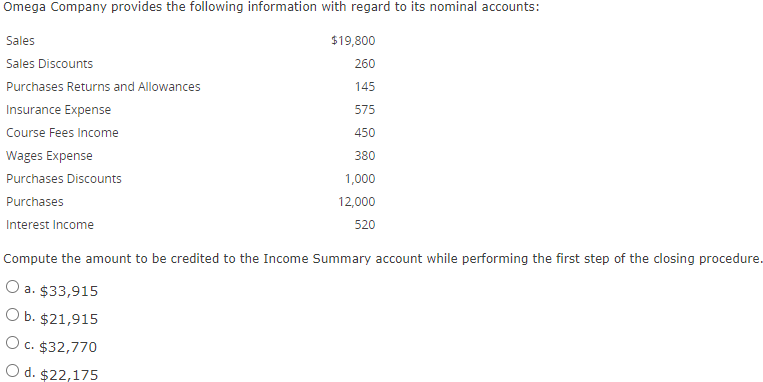

The total current assets of Beta Corp. is $16,740 and total current liabilities is $12,400. The current ratio of Beta is: O a. 0.75. O b. 0.90. O c. 1.35. O d. 1.00. The net sales of Gamboge Company for the current year is $48,000, and the gross profit for the year is $26,400. Calculate the gross profit percentage of Gamboge Company for the current year. O a. 50 percent O b. 40 percent O c. 45 percent O d. 55 percent The accounts that are closed at the end of a fiscal period are known as: O a. personal accounts. Ob. contra accounts. O c. real accounts. O d. nominal accounts. Which of the following journal entries is passed to close the Income Summary account into the Capital account, transferring the net income to the Capital account? O a. A debit to Net Income and a credit to Income summary Ob. A debit to Capital and a credit to Income summary O c. A debit to Income summary and a credit to Net Income Od. A debit to Income summary and a credit to Capital Which of the following digits of the account number arrangement in a chart of accounts indicates the placement of the account within the subclassification? O a. Third digit O b. Second digit OC. Fourth digit O d. Fifth digit Omega Company provides the following information with regard to its nominal accounts: $19,800 260 Sales Sales Discounts Purchases Returns and Allowances Insurance Expense Course Fees Income Wages Expense Purchases Discounts 145 575 450 380 1,000 12,000 Purchases Interest Income 520 Compute the amount to be credited to the Income Summary account while performing the first step of the closing procedure. O a. $33,915 O b. $21,915 O c. $32,770 O d. $22,175Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started