Answered step by step

Verified Expert Solution

Question

1 Approved Answer

q1 q2 q3 q4 q5 q6 q7 can i have them asap ty Valuing Preferred Stock ABC Company has preferred stock outstanding that is expected

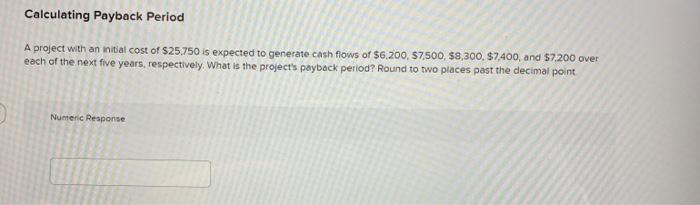

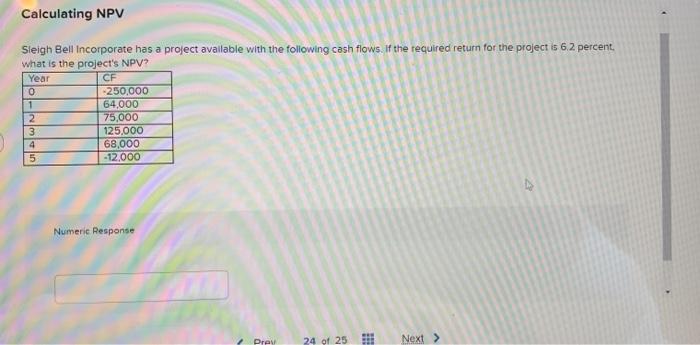

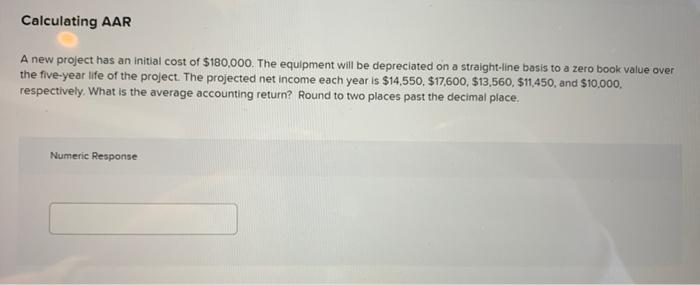

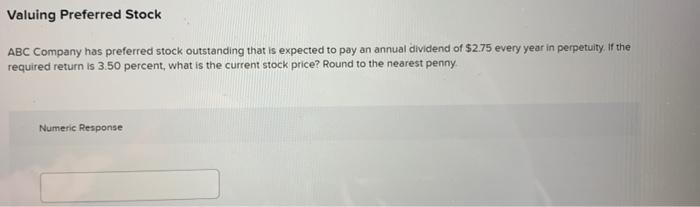

q1

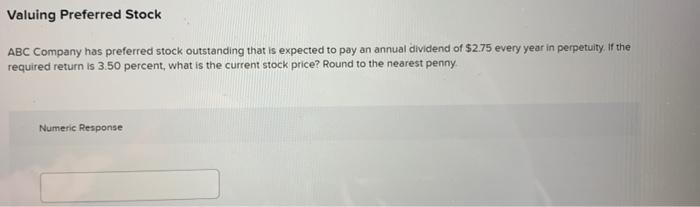

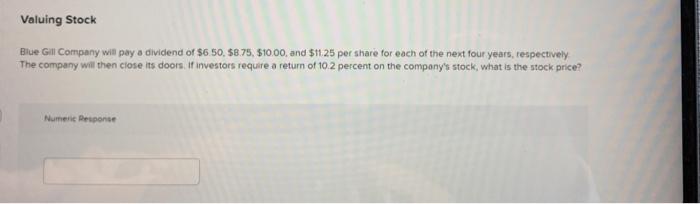

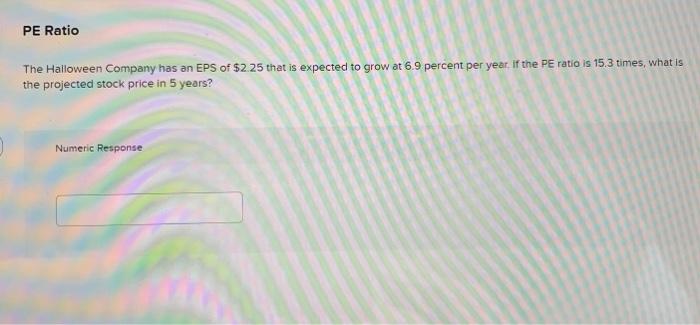

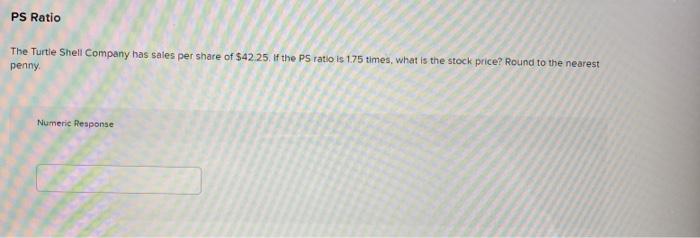

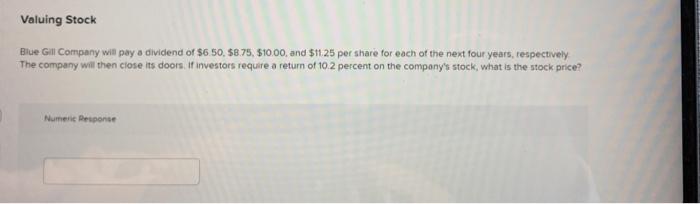

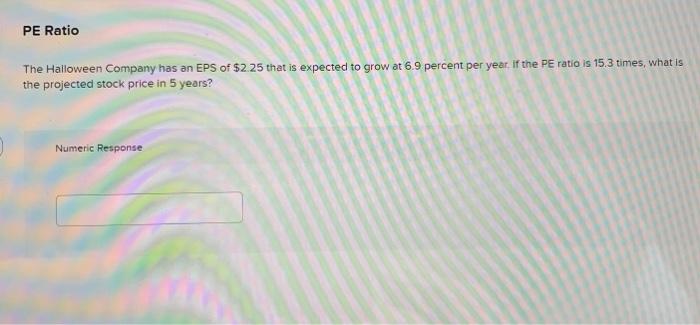

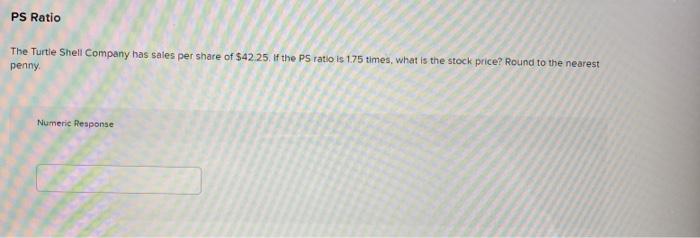

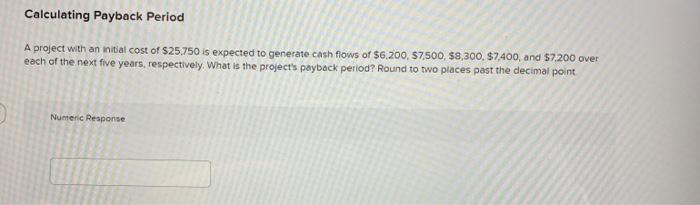

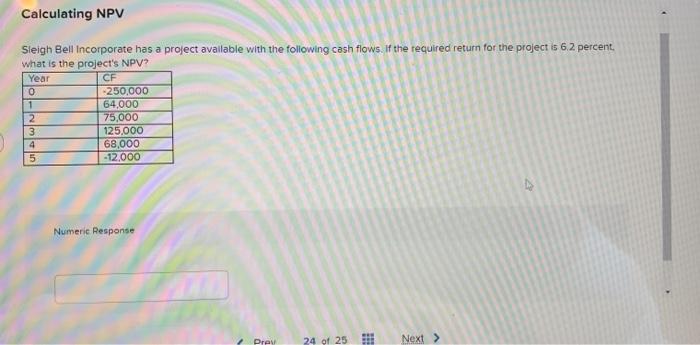

Valuing Preferred Stock ABC Company has preferred stock outstanding that is expected to pay an annual dividend of $2.75 every year in perpetuity. if the required return is 3.50 percent, what is the current stock price? Round to the nearest penny Numeric Response Biue Gill Company will pay a dividend of $5.50,$8.75,$10.00, and $11.25 per share for each of the next four years, respectively The company will then ciose its doors. If investors require a return of 10.2 percent on the compony's stock, what is the stock price? The Halloween Company has an EPS of $2.25 that is expected to grow at 6.9 percent per year if the PE ratio is 15.3 times, what is the projected stock price in 5 years? Numerie Response The Turtie Shell Company has sales per share of $42.25. If the P5 ratio is 1.75 times, what is the stock price? Round to the nearest penny. Numeric Response A project with an inital cost of $25,750 is expected to generate cash flows of $6,200,$7,500,$8,300,$7,400, and $7,200 over each of the next five years, respectively. What is the project's payback period? Round to two places past the decimal point. Numeric Response Sleigh Bell Incorporate has a project avallable with the following cash flows. If the required return for the project is 6.2 percent, what is the project's NPV? Numerie Response A new project has an initial cost of $180,000. The equipment will be depreciated on a straight-line basis to a zero book value over the five-year life of the project. The projected net income each year is $14,550,$17,600,$13,560,$11,450, and $10,000. respectively. What is the average accounting return? Round to two places past the decimal place. Numeric Response

q2

q3

q4

q5

q6

q7

can i have them asap

ty

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started