Answered step by step

Verified Expert Solution

Question

1 Approved Answer

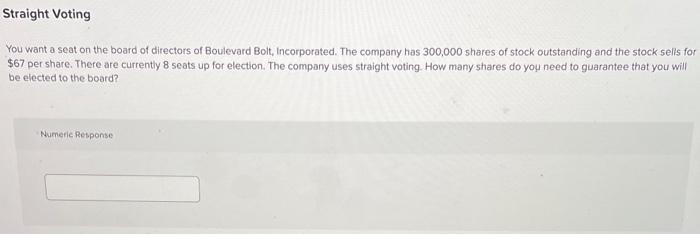

Q1 Q2 Q3 Q4 Q5 Q6 Q7 You want a seat on the board of directors of Boulevard Bolt, Incorporated. The company has 300,000 shares

Q1

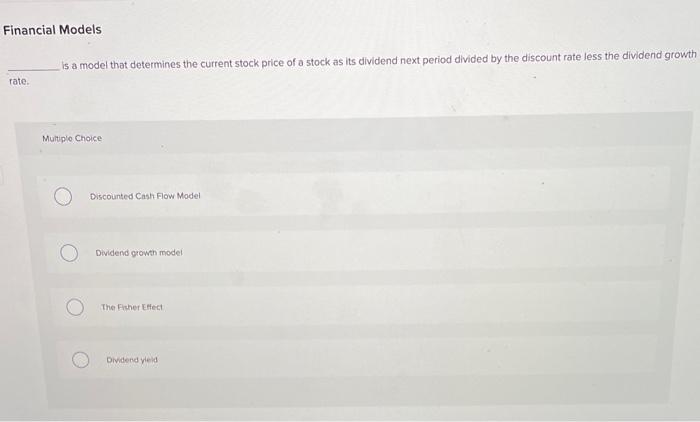

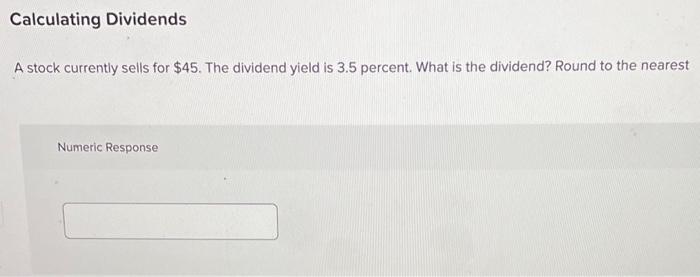

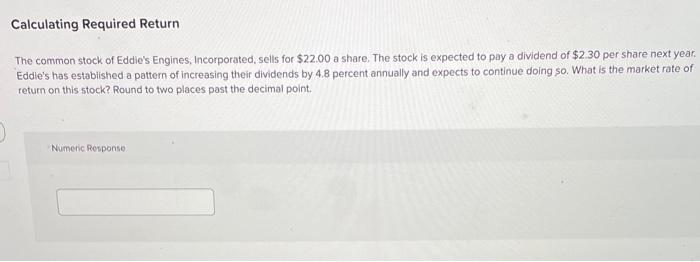

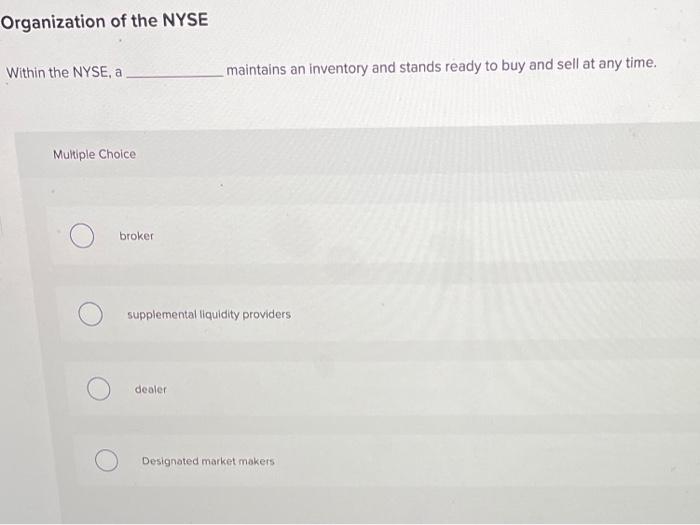

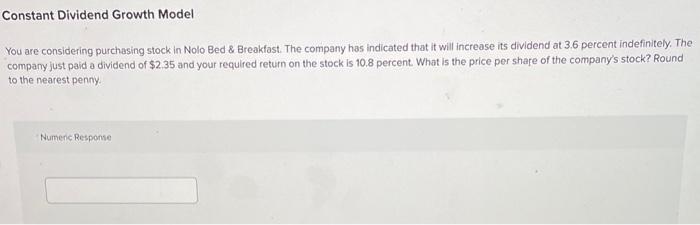

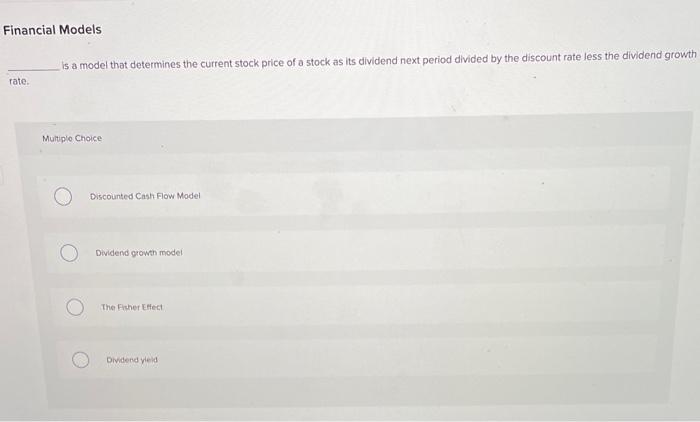

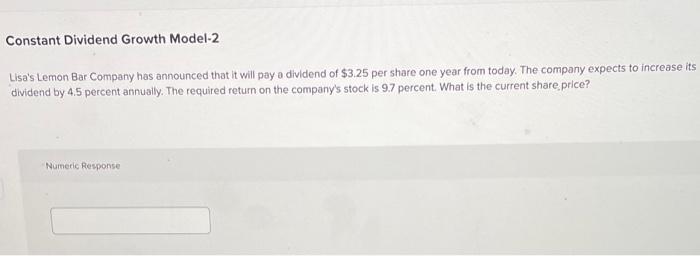

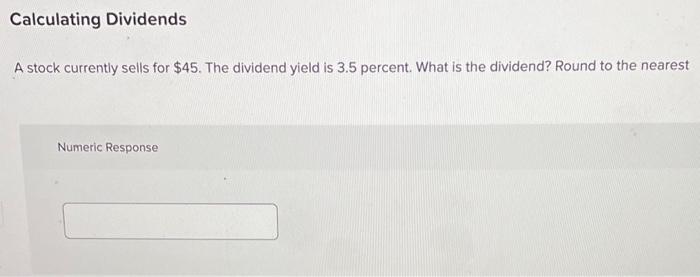

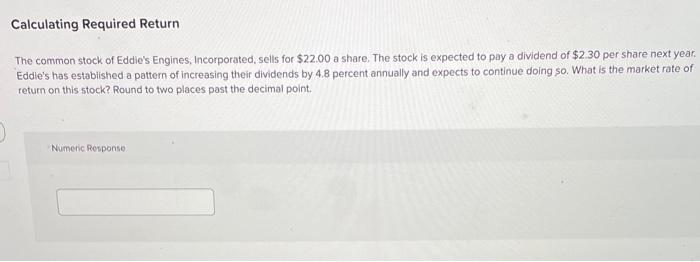

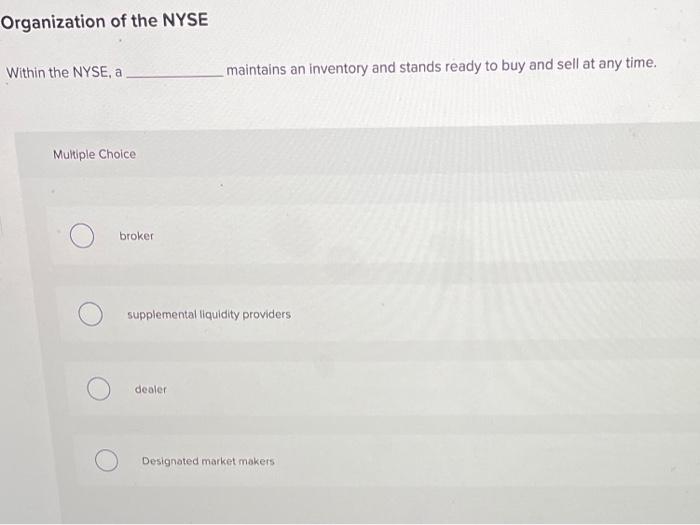

You want a seat on the board of directors of Boulevard Bolt, Incorporated. The company has 300,000 shares of stock outstanding and the stock sells for $67 per share. There are currently 8 seats up for election. The company uses straight voting . How many shares do you need to guarantee that you will be elected to the board? Constant Dividend Growth Model You are considering purchasing stock in Nolo Bed \& Breakfast. The company has indicated that it will increase its dividend at 3.6 percent indefinitely. The company just paid a dividend of $2.35 and your required return on the stock is 10.8 percent. What is the price per share of the company's stock? Round to the nearest penny. is a model that determines the current stock price of a stock as its dividend next period divided by the discount rate less the dividend growth rate. Multiplo Choice Discounted Cash Flow Model Dividend growth model The Futher Effect Dividend velid Lisa's Lemon Bar Company has announced that it will pay a dividend of $3.25 per share one year from today. The company expects to increase its dividend by 4.5 percent annusily. The required return on the company's stock is 9.7 percent. What is the current share.price? Numeric Response A stock currently sells for $45. The dividend yield is 3.5 percent. What is the dividend? Round to the nearest Numeric Response The common stock of Eddie's Engines, Incorporated, sells for $22.00 a share, The stock is expected to pay a dividend of $2.30 per share next year. Eddie's has established a pattern of increasing their dividends by 4.8 percent aninually and expects to continue doing so. What is the market rate of return on this stock? Round to two places past the decimal point. Numeric Response Within the NYSE, a maintains an inventory and stands ready to buy and sell at any time. Multiple Choice broker supplemental liquidity providers dealer Designated market makers

Q2

Q3

Q4

Q5

Q6

Q7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started