Q1.

Q2.

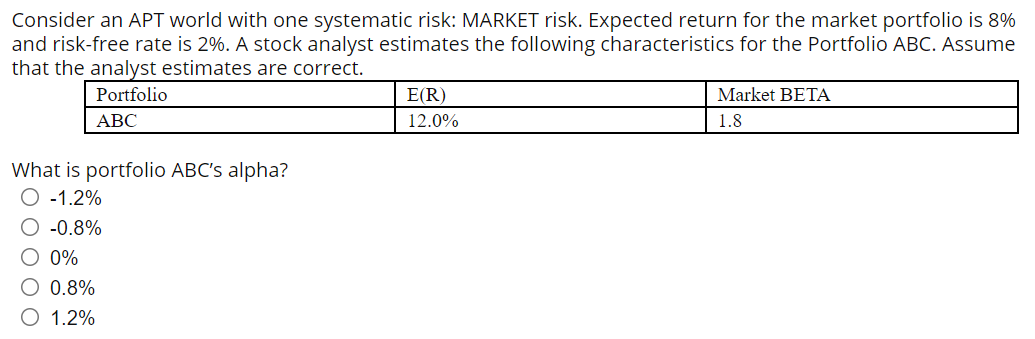

Q3.

Q4.

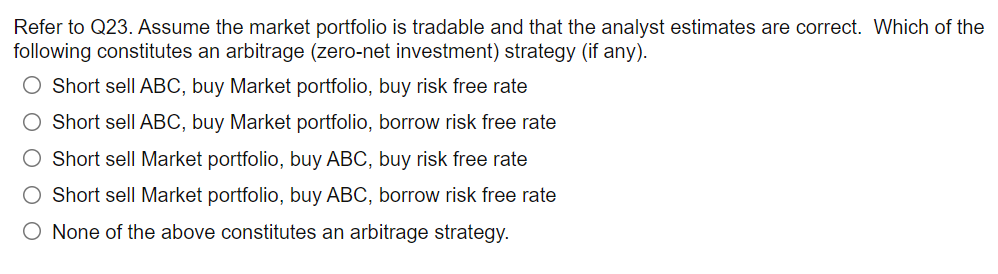

Refer to Q3.

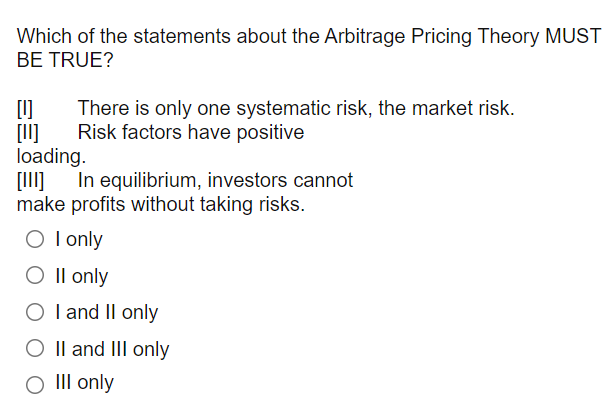

Q5.

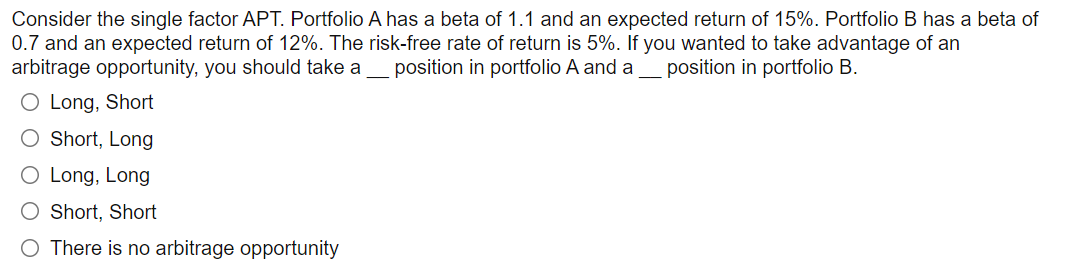

Q6.

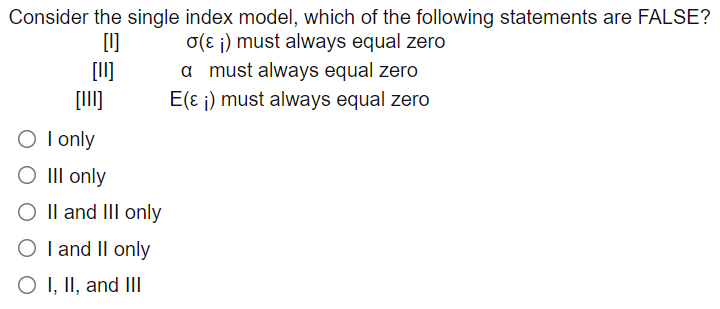

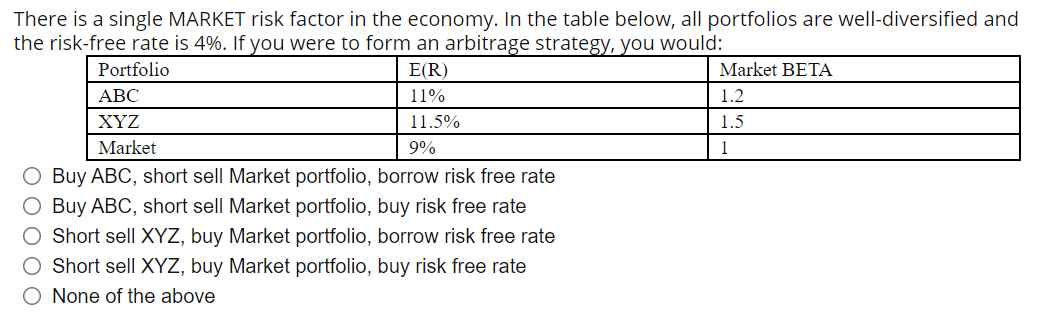

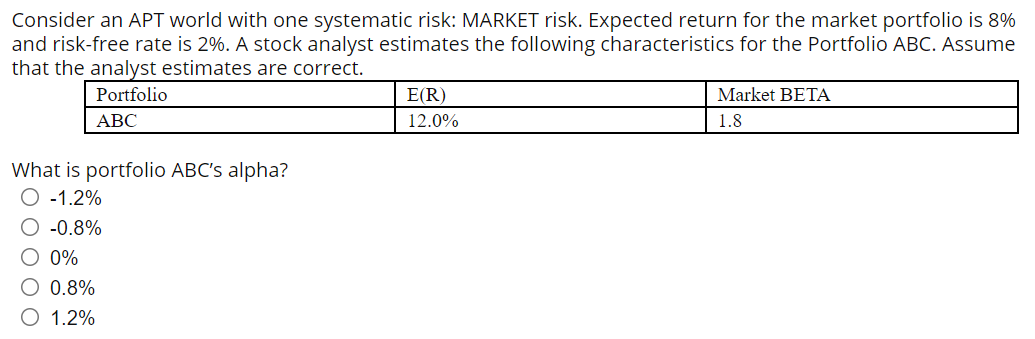

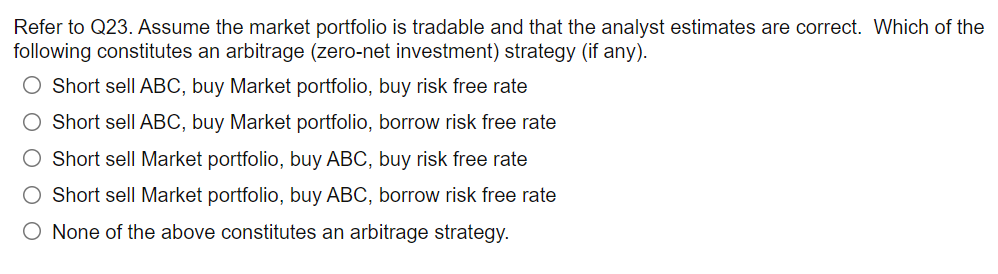

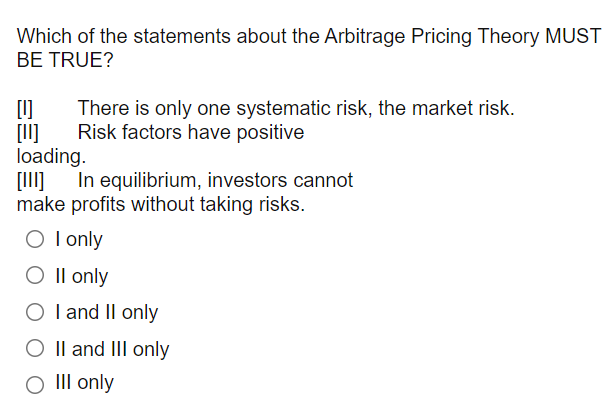

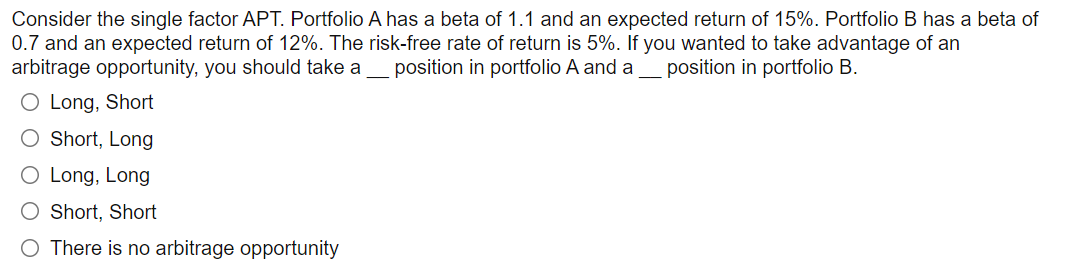

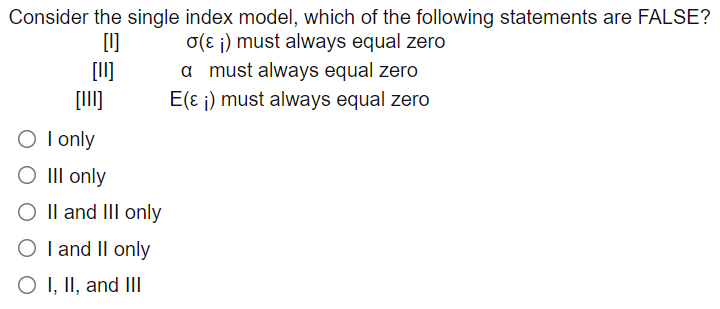

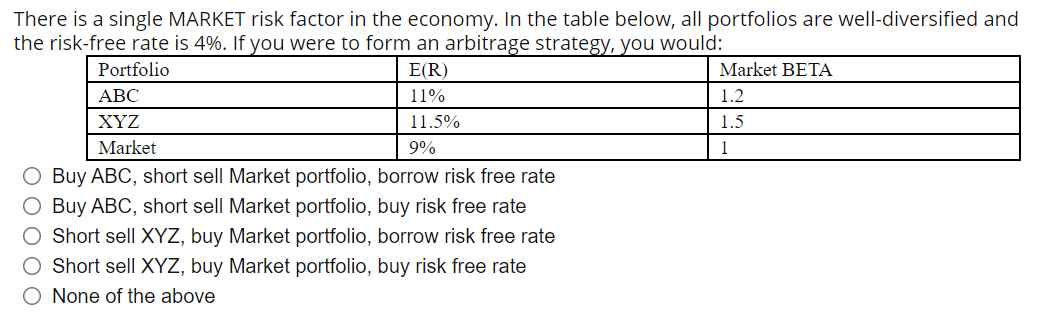

Consider the single index model, which of the following statements are FALSE? [U ( i) must always equal zero [11] a must always equal zero E( i) must always equal zero O I only O III only O II and III only O I and Il only O I, II, and III There is a single MARKET risk factor in the economy. In the table below, all portfolios are well-diversified and the risk-free rate is 4%. If you were to form an arbitrage strategy, you would: Portfolio E(R) Market BETA ABC 11% 1.2 XYZ 11.5% 1.5 Market 9% 1 O Buy ABC, short sell Market portfolio, borrow risk free rate O Buy ABC, short sell Market portfolio, buy risk free rate O Short sell XYZ, buy Market portfolio, borrow risk free rate O Short sell XYZ, buy Market portfolio, buy risk free rate None of the above Consider an APT world with one systematic risk: MARKET risk. Expected return for the market portfolio is 8% and risk-free rate is 2%. A stock analyst estimates the following characteristics for the Portfolio ABC. Assume that the analyst estimates are correct. Portfolio E(R) Market BETA ABC 12.0% 1.8 What is portfolio ABC's alpha? 0 -1.2% 0 -0.8% O 0% O 0.8% O 1.2% Refer to Q23. Assume the market portfolio is tradable and that the analyst estimates are correct. Which of the following constitutes an arbitrage (zero-net investment) strategy (if any). O Short sell ABC, buy Market portfolio, buy risk free rate O Short sell ABC, buy Market portfolio, borrow risk free rate O Short sell Market portfolio, buy ABC, buy risk free rate Short sell Market portfolio, buy ABC, borrow risk free rate O None of the above constitutes an arbitrage strategy. Which of the statements about the Arbitrage Pricing Theory MUST BE TRUE? [U] There is only one systematic risk, the market risk. [11] Risk factors have positive loading. In equilibrium, investors cannot make profits without taking risks. 0 I only O ll only O I and II only O II and III only Ill only Consider the single factor APT. Portfolio A has a beta of 1.1 and an expected return of 15%. Portfolio B has a beta of 0.7 and an expected return of 12%. The risk-free rate of return is 5%. If you wanted to take advantage of an arbitrage opportunity, you should take a position in portfolio A and a position in portfolio B. O Long, Short O Short, Long O Long, Long O Short, Short O There is no arbitrage opportunity