Answered step by step

Verified Expert Solution

Question

1 Approved Answer

q1 q2 The following data pertain to an investment proposal (Ignore income taxes) Amount $94,000 Description Cost of the investment Annual Cost Savings Estimated salvage

q1

q2

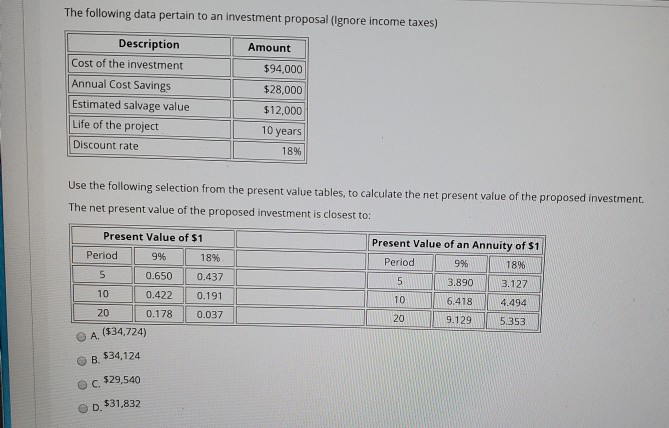

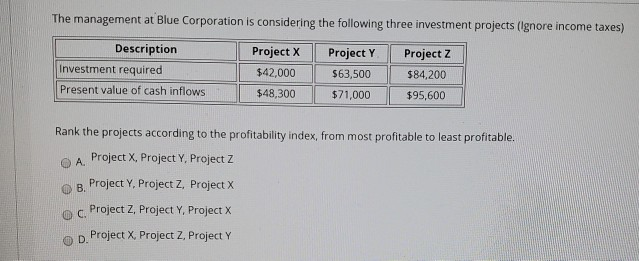

The following data pertain to an investment proposal (Ignore income taxes) Amount $94,000 Description Cost of the investment Annual Cost Savings Estimated salvage value Life of the project Discount rate $28,000 $12,000 10 years 18% Use the following selection from the present value tables, to calculate the net present value of the proposed investment. The net present value of the proposed investment is closest to: Present Value of $1 Period 9% 18% 5 0.650 0.437 Present Value of an Annuity of S1 Period 9% 18% 5 3.890 3.127 10 6.418 4.494 20 9.129 5.353 0.191 10 0.422 20 0.178 A. ($34,724) 0.037 $34,124 . $29,540 D. $31.832 The management at Blue Corporation is considering the following three investment projects (Ignore income taxes) Description Investment required Present value of cash inflows Project X $42,000 $48,300 Project Y $63,500 Project Z $84,200 $95,600 $71,000 Rank the projects according to the profitability index, from most profitable to least profitable. A. Project X, Project Y, Project Z B. Project Y, Project Z, Project X c. Project Z, Project Y, Project X D. Project X Project Z, Project Y

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started