Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1 Q2 The table here, , shows the one-year return distribution of Startup Inc. Calculate the: a. Expected return. b. The standard deviation of the

Q1

Q2

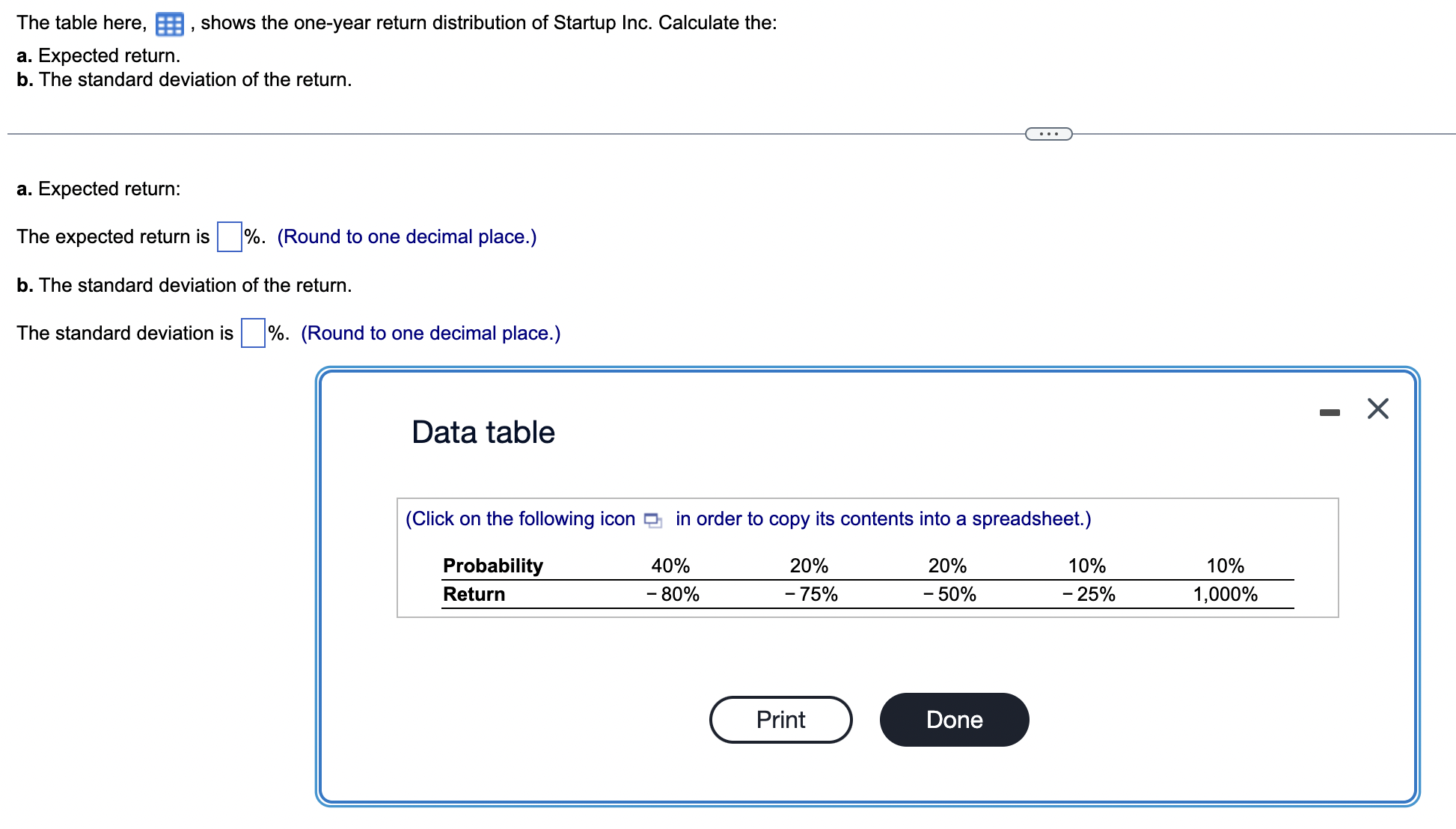

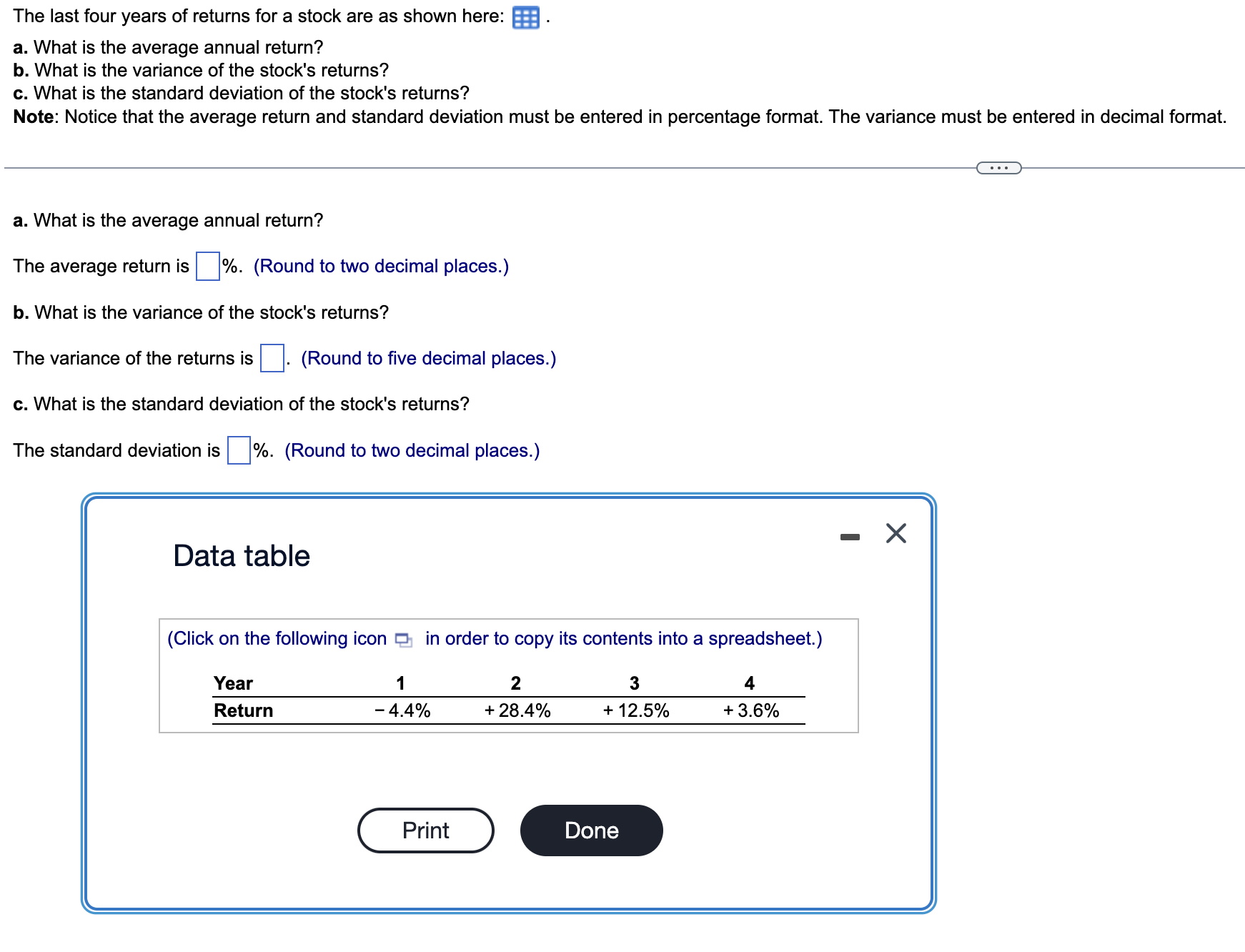

The table here, , shows the one-year return distribution of Startup Inc. Calculate the: a. Expected return. b. The standard deviation of the return. a. Expected return: The expected return is %. (Round to one decimal place.) b. The standard deviation of the return. The standard deviation is \%. (Round to one decimal place.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) The last four years of returns for a stock are as shown here: a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? Note: Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal format. a. What is the average annual return? The average return is %. (Round to two decimal places.) b. What is the variance of the stock's returns? The variance of the returns is . (Round to five decimal places.) c. What is the standard deviation of the stock's returns? The standard deviation is \%. (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.)

The table here, , shows the one-year return distribution of Startup Inc. Calculate the: a. Expected return. b. The standard deviation of the return. a. Expected return: The expected return is %. (Round to one decimal place.) b. The standard deviation of the return. The standard deviation is \%. (Round to one decimal place.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) The last four years of returns for a stock are as shown here: a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? Note: Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal format. a. What is the average annual return? The average return is %. (Round to two decimal places.) b. What is the variance of the stock's returns? The variance of the returns is . (Round to five decimal places.) c. What is the standard deviation of the stock's returns? The standard deviation is \%. (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started