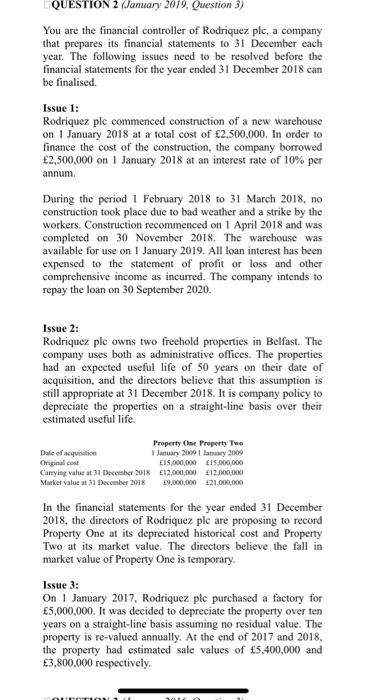

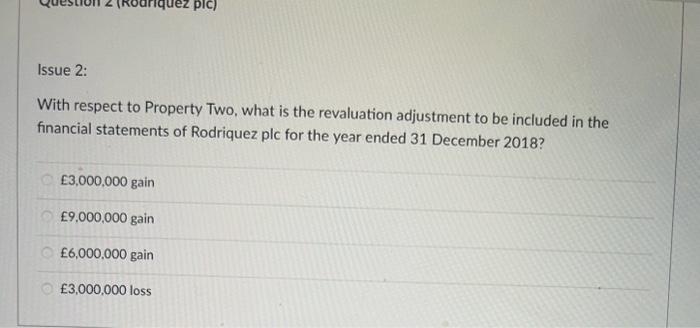

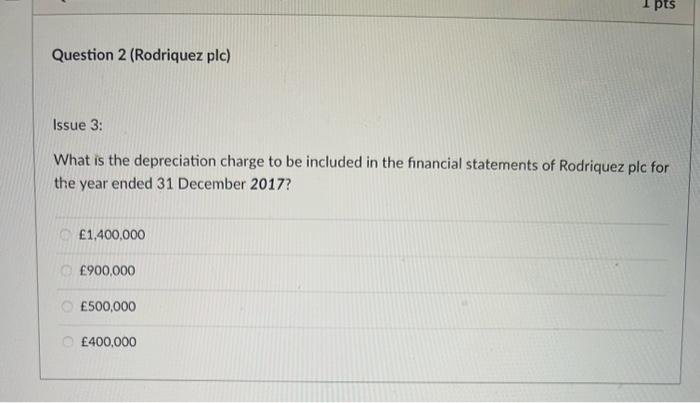

You are the financial controller of Rodriquez plc, a company that prepares its financial statements to 31 December each year. The following issues need to be resolved before the financial statements for the year ended 31 December 2018 can be finalised. Issue 1: Rodriquez ple commenced construction of a new warehouse on 1 January 2018 at a total cost of 2,500,000. In order to finance the cost of the construction, the company borrowed 2,500,000 on 1 January 2018 at an interest rate of 10% per annum. During the period 1 February 2018 to 31 March 2018, no construction took place due to bad weather and a strike by the workers. Construction recommenced on 1 April 2018 and was completed on 30 November 2018. The warehouse was available for use on 1 January 2019. All loan interest has been expensed to the statement of profit or loss and other comprehensive income as incurred. The company intends to repay the loan on 30 September 2020. Issue 2: Rodriquez ple owns two freehold properties in Belfast. The company uses both as administrative offices. The properties had an expected useful life of 50 years on their date of acquisition, and the directors believe that this assumption is still appropriate at 31 December 2018. It is company policy to depreciate the properties on a straight-line basis over their estimated useful life. In the financial statements for the year ended 31 December 2018, the directors of Rodriquez ple are proposing to record Property One at its depreciated historical cost and Property Two at its market value. The directors believe the fall in market value of Property One is temporary. Issue 3: On 1 January 2017, Rodriquez ple purchased a factory for 5,000,000. It was decided to depreciate the property over ten years on a straight-line basis assuming no residual value. The property is re-valued annually. At the end of 2017 and 2018. the property had estimated sale values of 5,400,000 and 3,800,000 respectively. What is the depreciation charge to be included in the financial statements of Rodriquez plc for the year ended 31 December 2017? E1,400,000 900,000 E500,000 400,000 Issue 2: With respect to Property Two, what is the revaluation adjustment to be included in the financial statements of Rodriquez plc for the year ended 31 December 2018? 3,000,000 gain 9,000,000 gain 6,000,000 gain 3,000,000 loss