Answered step by step

Verified Expert Solution

Question

1 Approved Answer

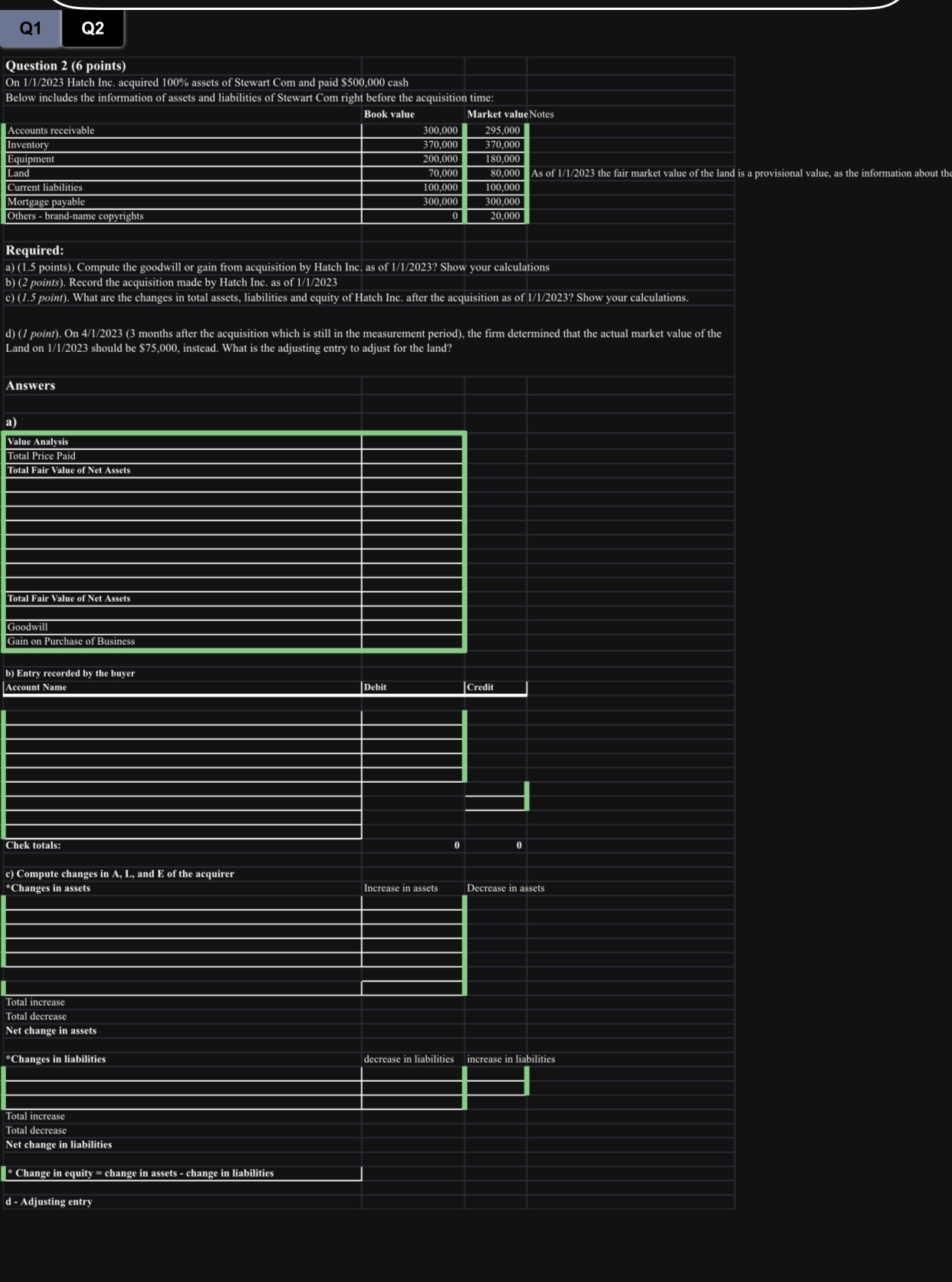

Q1 Question 2 (6 points) On 1/1/2023 Hatch Inc. acquired 100% assets of Stewart Com and paid $500,000 cash Below includes the information of

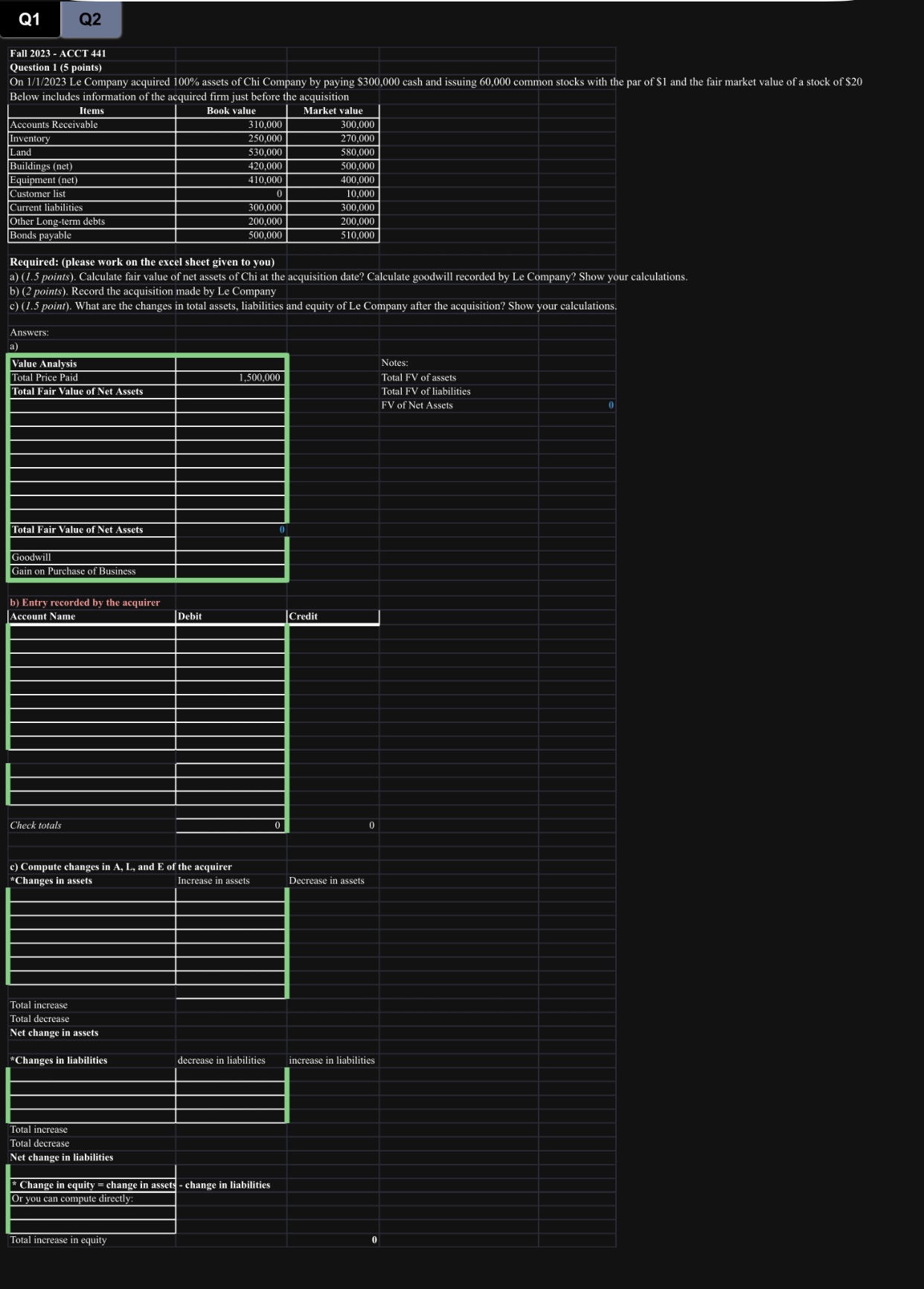

Q1 Question 2 (6 points) On 1/1/2023 Hatch Inc. acquired 100% assets of Stewart Com and paid $500,000 cash Below includes the information of assets and liabilities of Stewart Com right before the acquisition time: Book value Q2 Accounts receivable Inventory Equipment Land Current liabilities Mortgage payable Others - brand-name copyrights Answers Required: a) (1.5 points). Compute the goodwill or gain from acquisition by Hatch Inc. as of 1/1/2023? Show your calculations b) (2 points). Record the acquisition made by Hatch Inc. as of 1/1/2023 c) (1.5 point). What are the changes in total assets, liabilities and equity of Hatch Inc. after the acquisition as of 1/1/2023? Show your calculations. a) Value Analysis Total Price Paid Total Fair Value of Net Assets d) (1 point). On 4/1/2023 (3 months after the acquisition which is still in the measurement period), the firm determined that the actual market value of the Land on 1/1/2023 should be $75,000, instead. What is the adjusting entry to adjust for the land? Total Fair Value of Net Assets Goodwill Gain on Purchase of Business b) Entry recorded by the buyer Account Name Chek totals: c) Compute changes in A, L, and E of the acquirer *Changes in assets Total increase Total decrease Net change in assets *Changes in liabilities 300,000 370,000 200,000 70,000 100.000 300,000 0 Total increase Total decrease Net change in liabilities * Change in equity = change in assets - change in liabilities d-Adjusting entry Debit Market value Notes 295,000 370,000 180,000 80,000 As of 1/1/2023 the fair market value of the land is a provisional value, as the information about the 100,000 300,000 20,000 Increase in assets Credit Decrease in assets decrease in liabilities increase in liabilities Q1 Fall 2023 - ACCT 441 Question 1 (5 points) Q2 On 1/1/2023 Le Company acquired 100% assets of Chi Company by paying $300,000 cash and issuing 60,000 common stocks with the par of $1 and the fair market value of a stock of $20 Below includes information of the acquired firm just before the acquisition Items Book value Market value Accounts Receivable Inventory Land Buildings (net) Equipment (net) Customer list Current liabilities Other Long-term debts Bonds payable Answers: a) Value Analysis Total Price Paid Total Fair Value of Net Assets Total Fair Value of Net Assets Required: (please work on the excel sheet given to you) a) (1.5 points). Calculate fair value of net assets of Chi at the acquisition date? Calculate goodwill recorded by Le Company? Show your calculations. b) (2 points). Record the acquisition made by Le Company c) (1.5 point). What are the changes in total assets, liabilities and equity of Le Company after the acquisition? Show your calculations. Goodwill Gain on Purchase of Business b) Entry recorded by the acquirer Account Name Check totals Total increase Total decrease Net change in assets *Changes in liabilities Total increase Total decrease Net change in liabilities 310.000 250,000 530,000 420,000 410,000 0 Debit 300,000 200,000 500,000 c) Compute changes in A, L, and E of the acquirer *Changes in assets Increase in assets Total increase in equity 1,500,000 decrease in liabilities. * Change in equity = change in assets - change in liabilities Or you can compute directly: 0 300.000 270,000 580,000 500,000 400,000 10.000 300,000 200.000 510,000 Credit Decrease in assets 0 increase in liabilities Notes: Total FV of assets Total FV of liabilities FV of Net Assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay lets work through this stepbystep a Calculation of Fair Value of Net Assets and Goodwill Land 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started