Q1. Research, cite, and summarize (in one or two sentences per standard identified) the auditing standards that address Garcia and Foster, CPA's, responsibility in relation to sending accounts receivable confirmations. Identify the most relevant paragraph(s) in each standard.

Q2. Review the accounts receivable narrative (AR 1.1) and review the accounts receivable flowchart processes (AR 1.2 to identify all of the internal control weaknesses for accounts receivable and sales processes. Provide one or two sentences on why each item identified is a weakness. This relates to Step 2 of the Garcia and Foster Audit Plan.

Q3. Based on the review of the accounts receivable test of controls procedures (workpapers AR 2.1 to AR 2.4), you believe that there were some issues with the audit work performed. Review in detail the auditing procedures from the audit program the related documentation. Pay particular attention to their implementation of the attribute sampling procedures- their sample selection process and evaluation of the results. Identify any of the following issues:

a.Did they perform all of the steps associated with the audit program?

b.Did they perform the steps accurately? If not, specifically stat the nature of the problems and follow up on it to the extent possible with the information given.

c.Do you see any other issues or problems with the auditors' work or client documentation?

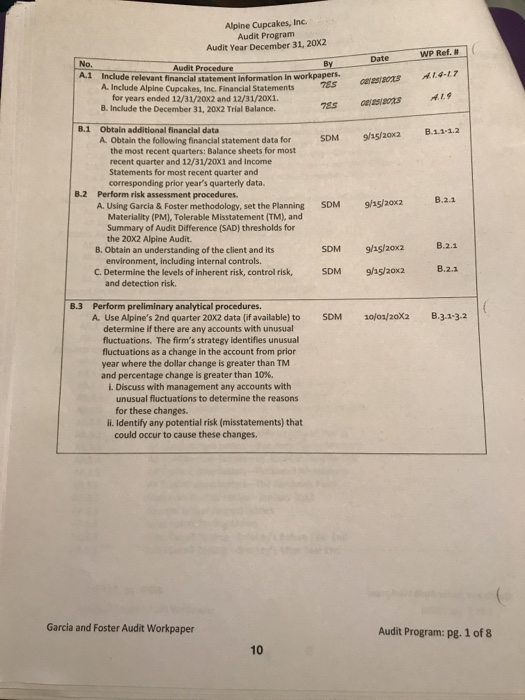

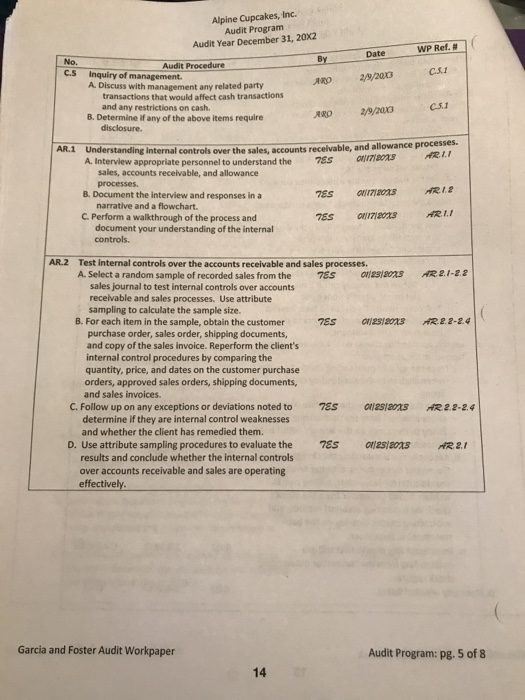

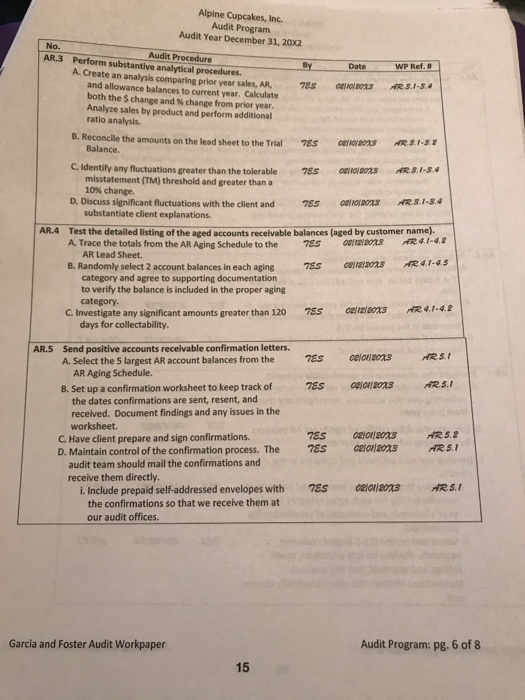

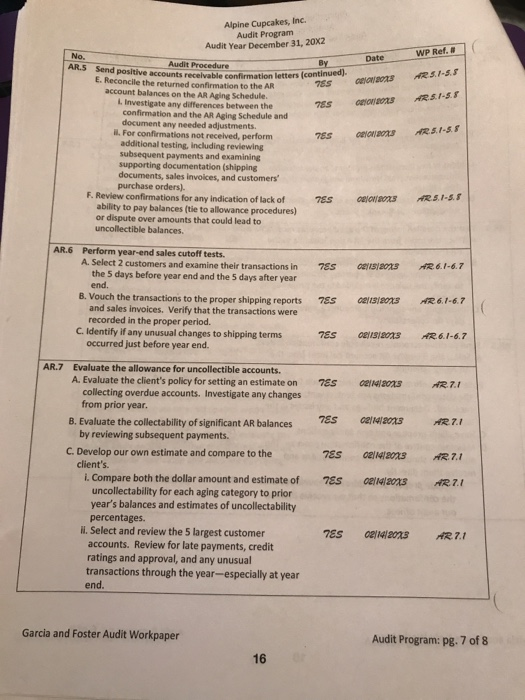

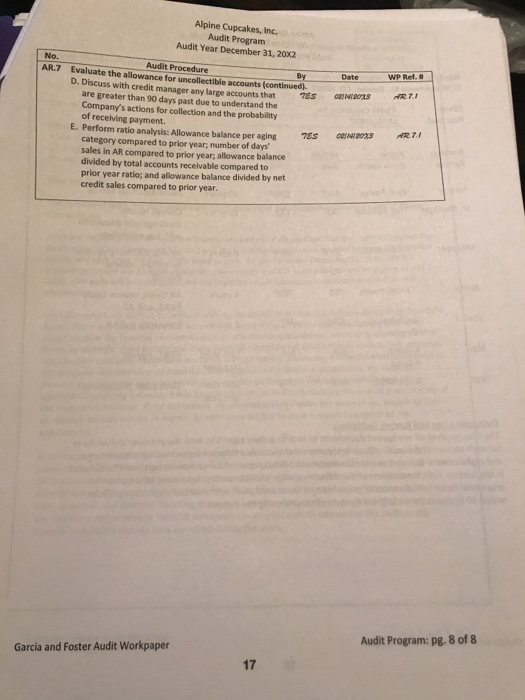

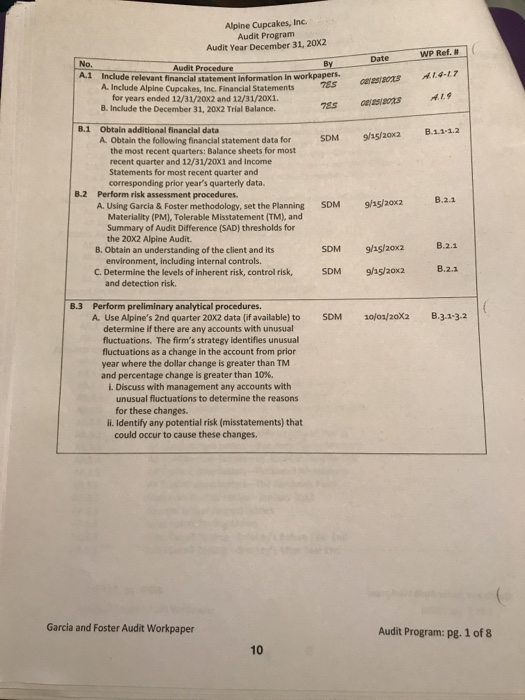

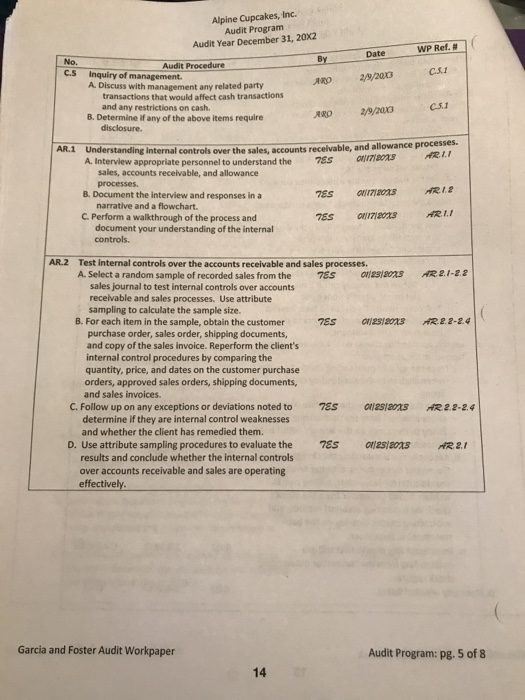

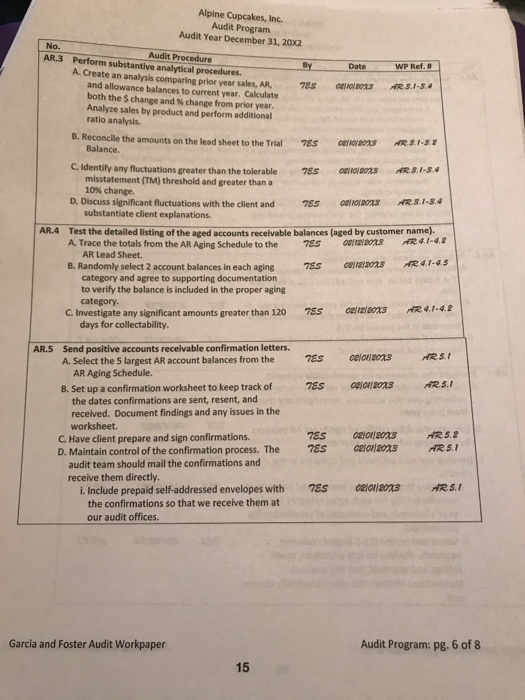

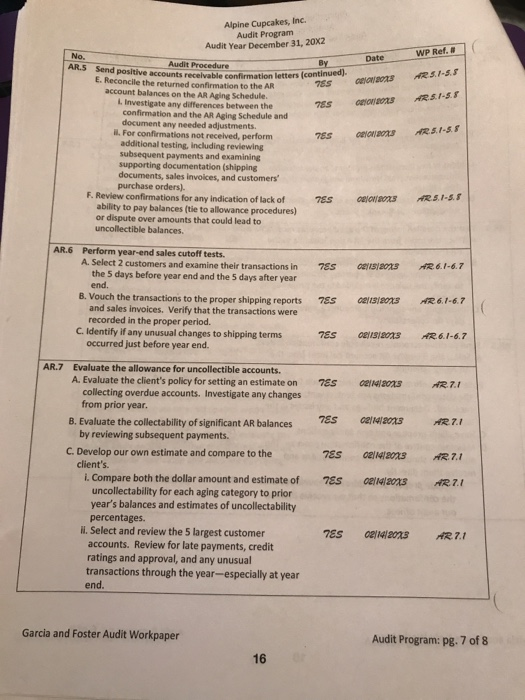

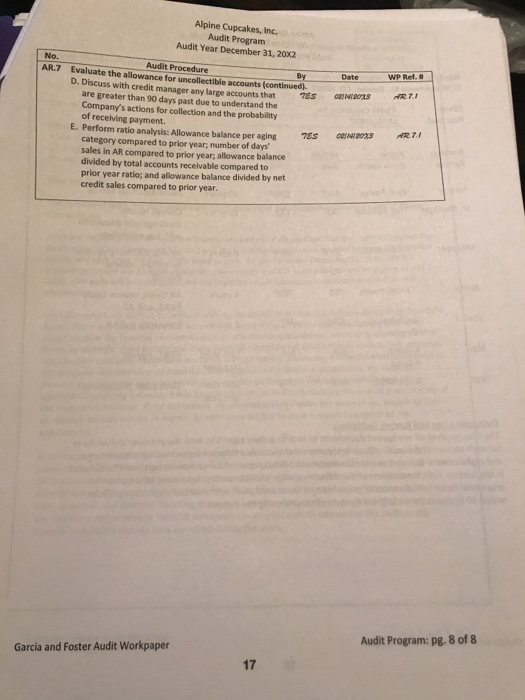

Alpine Cupcakes, Inc. Audit Program Audit Year December 31, 20x2 WP Ref. # Date No. A.1 Include relevant financial statement information in workpapers By Audit Procedure A. Include Alpine Cupcakes, Inc. Financial Statements B. Include the December 31, 20X2 Trial Balance. Obtain additional financial data for years ended 12/31/20x2 and 12/31/20x1 B.1 A. Obtain the following financial statement data for SDM 9/s/20x2 B.1.1-1.2 the most recent quarters: Balance sheets for most recent quarter and 12/31/20x1 and Income Statements for most recent quarter and corresponding prior year's quarterly data B.2 Perform risk assessment procedures. A. Using Garcia & Foster methodology, set the Planning SDM 9/15/20x2 Materiality (PM), Tolerable Misstatement (TM), and Summary of Audit Difference (SAD) thresholds for the 20X2 Alpine Audit. B. Obtain an understanding of the client and its SDM 9/s/20x2 B.2.1 environment, including internal controls. B.2.1 C. Determine the levels of inherent risk, control risk, SDM 9/15/20x2 and detection risk. B.3 Perform preliminary analytical procedures. A Use Alpine's 2nd quarter 20X2 data (if available) to SDM 0/2X2 B.3.1-3.2 determine if there are any accounts with unusual fluctuations. The firm's stratesy identifies unusual fluctuations as a change in the account from prior year where the dollar change is greater than TM and percentage change is greater than 10%. i. Discuss with management any accounts with unusual fluctuations to determine the reasons for these changes. li. Identify any potential risk (misstatements) that could occur to cause these changes Garcia and Foster Audit Workpaper Audit Program: pg. 1 of 8 10 Alpine Cupcakes, Inc. Audit Program Audit Year December 31, 20x2 WP Ref. # Date By No. C.s Audit Procedure C.S.1 Inquiry of management. A. Discuss with management any related party ARO2/9/2003 transactions that would affect cash transactions and any restrictions on cash B. Determine if any of the above items require Understanding internal controls over the sales, accounts receivable, and allowance processes. A. Interview appropriate personnel to understand the 7S AR.1 017a TR.L sales, accounts receivable, and allowance processes narrative and a flowchart. document your understanding of the internal B. Document the interview and responses in a C. Perform a walkthrough of the process and controls AR.2 Test internal controls over the accounts receivable and sales processes. A. Select a random sample of recorded sales from the 7Es S10AR21-22 sales journal to test internal controls over accounts receivable and sales processes. Use attri bute sampling to calculate the sample size. B. For each item in the sample, obtain the customerS a2s/oxs AR 2.2-24 purchase order, sales order, shipping documents, and copy of the sales invoice. Reperform the client's int ternal control procedures by comparing the quantity, price, and dates on the customer purchase orders, approved sales orders, shipping documents, and sales invoices. C. Follow up on any exceptions or deviations noted to SS R22-2.4 determine if they are internal control weaknesses and whether the client has remedied them. D. Use attribute sampling procedures to evaluate the S al2sas R.2. results and conclude whether the internal controls over accounts receivable and sales are operating effectively Garcia and Foster Audit Workpaper Audit Program: pg. 5 of 8 14 Alpine Cupcakes, Inc. Audit Program Audit Year December 31, 20x2 No. AR.3 Perform substantive analytical procedures Audit Procedure WP Ref. A. Create an analysis comparing prior year sales, AR,78S ORNOARS and allowance balances to current year. Cakculate both the $ change and % change from prior year Analyze sales by product and perform additional ratio analysis. B. Reconcile the amounts on the lead sheet to the Trial ESTO BOLS FR.S.1.S Balance. dentiy any fuctuations greater than the tolerable 765 Go1 s Rs.is. misstatement (TM) threshold and greater than a 10% change. D. Discuss significant fluctuations with the client and 7S ns ARS.1-5.4 substantiate client explanations. AR4 Test the detailed listing of the aged accounts receivable balances (aged by customer name) A Trace the totals from the AR Aging Schedule to the 7Es 0elTeleors ARAide AR Lead Sheet. B. Randomly select 2 account balances in each aging category and agree to supporting documentation to verify the balance is included in the proper aging category- icant amounts greater than 120GeTaens MR4I.a. days for collectability Send positive accounts receivable confirmation letters. A. Select the 5 largest AR account balances from the AR.5 ES alon aoasRS AR Aging Schedule. B. Set up a confirmation worksheet to keep track of 76S celoARS. the dates confirmations are sent, resent, and received. Document findings and any issues in the worksheet. Have client prepare and sign confirmations. D. Maintain control of the confirmation process. The S elolas R. audit team should mail the confirmations and receive them directly. i. Include prepaid self-addressed envelopes with 7ESalolasR.s the confirmations so that we receive them at our audit offices. Garcia and Foster Audit Workpaper Audit Program: pg.6 of 8 15 Alpine Cupcakes, Inc. Audit Program Audit Year December 31, 20x2 No. AR.7 Audit Procedure By Evaluate the allowance for uncollectible accounts (continued). D. Discuss with credit manager any large accounts that are greater than 90 days past due to understand the Company's actions for collection and the probability of receiving payment E. Perform ratio analysis: Allowance balance per aging 76s s category compared to prior year; number of days sales in AR compared to prior year; allowance balance divided by total accounts recelvable compared to prior year ratio; and allowance balance divided by net credit sales compared to prior year Audit Program: pg. 8 of 8 Garcia and Foster Audit Workpaper 17 Alpine Cupcakes, Inc. Audit Program Audit Year December 31, 20x2 WP Ref. # Date No. A.1 Include relevant financial statement information in workpapers By Audit Procedure A. Include Alpine Cupcakes, Inc. Financial Statements B. Include the December 31, 20X2 Trial Balance. Obtain additional financial data for years ended 12/31/20x2 and 12/31/20x1 B.1 A. Obtain the following financial statement data for SDM 9/s/20x2 B.1.1-1.2 the most recent quarters: Balance sheets for most recent quarter and 12/31/20x1 and Income Statements for most recent quarter and corresponding prior year's quarterly data B.2 Perform risk assessment procedures. A. Using Garcia & Foster methodology, set the Planning SDM 9/15/20x2 Materiality (PM), Tolerable Misstatement (TM), and Summary of Audit Difference (SAD) thresholds for the 20X2 Alpine Audit. B. Obtain an understanding of the client and its SDM 9/s/20x2 B.2.1 environment, including internal controls. B.2.1 C. Determine the levels of inherent risk, control risk, SDM 9/15/20x2 and detection risk. B.3 Perform preliminary analytical procedures. A Use Alpine's 2nd quarter 20X2 data (if available) to SDM 0/2X2 B.3.1-3.2 determine if there are any accounts with unusual fluctuations. The firm's stratesy identifies unusual fluctuations as a change in the account from prior year where the dollar change is greater than TM and percentage change is greater than 10%. i. Discuss with management any accounts with unusual fluctuations to determine the reasons for these changes. li. Identify any potential risk (misstatements) that could occur to cause these changes Garcia and Foster Audit Workpaper Audit Program: pg. 1 of 8 10 Alpine Cupcakes, Inc. Audit Program Audit Year December 31, 20x2 WP Ref. # Date By No. C.s Audit Procedure C.S.1 Inquiry of management. A. Discuss with management any related party ARO2/9/2003 transactions that would affect cash transactions and any restrictions on cash B. Determine if any of the above items require Understanding internal controls over the sales, accounts receivable, and allowance processes. A. Interview appropriate personnel to understand the 7S AR.1 017a TR.L sales, accounts receivable, and allowance processes narrative and a flowchart. document your understanding of the internal B. Document the interview and responses in a C. Perform a walkthrough of the process and controls AR.2 Test internal controls over the accounts receivable and sales processes. A. Select a random sample of recorded sales from the 7Es S10AR21-22 sales journal to test internal controls over accounts receivable and sales processes. Use attri bute sampling to calculate the sample size. B. For each item in the sample, obtain the customerS a2s/oxs AR 2.2-24 purchase order, sales order, shipping documents, and copy of the sales invoice. Reperform the client's int ternal control procedures by comparing the quantity, price, and dates on the customer purchase orders, approved sales orders, shipping documents, and sales invoices. C. Follow up on any exceptions or deviations noted to SS R22-2.4 determine if they are internal control weaknesses and whether the client has remedied them. D. Use attribute sampling procedures to evaluate the S al2sas R.2. results and conclude whether the internal controls over accounts receivable and sales are operating effectively Garcia and Foster Audit Workpaper Audit Program: pg. 5 of 8 14 Alpine Cupcakes, Inc. Audit Program Audit Year December 31, 20x2 No. AR.3 Perform substantive analytical procedures Audit Procedure WP Ref. A. Create an analysis comparing prior year sales, AR,78S ORNOARS and allowance balances to current year. Cakculate both the $ change and % change from prior year Analyze sales by product and perform additional ratio analysis. B. Reconcile the amounts on the lead sheet to the Trial ESTO BOLS FR.S.1.S Balance. dentiy any fuctuations greater than the tolerable 765 Go1 s Rs.is. misstatement (TM) threshold and greater than a 10% change. D. Discuss significant fluctuations with the client and 7S ns ARS.1-5.4 substantiate client explanations. AR4 Test the detailed listing of the aged accounts receivable balances (aged by customer name) A Trace the totals from the AR Aging Schedule to the 7Es 0elTeleors ARAide AR Lead Sheet. B. Randomly select 2 account balances in each aging category and agree to supporting documentation to verify the balance is included in the proper aging category- icant amounts greater than 120GeTaens MR4I.a. days for collectability Send positive accounts receivable confirmation letters. A. Select the 5 largest AR account balances from the AR.5 ES alon aoasRS AR Aging Schedule. B. Set up a confirmation worksheet to keep track of 76S celoARS. the dates confirmations are sent, resent, and received. Document findings and any issues in the worksheet. Have client prepare and sign confirmations. D. Maintain control of the confirmation process. The S elolas R. audit team should mail the confirmations and receive them directly. i. Include prepaid self-addressed envelopes with 7ESalolasR.s the confirmations so that we receive them at our audit offices. Garcia and Foster Audit Workpaper Audit Program: pg.6 of 8 15 Alpine Cupcakes, Inc. Audit Program Audit Year December 31, 20x2 No. AR.7 Audit Procedure By Evaluate the allowance for uncollectible accounts (continued). D. Discuss with credit manager any large accounts that are greater than 90 days past due to understand the Company's actions for collection and the probability of receiving payment E. Perform ratio analysis: Allowance balance per aging 76s s category compared to prior year; number of days sales in AR compared to prior year; allowance balance divided by total accounts recelvable compared to prior year ratio; and allowance balance divided by net credit sales compared to prior year Audit Program: pg. 8 of 8 Garcia and Foster Audit Workpaper 17