Answered step by step

Verified Expert Solution

Question

1 Approved Answer

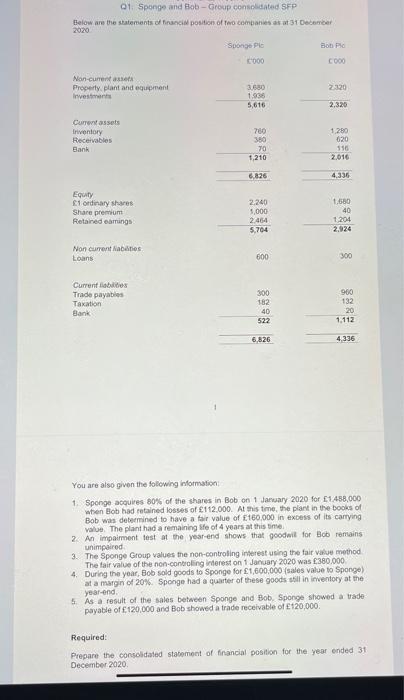

Q1: Sponge and Bob-Group consolidated SFP Below are the statements of financial position of two companies as at 31 December 2020 Sponge Pic 000

Q1: Sponge and Bob-Group consolidated SFP Below are the statements of financial position of two companies as at 31 December 2020 Sponge Pic 000 Bob Pic C000 Non-cument assets Property, plant and equipment 3,680 2.320 Investments 1.936 5,616 2,320 Current assets Inventory Receivables Bank 760 1,280 380 620 70 116 1,210 2,016 6,826 4.336 Equity 1 ordinary shares 2.240 1,680 Share premium 1,000 40 Retained eamings 2.464 1,204 5,704 2.924 Non current liabilities Loans 600 300 Current liabilities Trade payables Taxation Bank 300 960 132 182 40 20 522 1,112 6,826 4,336 You are also given the following information: 1. Sponge acquires 80% of the shares in Bob on 1 January 2020 for 1,488,000 when Bob had retained losses of 112,000. At this time, the plant in the books of Bob was determined to have a fair value of 160,000 in excess of its carrying value. The plant had a remaining Sfe of 4 years at this time. 2. An impairment test at the year-end shows that goodwill for Bob remains unimpaired 3. The Sponge Group values the non-controling interest using the fair value method. The fair value of the non-controlling interest on 1 January 2020 was 380,000. 4. During the year, Bob sold goods to Sponge for 1,600,000 (sales value to Sponge). at a margin of 20%. Sponge had a quarter of these goods still in inventory at the year-end. 5. As a result of the sales between Sponge and Bob. Sponge showed a trade payable of 120,000 and Bob showed a trade receivable of 120,000. Required: Prepare the consolidated statement of financial position for the year ended 31 December 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started