Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1. Tantor Supply, Inc., is a small corporation acting as the exclusive distributor of a major line of sporting goods. During 2010 the firm earned

Q1. Tantor Supply, Inc., is a small corporation acting as the exclusive distributor of a major line of sporting goods. During 2010 the firm earned $92,500 before taxes. (CLO1)

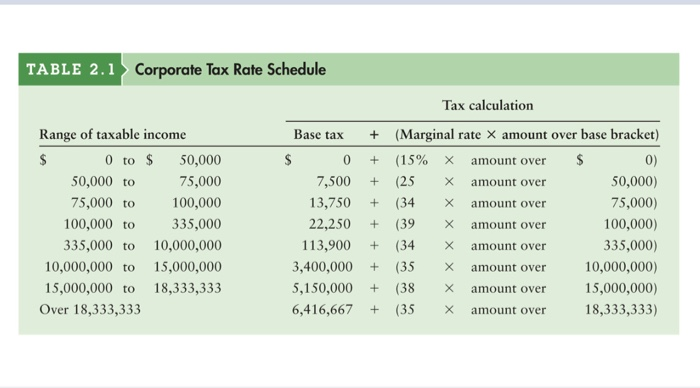

a. Calculate the firms tax liability using the corporate tax rate schedule given in Table 2.1.

b. How much are Tantor Supplys 2010 after-tax earnings?

c. What was the firms average tax rate, based on your findings in part a?

d. What is the firms marginal tax rate, based on your findings in part a?

Q2. Describe how the managerial finance function is related to economics and accounting. (CLO1)

Q3. Describe the legal forms of business organization. (CLO1)

Q4. Discuss business taxes and their importance in financial decisions. (CLO1)

Q5) Liquidity management Bauman Companys total current assets, total current liabilities, and inventory for each of the past 4 years follow. (CLO2)

Item

2009

2010

2011

2012

Total current assets

$16,950

$21,900

$22,500

$27,000

Total current liabilities

$9000

$12600

$12600

$17400

Inventory

6000

6900

6900

7200

a. Calculate the firms current and quick ratios for each year. Compare the resulting time series for these measures of liquidity.

b. Comment on the firms liquidity over the 20092010 period.

Q6). (CLO2) Inventory management Wilkins Manufacturing has annual sales of $4 million and a gross profit margin of 40%. Its end-of-quarter inventories are

Quarter

Inventory

1

$400000

2

800,000

3

1,200,000

4

200,000

a). Find the average quarterly inventory and use it to calculate the firms inventory turnover and the average age of inventory.

b). Assuming that the company is in an industry with an average inventory turnover of 2.0, how would you evaluate the activity of Wilkins inventory?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started