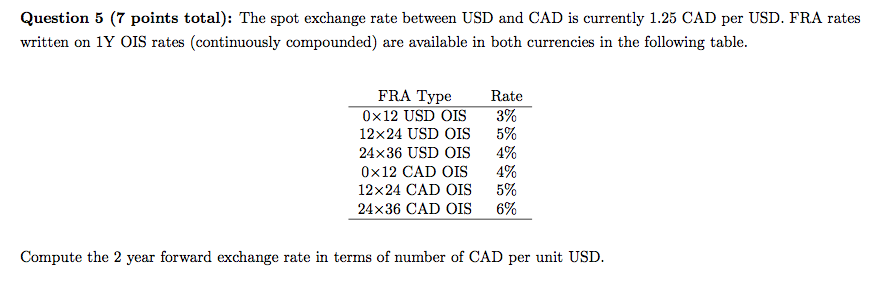

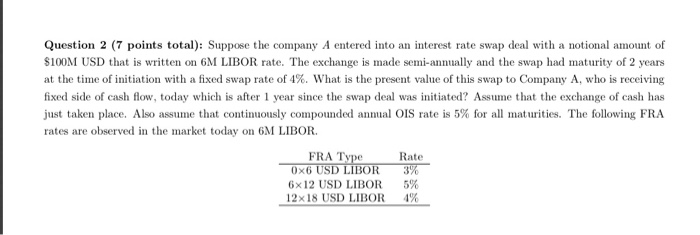

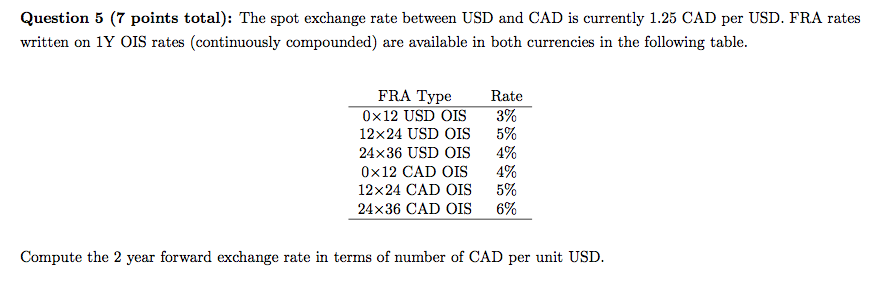

Question 5 (7 points total): The spot exchange rate between USD and CAD is currently 1.25 CAD per USD. FRA rates written on 1Y OIS rates (continuously compounded) are available in both currencies in the following table. FRA Type 0x12 USD OIS 12x24 USD OIS 24x36 USD OIS 0x12 CAD OIS 12x 24 CAD OIS 24x36 CAD OIS Rate 3% 5% 4% 4% 5% 6% Compute the 2 year forward exchange rate in terms of number of CAD per unit USD. Question 2 (7 points total): Suppose the company A entered into an interest rate swap deal with a notional amount of $100M USD that is written on 6M LIBOR rate. The exchange is made semi-annually and the swap had maturity of 2 years at the time of initiation with a fixed swap rate of 4%. What is the present value of this swap to Company A, who is receiving fixed side of cash flow, today which is after 1 year since the swap deal was initiated? Assume that the exchange of cash has just taken place. Also assume that continuously compounded annual OIS rate is 5% for all maturities. The following FRA rates are observed in the market today on 6M LIBOR. FRA Type 0x6 USD LIBOR 6x 12 USD LIBOR 12x18 USD LIBOR Rate 3% 5% 4% Question 5 (7 points total): The spot exchange rate between USD and CAD is currently 1.25 CAD per USD. FRA rates written on 1Y OIS rates (continuously compounded) are available in both currencies in the following table. FRA Type 0x12 USD OIS 12x24 USD OIS 24x36 USD OIS 0x12 CAD OIS 12x 24 CAD OIS 24x36 CAD OIS Rate 3% 5% 4% 4% 5% 6% Compute the 2 year forward exchange rate in terms of number of CAD per unit USD. Question 2 (7 points total): Suppose the company A entered into an interest rate swap deal with a notional amount of $100M USD that is written on 6M LIBOR rate. The exchange is made semi-annually and the swap had maturity of 2 years at the time of initiation with a fixed swap rate of 4%. What is the present value of this swap to Company A, who is receiving fixed side of cash flow, today which is after 1 year since the swap deal was initiated? Assume that the exchange of cash has just taken place. Also assume that continuously compounded annual OIS rate is 5% for all maturities. The following FRA rates are observed in the market today on 6M LIBOR. FRA Type 0x6 USD LIBOR 6x 12 USD LIBOR 12x18 USD LIBOR Rate 3% 5% 4%