Answered step by step

Verified Expert Solution

Question

1 Approved Answer

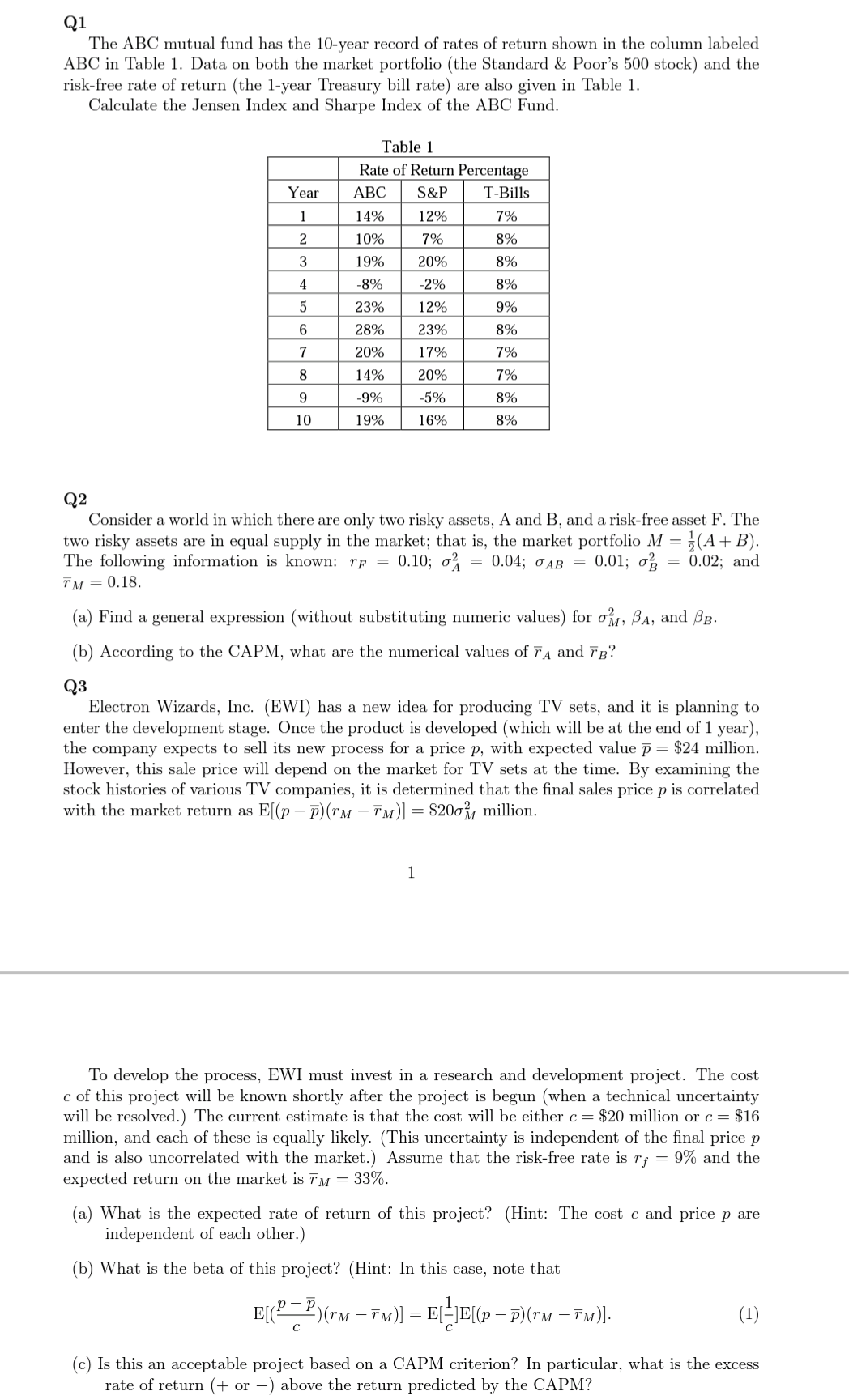

Q1 The ABC mutual fund has the 10-year record of rates of return shown in the column labeled ABC in Table 1. Data on both

Q1 The ABC mutual fund has the 10-year record of rates of return shown in the column labeled ABC in Table 1. Data on both the market portfolio (the Standard & Poor's 500 stock) and the risk-free rate of return (the 1-year Treasury bill rate) are also given in Table 1. Calculate the Jensen Index and Sharpe Index of the ABC Fund. Table 1 Rate of Return Percentage ABC S&P T-Bills Year 1 12% 7% 2 7% 8% 3 20% 14% 10% 19% -8% 23% 28% 4 -2% 12% 5 6 8% 8% 9% 8% 7% 7% 8% 7 23% 17% 20% -5% 20% 14% -9% 19% 8 9 10 16% 8% Q2 Consider a world in which there are only two risky assets, A and B, and a risk-free asset F. The two risky assets are in equal supply in the market; that is, the market portfolio M = (A+B). The following information is known: rf = 0.10; = 0.04; OAB = 0.01; of = 0.02; and TM = 0.18. (a) Find a general expression (without substituting numeric values) for om, Ba, and Bb. (b) According to the CAPM, what are the numerical values of TA and TB? Q3 Electron Wizards, Inc. (EWI) has a new idea for producing TV sets, and it is planning to enter the development stage. Once the product is developed (which will be at the end of 1 year), the company expects to sell its new process for a price p, with expected value p = $24 million. However, this sale price will depend on the market for TV sets at the time. By examining the stock histories of various TV companies, it is determined that the final sales price p is correlated with the market return as E[(p ?)(rm-7m)] = $200m million. = 1 To develop the process, EWI must invest in a research and development project. The cost c of this project will be known shortly after the project is begun (when a technical uncertainty will be resolved.) The current estimate is that the cost will be either c= $20 million or c= $16 million, and each of these is equally likely. (This uncertainty is independent of the final price p and is also uncorrelated with the market.) Assume that the risk-free rate is rf = 9% and the expected return on the market is im = 33%. (a) What is the expected rate of return of this project? (Hint: The cost c and price p are independent of each other.) (b) What is the beta of this project? (Hint: In this case, note that - p ELCP=?)(M 7m)] = EL-]E[(p )(rm im)]. (1) (c) Is this an acceptable project based on a CAPM criterion? In particular, what is the excess rate of return (+ or - ) above the return predicted by the CAPM? Q1 The ABC mutual fund has the 10-year record of rates of return shown in the column labeled ABC in Table 1. Data on both the market portfolio (the Standard & Poor's 500 stock) and the risk-free rate of return (the 1-year Treasury bill rate) are also given in Table 1. Calculate the Jensen Index and Sharpe Index of the ABC Fund. Table 1 Rate of Return Percentage ABC S&P T-Bills Year 1 12% 7% 2 7% 8% 3 20% 14% 10% 19% -8% 23% 28% 4 -2% 12% 5 6 8% 8% 9% 8% 7% 7% 8% 7 23% 17% 20% -5% 20% 14% -9% 19% 8 9 10 16% 8% Q2 Consider a world in which there are only two risky assets, A and B, and a risk-free asset F. The two risky assets are in equal supply in the market; that is, the market portfolio M = (A+B). The following information is known: rf = 0.10; = 0.04; OAB = 0.01; of = 0.02; and TM = 0.18. (a) Find a general expression (without substituting numeric values) for om, Ba, and Bb. (b) According to the CAPM, what are the numerical values of TA and TB? Q3 Electron Wizards, Inc. (EWI) has a new idea for producing TV sets, and it is planning to enter the development stage. Once the product is developed (which will be at the end of 1 year), the company expects to sell its new process for a price p, with expected value p = $24 million. However, this sale price will depend on the market for TV sets at the time. By examining the stock histories of various TV companies, it is determined that the final sales price p is correlated with the market return as E[(p ?)(rm-7m)] = $200m million. = 1 To develop the process, EWI must invest in a research and development project. The cost c of this project will be known shortly after the project is begun (when a technical uncertainty will be resolved.) The current estimate is that the cost will be either c= $20 million or c= $16 million, and each of these is equally likely. (This uncertainty is independent of the final price p and is also uncorrelated with the market.) Assume that the risk-free rate is rf = 9% and the expected return on the market is im = 33%. (a) What is the expected rate of return of this project? (Hint: The cost c and price p are independent of each other.) (b) What is the beta of this project? (Hint: In this case, note that - p ELCP=?)(M 7m)] = EL-]E[(p )(rm im)]. (1) (c) Is this an acceptable project based on a CAPM criterion? In particular, what is the excess rate of return (+ or - ) above the return predicted by the CAPM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started