Answered step by step

Verified Expert Solution

Question

1 Approved Answer

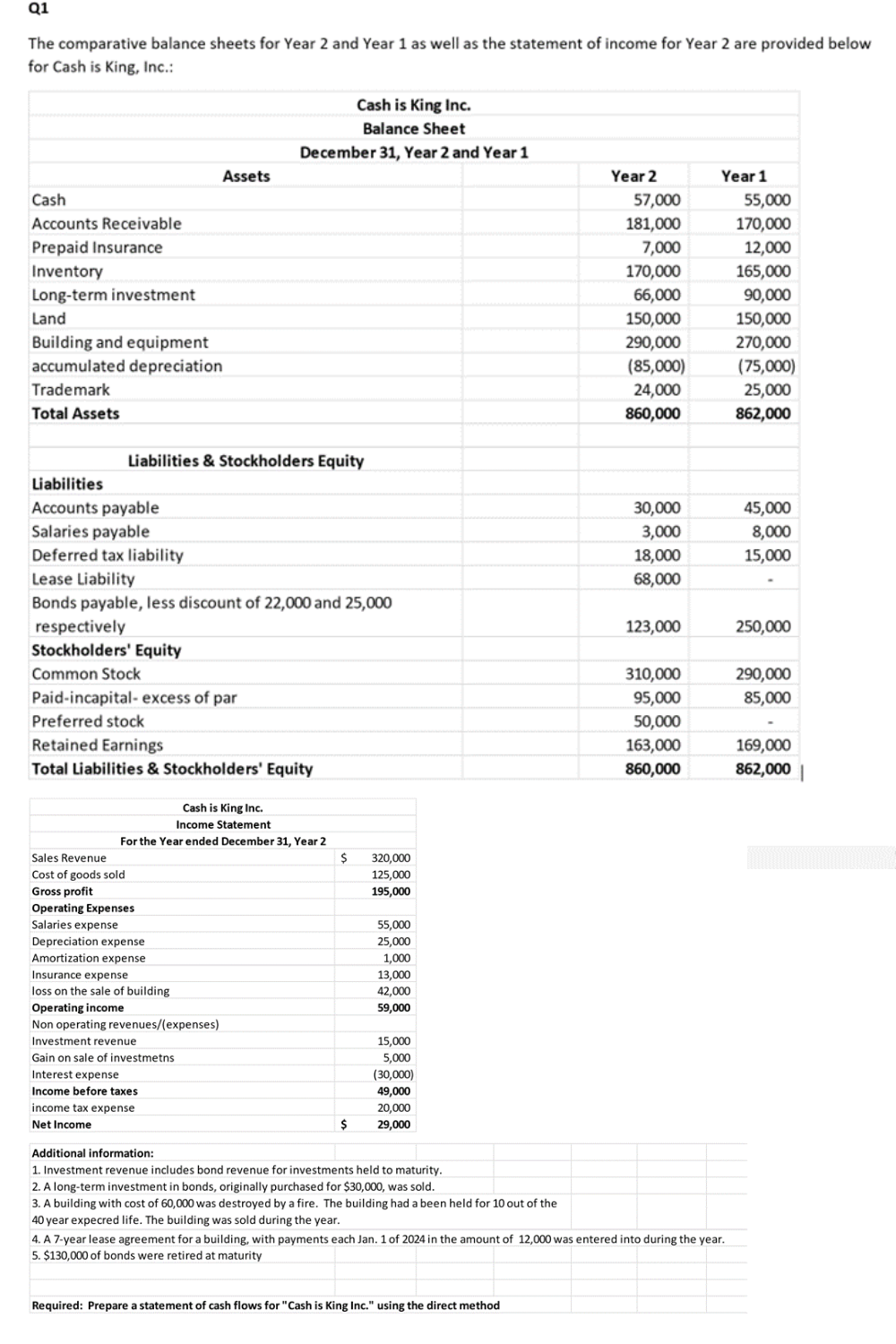

Q1 The comparative balance sheets for Year 2 and Year 1 as well as the statement of income for Year 2 are provided below

Q1 The comparative balance sheets for Year 2 and Year 1 as well as the statement of income for Year 2 are provided below for Cash is King, Inc.: Cash is King Inc. Balance Sheet December 31, Year 2 and Year 1 Assets Year 2 Year 1 Cash 57,000 55,000 Accounts Receivable Prepaid Insurance Inventory Long-term investment Land 181,000 170,000 7,000 12,000 170,000 165,000 66,000 90,000 150,000 150,000 Building and equipment 290,000 270,000 accumulated depreciation (85,000) (75,000) Trademark 24,000 25,000 Total Assets 860,000 862,000 Liabilities & Stockholders Equity Liabilities Accounts payable 30,000 45,000 Salaries payable 3,000 8,000 Deferred tax liability 18,000 15,000 Lease Liability 68,000 Bonds payable, less discount of 22,000 and 25,000 respectively 123,000 250,000 Stockholders' Equity Common Stock 310,000 290,000 Paid-incapital- excess of par 95,000 85,000 Preferred stock 50,000 Retained Earnings 163,000 169,000 Total Liabilities & Stockholders' Equity 860,000 862,000 Sales Revenue Cost of goods sold Gross profit Cash is King Inc. Income Statement For the Year ended December 31, Year 2 $ 320,000 125,000 195,000 Operating Expenses Salaries expense Depreciation expense 55,000 25,000 Amortization expense 1,000 Insurance expense 13,000 loss on the sale of building 42,000 Operating income 59,000 Non operating revenues/(expenses) Investment revenue Gain on sale of investmetns Interest expense Income before taxes income tax expense Net Income 15,000 5,000 (30,000) 49,000 20,000 $ 29,000 Additional information: 1. Investment revenue includes bond revenue for investments held to maturity. 2. A long-term investment in bonds, originally purchased for $30,000, was sold. 3. A building with cost of 60,000 was destroyed by a fire. The building had a been held for 10 out of the 40 year expecred life. The building was sold during the year. 4. A 7-year lease agreement for a building, with payments each Jan. 1 of 2024 in the amount of 12,000 was entered into during the year. 5. $130,000 of bonds were retired at maturity Required: Prepare a statement of cash flows for "Cash is King Inc." using the direct method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started