Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Marcon Ltd. is a Canadian company that is publicly traded on the Toronto Stock Exchange. For both income tax purposes and accounting purposes, the

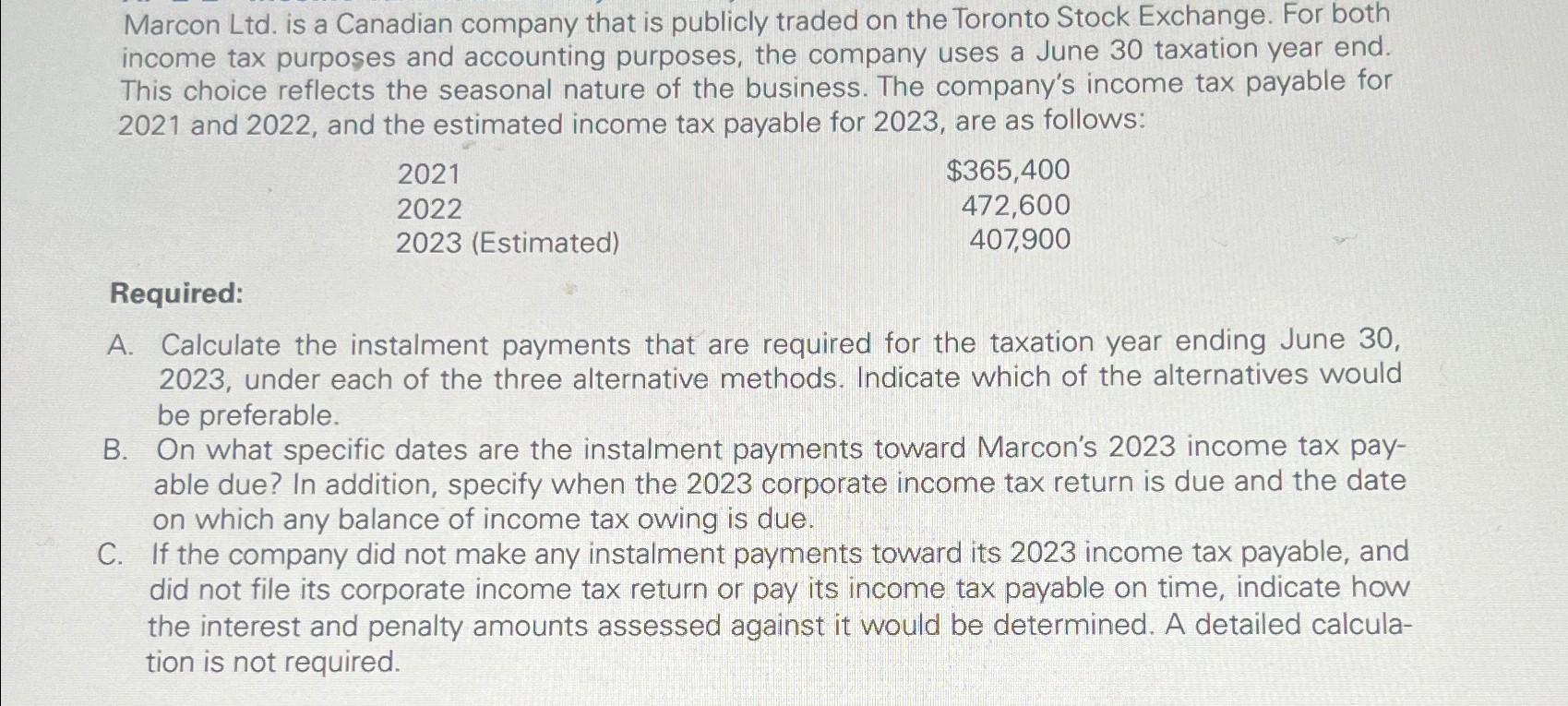

Marcon Ltd. is a Canadian company that is publicly traded on the Toronto Stock Exchange. For both income tax purposes and accounting purposes, the company uses a June 30 taxation year end. This choice reflects the seasonal nature of the business. The company's income tax payable for 2021 and 2022, and the estimated income tax payable for 2023, are as follows: 2021 2022 2023 (Estimated) $365,400 472,600 407,900 Required: A. Calculate the instalment payments that are required for the taxation year ending June 30, 2023, under each of the three alternative methods. Indicate which of the alternatives would be preferable. B. On what specific dates are the instalment payments toward Marcon's 2023 income tax pay- able due? In addition, specify when the 2023 corporate income tax return is due and the date on which any balance of income tax owing is due. C. If the company did not make any instalment payments toward its 2023 income tax payable, and did not file its corporate income tax return or pay its income tax payable on time, indicate how the interest and penalty amounts assessed against it would be determined. A detailed calcula- tion is not required.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started