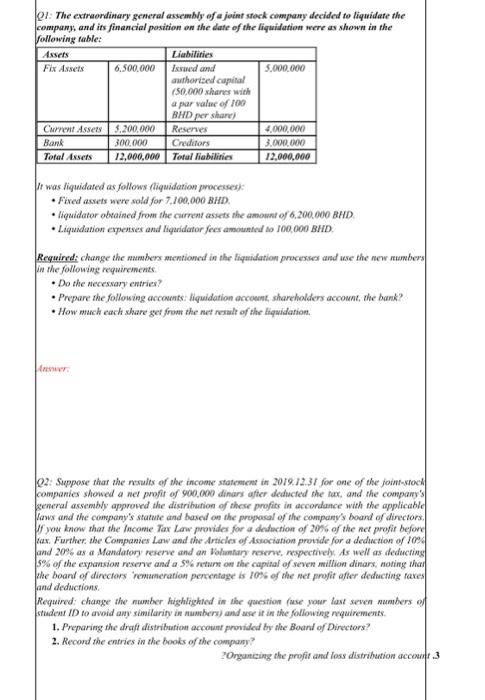

Q1: The extraordinary general assembly of a joint stock company decided to liquidate the company, and its financial position on the date of the liquidation were as shown in the following able: Assets Liabilities Fix Assets 6.500.000 Issued and 5.000.000 authorized capital (50.000 shares with a par value of 100 BHD per share) Current Assets 3.200,000 Reserves 4.000.000 Bank 300.000 Creditors 3.000.000 Total Assets 12,000,000 Total liabilities 12,000,000 . it was liquidated as follows (liquidation processes: Fixed assets were sold for 7,100,000 BHD. liquidator obtained from the current assets the amount of 6.200.000 BHD Liquidation expenses and Miquidator fees amounted to 100.000 BHD. Required: change the numbers mentioned in the liquidation processes and use the new numbers in the following requirements Do the necessary entries? Prepare the following accounts: liquidation account, shareholders account, the bank? How much each share get from the must result of the liquidation . . 02: Suppose thar the results of the income statement in 2019.12.31 for one of the join-stoch companies showed a ner profit of 900.000 dinars after deducted the lux and the company's general assembly approved the distribution of these profits in accordance with the applicable laws and the company's statute and based on the proposal of the company's board of directors, you know that the Income Tax Law provides for a deduction of 20% of the net profit before ax. Further, the Companies Law and the Articles of Association provide for a deduction of 10% and 20% as a Mandatory reserve and an Voluntary rosene, respectively. As well as deducting 5% of the expansion reserve and a 5% retire on the capital of seven million dinars, noting that the board of directors romaneration percentage is 10% of the net profit after deducting raxes and deductions Required change the number Highlighted in the question (use your last seven numbers of student ID to avoid any similarity in numbers) and use it in the following requirements 1. Preparing the draft distribution account provided by the Board of Directors? 2. Record the entries in the books of the company? Oryancing the profit and loss distribution account.3