Answered step by step

Verified Expert Solution

Question

1 Approved Answer

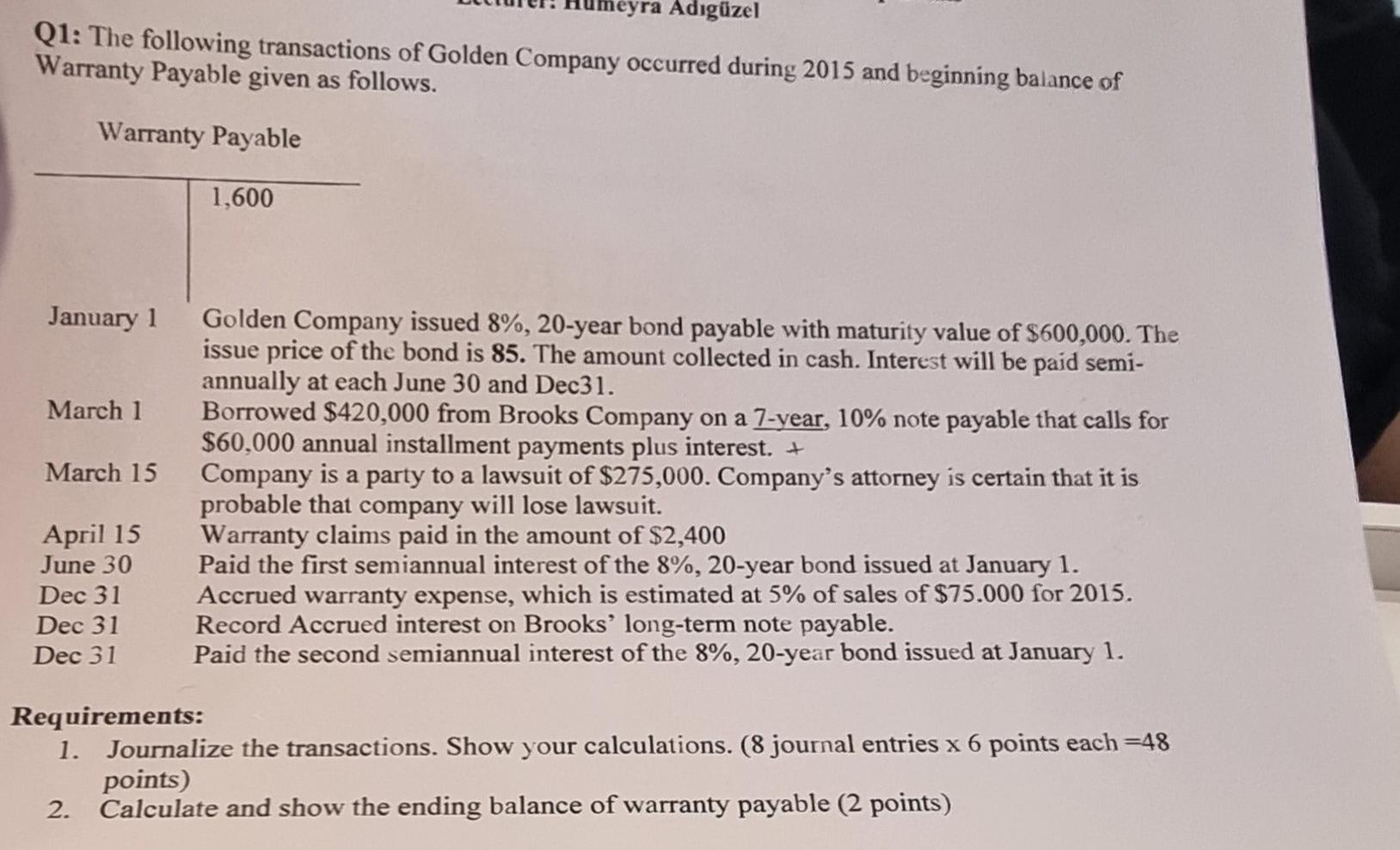

Q1: The following transactions of Golden Company occurred during 2015 and beginning balance of Warranty Payable given as follows. Warranty Payable begin{tabular}{l|l} hline & 1,600

Q1: The following transactions of Golden Company occurred during 2015 and beginning balance of Warranty Payable given as follows. Warranty Payable \begin{tabular}{l|l} \hline & 1,600 \end{tabular} January 1 Golden Company issued 8%,20-year bond payable with maturity value of $600,000. The issue price of the bond is 85. The amount collected in cash. Interest will be paid semiannually at each June 30 and Dec 31. March 1 Borrowed $420,000 from Brooks Company on a 7 -year, 10% note payable that calls for $60,000 annual installment payments plus interest. + March 15 Company is a party to a lawsuit of $275,000. Company's attorney is certain that it is probable that company will lose lawsuit. April 15 Warranty claims paid in the amount of $2,400 June 30 Paid the first semiannual interest of the 8%,20-year bond issued at January 1 . Dec 31 Accrued warranty expense, which is estimated at 5\% of sales of $75.000 for 2015. Dec 31 Record Accrued interest on Brooks' long-term note payable. Dec 31 Paid the second semiannual interest of the 8\%, 20-year bond issued at January 1. Requirements: 1. Journalize the transactions. Show your calculations. ( 8 journal entries 6 points each =48 points) 2. Calculate and show the ending balance of warranty payable ( 2 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started