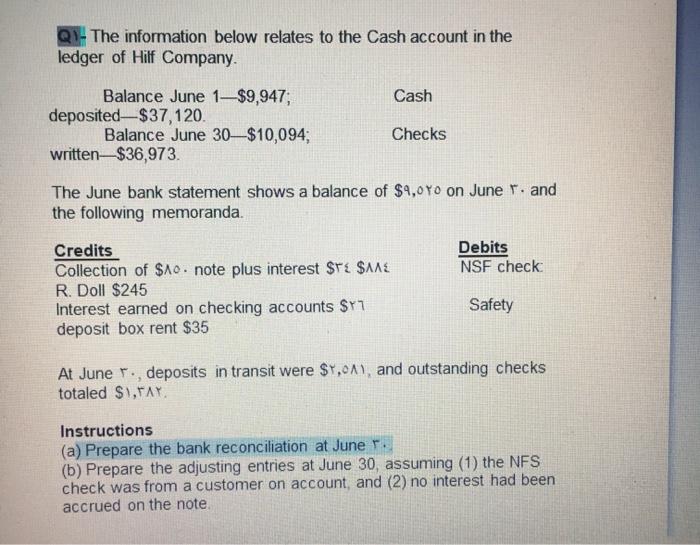

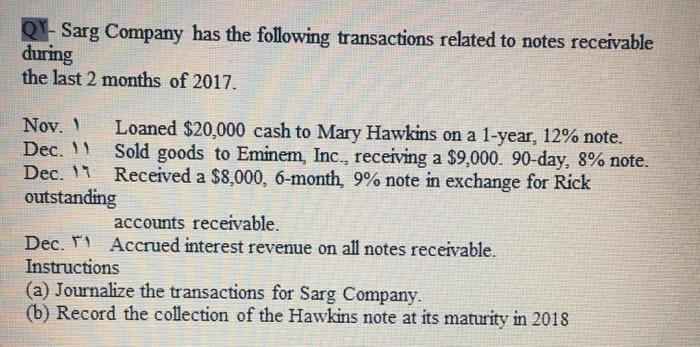

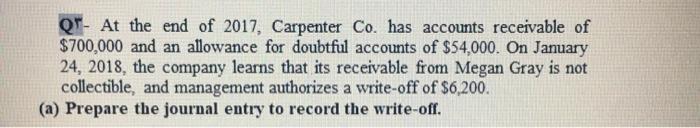

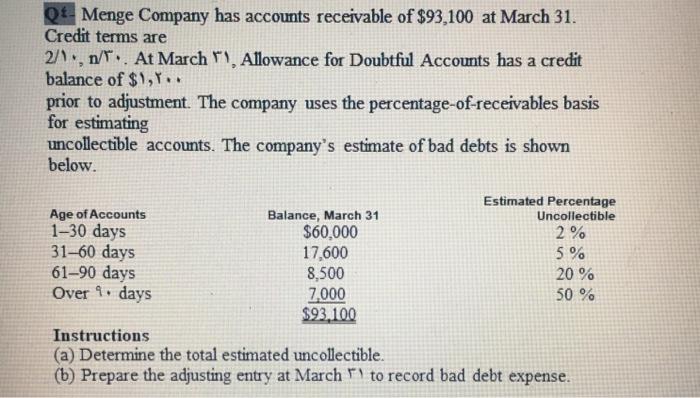

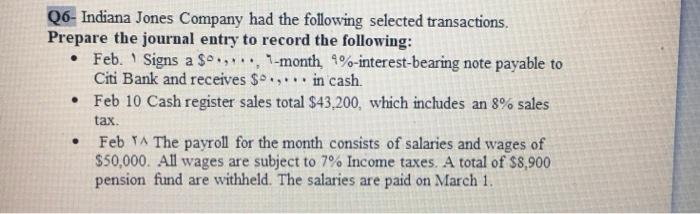

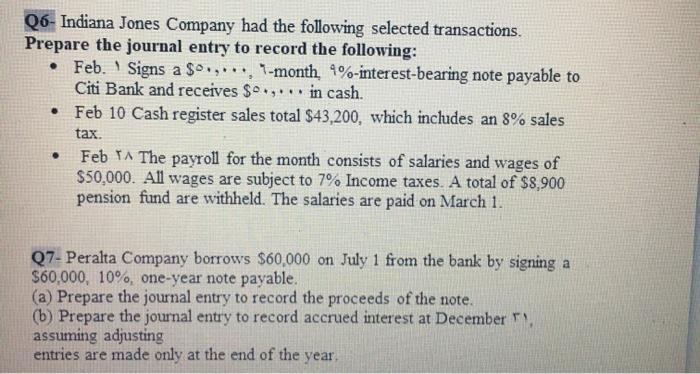

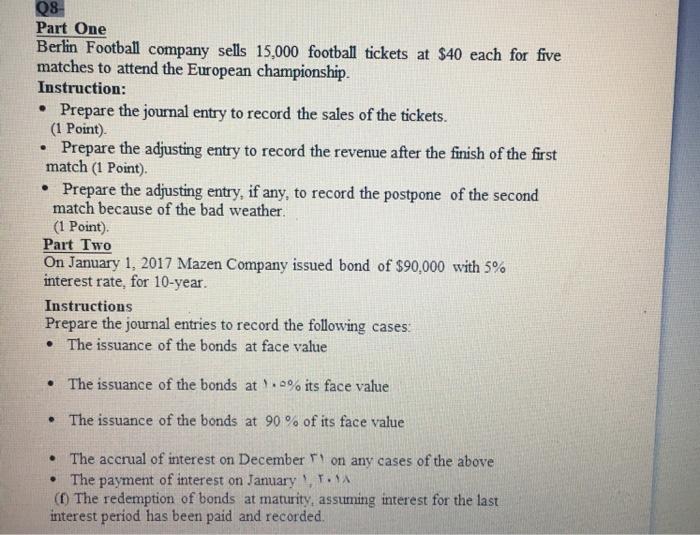

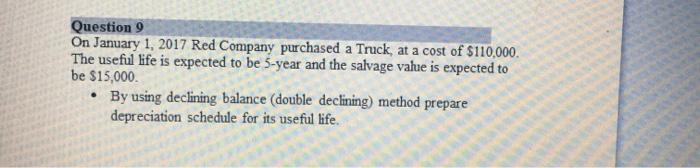

Q1- The information below relates to the Cash account in the ledger of Hilf Company. Cash Balance June 1$9,947, deposited$37,120 Balance June 30$10,094; written-$36,973. Checks The June bank statement shows a balance of $4,090 on June r. and the following memoranda. Debits NSF check Credits Collection of $10. note plus interest Sri $12 R. Doll $245 Interest earned on checking accounts $71 deposit box rent $35 Safety At June r., deposits in transit were $1,01), and outstanding checks totaled $ Instructions (a) Prepare the bank reconciliation at June r. (6) Prepare the adjusting entries at June 30, assuming (1) the NFS check was from a customer on account, and (2) no interest had been accrued on the note RY- Sarg Company has the following transactions related to notes receivable during the last 2 months of 2017. Nov.) Loaned $20,000 cash to Mary Hawkins on a 1-year, 12% note. Dec. 1) Sold goods to Eminem, Inc., receiving a $9,000. 90-day, 8% note. Dec. 11 Received a $8,000, 6-month, 9% note in exchange for Rick outstanding accounts receivable. Dec. Ti Accrued interest revenue on all notes receivable. Instructions (a) Journalize the transactions for Sarg Company. (6) Record the collection of the Hawkins note at its maturity in 2018 QT- At the end of 2017, Carpenter Co. has accounts receivable of $700,000 and an allowance for doubtful accounts of $54,000. On January 24, 2018, the company learns that its receivable from Megan Gray is not collectible, and management authorizes a write-off of $6,200. (a) Prepare the journal entry to record the write-off. QMenge Company has accounts receivable of $93,100 at March 31. Credit terms are 2/1, n/T.. At MarchT), Allowance for Doubtful Accounts has a credit balance of $1,Y.. prior to adjustment. The company uses the percentage-of-receivables basis for estimating uncollectible accounts. The company's estimate of bad debts is shown below. Estimated Percentage Age of Accounts Balance, March 31 Uncollectible 1-30 days $60,000 2% 31-60 days 17,600 5 % 61-90 days 8,500 20 % Over 9 days 7,000 50 % $93.100 Instructions (a) Determine the total estimated uncollectible. (b) Prepare the adjusting entry at March to record bad debt expense. Q6- Indiana Jones Company had the following selected transactions. Prepare the journal entry to record the following: Feb. Signs a $.,*.., 1-month 9%-interest-bearing note payable to Citi Bank and receives $0, in cash. Feb 10 Cash register sales total $43,200, which includes an 8% sales tax Feb YA The payroll for the month consists of salaries and wages of $50,000. All wages are subject to 7% Income taxes. A total of $8,900 pension fund are withheld. The salaries are paid on March 1. Q6- Indiana Jones Company had the following selected transactions. Prepare the journal entry to record the following: Feb. Signs a $0, 1-month, 4%-interest-bearing note payable to Citi Bank and receives $0.,.. in cash. Feb 10 Cash register sales total $43,200, which includes an 8% sales tax. Feb TA The payroll for the month consists of salaries and wages of $50,000. All wages are subject to 7% Income taxes. A total of $8,900 pension fund are withheld. The salaries are paid on March 1. Q7- Peralta Company borrows $60,000 on July 1 from the bank by signing a $60,000, 10%, one-year note payable. (a) Prepare the journal entry to record the proceeds of the note. (b) Prepare the journal entry to record accrued interest at December assuming adjusting entries are made only at the end of the year. . . Q8 Part One Berlin Football company sells 15,000 football tickets at $40 each for five matches to attend the European championship. Instruction: Prepare the journal entry to record the sales of the tickets. (1 Point) Prepare the adjusting entry to record the revenue after the finish of the first match (1 Point) Prepare the adjusting entry, if any, to record the postpone of the second match because of the bad weather (1 Point) Part Two On January 1, 2017 Mazen Company issued bond of $90,000 with 5% interest rate, for 10-year. Instructions Prepare the journal entries to record the following cases The issuance of the bonds at face value The issuance of the bonds at 9.6% its face value The issuance of the bonds at 90 % of its face value The accrual of interest on December) on any cases of the above The payment of interest on January (1) The redemption of bonds at maturity, assuming interest for the last interest period has been paid and recorded. Question 9 On January 1, 2017 Red Company purchased a Truck, at a cost of $110,000 The useful life is expected to be 5-year and the salvage value is expected to be $15,000 By using declining balance (double declining) method prepare depreciation schedule for its useful life