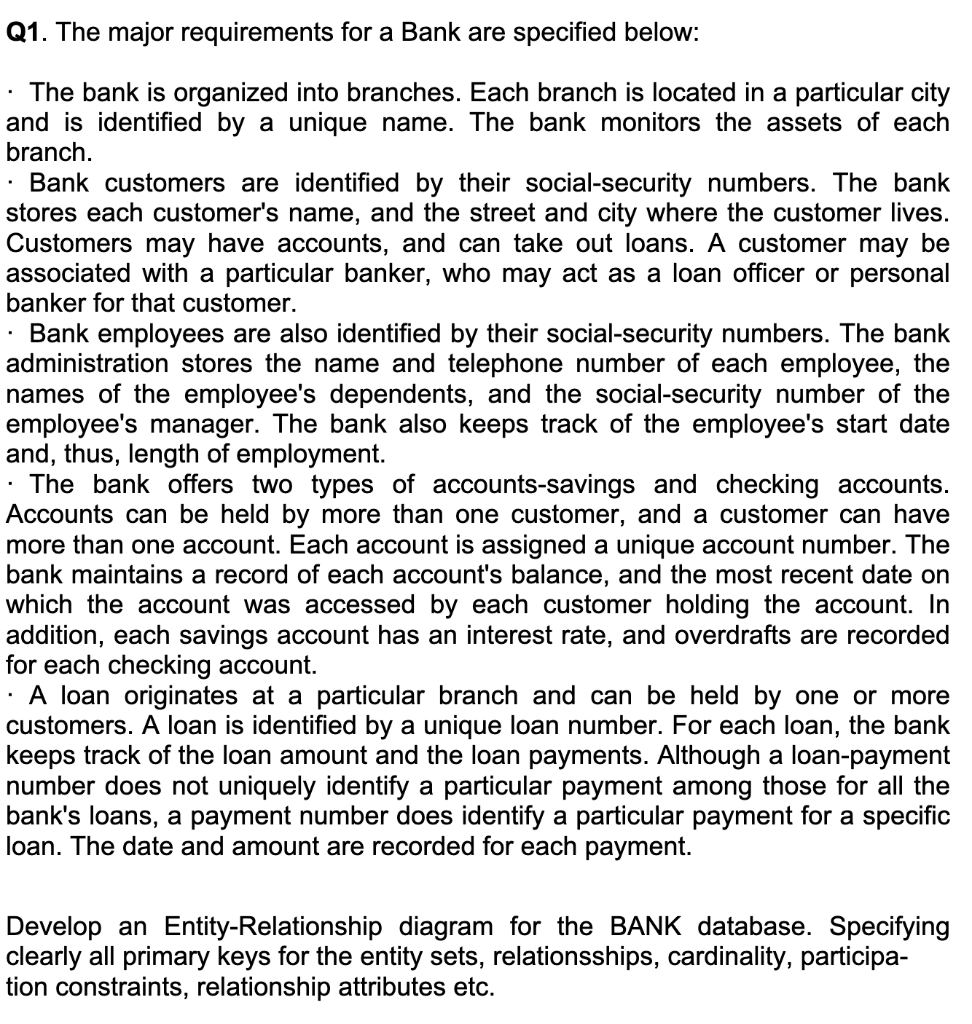

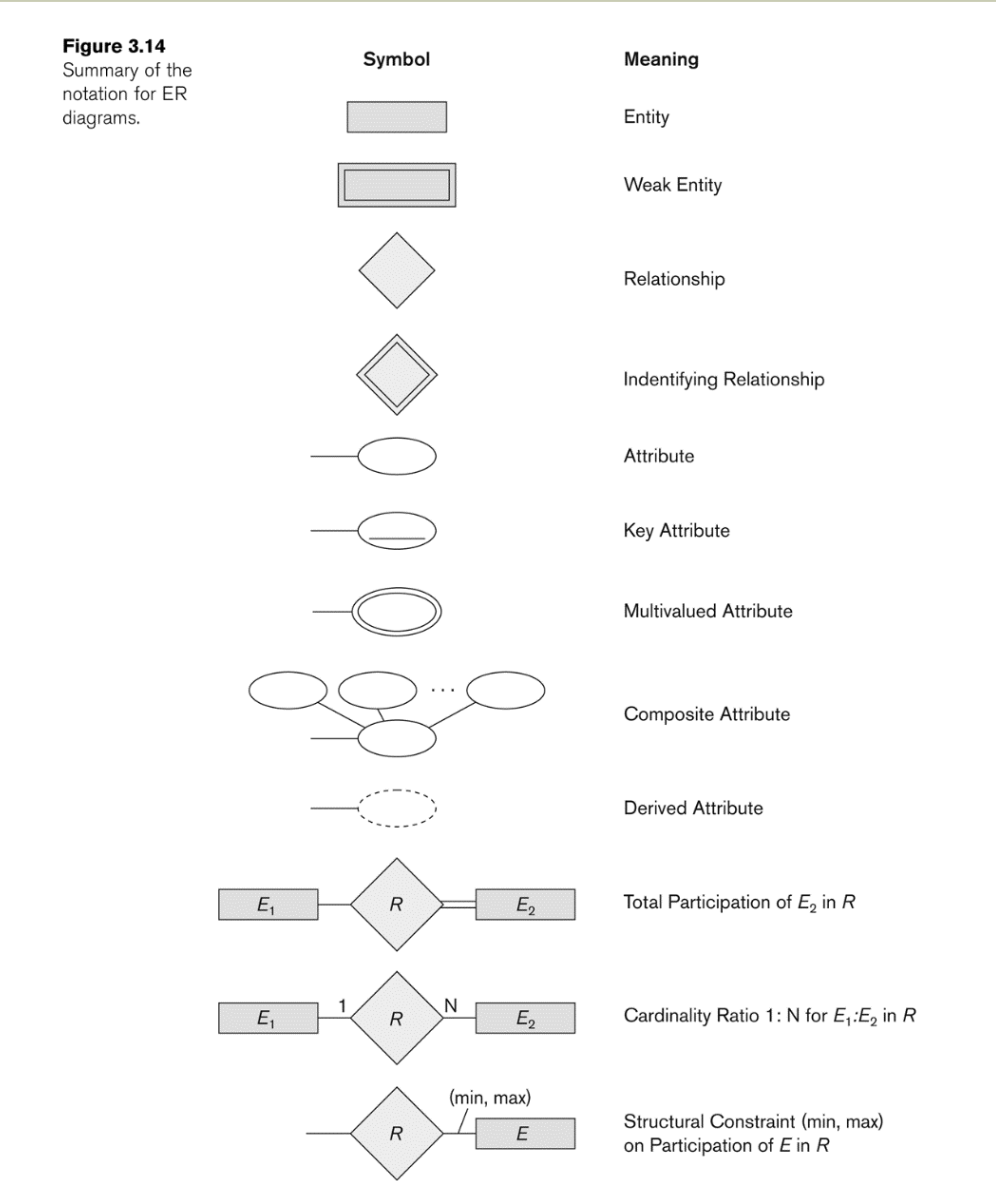

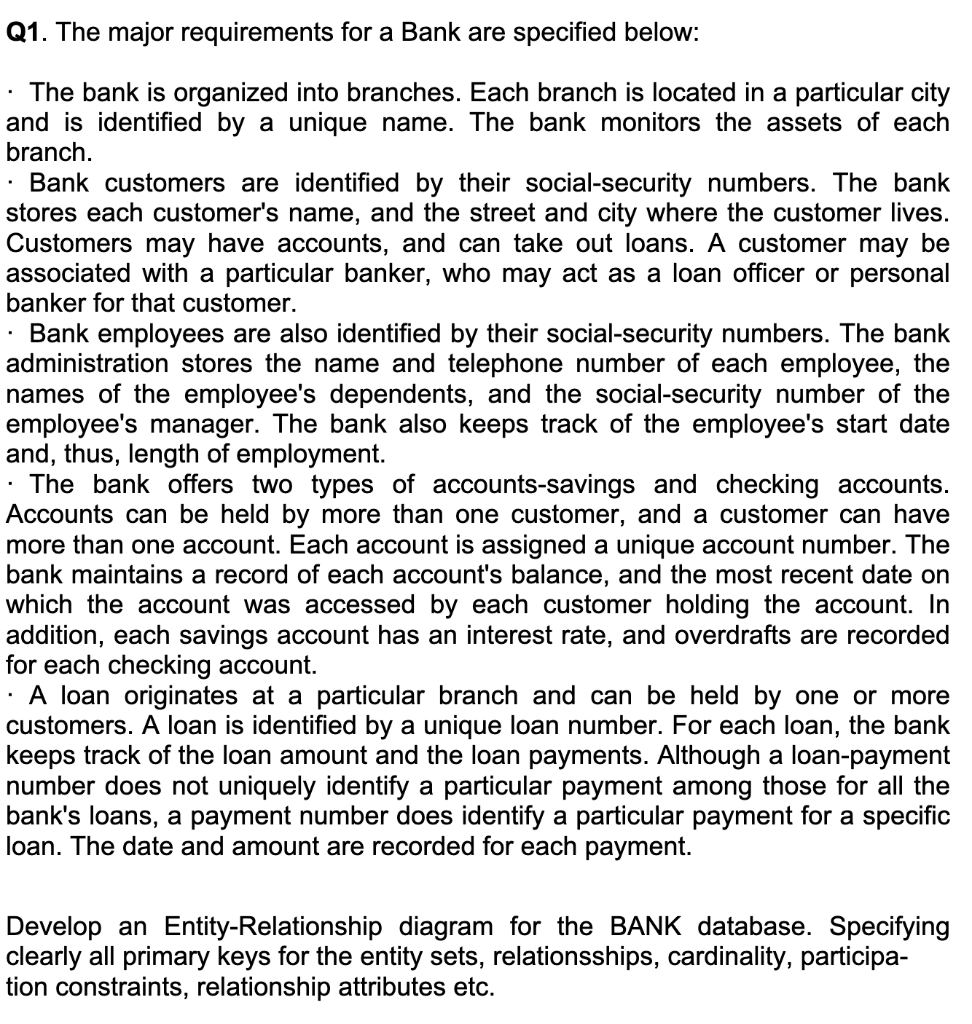

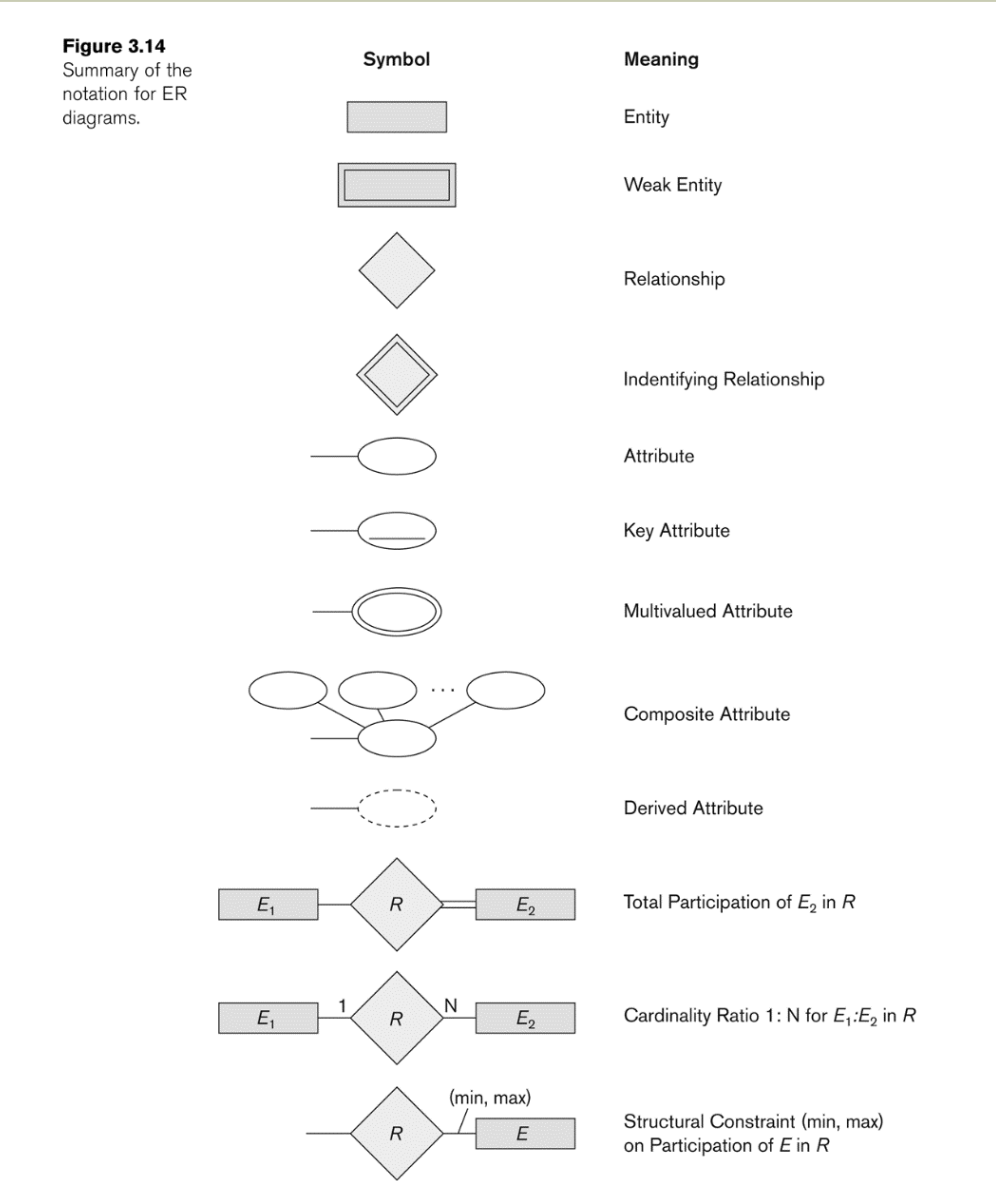

Q1. The major requirements for a Bank are specified below: The bank is organized into branches. Each branch is located in a particular city and is identified by a unique name. The bank monitors the assets of each branch. Bank customers are identified by their social-security numbers. The bank stores each customer's name, and the street and city where the customer lives. Customers may have accounts, and can take out loans. A customer may be associated with a particular banker, who may act as a loan officer or personal banker for that customer. Bank employees are also identified by their social security numbers. The bank administration stores the name and telephone number of each employee, the names of the employee's dependents, and the social-security number of the employee's manager. The bank also keeps track of the employee's start date and, thus, length of employment. The bank offers two types of accounts-savings and checking accounts. Accounts can be held by more than one customer, and a customer can have more than one account. Each account is assigned a unique account number. The bank maintains a record of each account's balance, and the most recent date on which the account was accessed by each customer holding the account. In addition, each savings account has an interest rate, and overdrafts are recorded for each checking account. A loan originates at a particular branch and can be held by one or more customers. A loan is identified by a unique loan number. For each loan, the bank keeps track of the loan amount and the loan payments. Although a loan-payment number does not uniquely identify a particular payment among those for all the bank's loans, a payment number does identify a particular payment for a specific loan. The date and amount are recorded for each payment. Develop an Entity-Relationship diagram for the BANK database. Specifying clearly all primary keys for the entity sets, relationsships, cardinality, participa- tion constraints, relationship attributes etc. Symbol Meaning Figure 3.14 Summary of the notation for ER diagrams. Entity Weak Entity Relationship Indentifying Relationship Attribute Key Attribute Multivalued Attribute ego Composite Attribute O Derived Attribute Total Participation of E, in R N Cardinality Ratio 1: N for E:Ey in R (min, max) Structural Constraint (min, max) on Participation of E in R