Question

Q1. The Red-Blen Inc. produces air-condition materials in Denmark. The company has become the third largest producer for cooling items in the market with $3,500,000

Q1. The Red-Blen Inc. produces air-condition materials in Denmark. The company has become the third largest producer for cooling items in the market with $3,500,000 of Net Sales at the end of 2020. As of today (31.12.2020), shares outstanding of the firm is 185,000. Net Sales of the company is expected to increase by 7% in each year (2021, 2022 and 2023). Financial analyst of the firm has estimated the following ratios:

a) Current EBIT margin of the firm is 45% and it will be constant for future

b) Current NWC turnover is and it will be constant for each year

c) Current Fixed Asset turnover and it will be constant for each year.

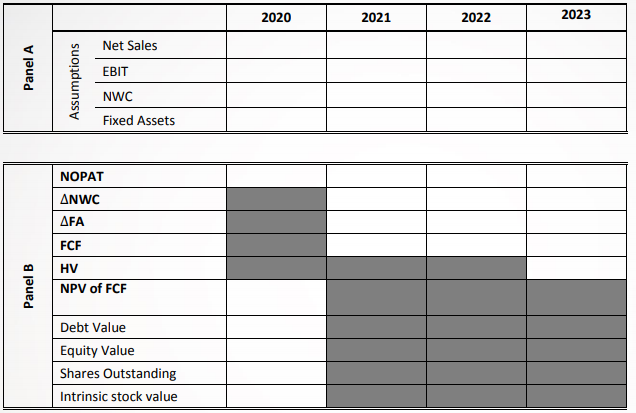

According to the report of finance department total market value of companys long term and short-term debts is $2,252,000. Growth rate of the free cash flows after 2023 is expected as 4%. Cost of capital is reported as 8% and expected to be constant for the following 3 years. Tax rate of the firm is 35%. Calculate the intrinsic stock value of the firm using the template below and show your calculations for year 2023.

Q2. If market price of the stock is $12.35, what would be your recommendation? Answer with justification

2020 2021 2022 2023 Net Sales Panel A EBIT Assumptions NWC Fixed Assets NOPAT ANWC AFA FCF HV Panel B NPV of FCF Debt Value Equity Value Shares Outstanding Intrinsic stock valueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started