Answered step by step

Verified Expert Solution

Question

1 Approved Answer

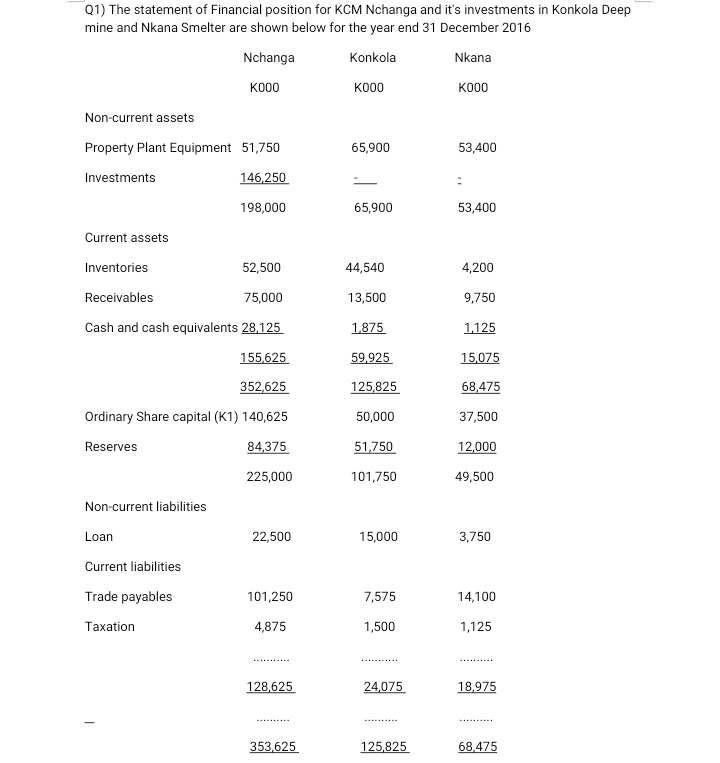

Q1) The statement of Financial position for KCM Nchanga and it's investments in Konkola Deep Additional information a) KCM Nchanga acquired 40,000,000 ordinary shares in

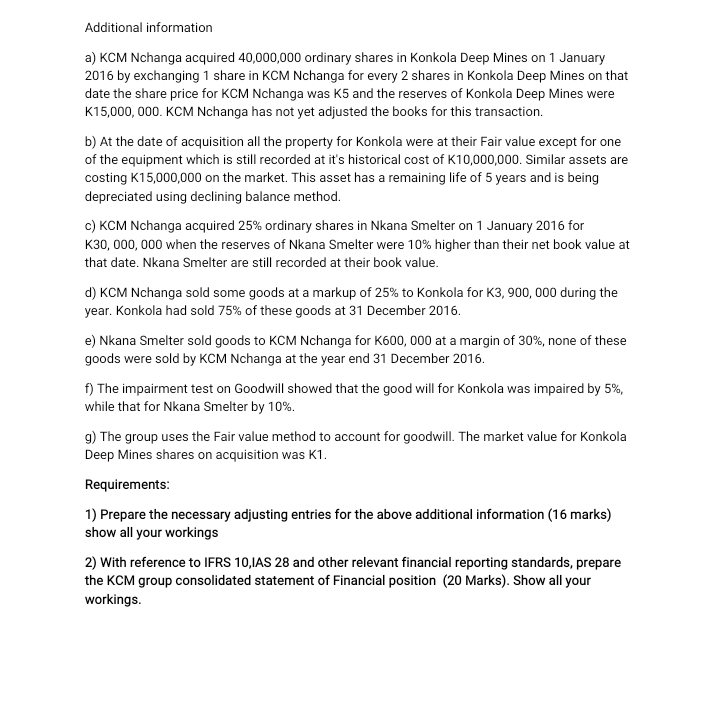

Q1) The statement of Financial position for KCM Nchanga and it's investments in Konkola Deep Additional information a) KCM Nchanga acquired 40,000,000 ordinary shares in Konkola Deep Mines on 1 January 2016 by exchanging 1 share in KCM Nchanga for every 2 shares in Konkola Deep Mines on that date the share price for KCM Nchanga was K5 and the reserves of Konkola Deep Mines were K15,000, 000. KCM Nchanga has not yet adjusted the books for this transaction. b) At the date of acquisition all the property for Konkola were at their Fair value except for one of the equipment which is still recorded at it's historical cost of K10,000,000. Similar assets are costing K15,000,000 on the market. This asset has a remaining life of 5 years and is being depreciated using declining balance method. c) KCM Nchanga acquired 25% ordinary shares in Nkana Smelter on 1 January 2016 for K30, 000, 000 when the reserves of Nkana Smelter were 10% higher than their net book value at that date. Nkana Smelter are still recorded at their book value. d) KCM Nchanga sold some goods at a markup of 25% to Konkola for K3, 900,000 during the year. Konkola had sold 75% of these goods at 31 December 2016. e) Nkana Smelter sold goods to KCM Nchanga for K600, 000 at a margin of 30%, none of these goods were sold by KCM Nchanga at the year end 31 December 2016. f) The impairment test on Goodwill showed that the good will for Konkola was impaired by 5%, while that for Nkana Smelter by 10%. g) The group uses the Fair value method to account for goodwill. The market value for Konkola Deep Mines shares on acquisition was K1. Requirements: 1) Prepare the necessary adjusting entries for the above additional information (16 marks) show all your workings 2) With reference to IFRS 10,IAS 28 and other relevant financial reporting standards, prepare the KCM group consolidated statement of Financial position (20 Marks). Show all your workings. Q1) The statement of Financial position for KCM Nchanga and it's investments in Konkola Deep Additional information a) KCM Nchanga acquired 40,000,000 ordinary shares in Konkola Deep Mines on 1 January 2016 by exchanging 1 share in KCM Nchanga for every 2 shares in Konkola Deep Mines on that date the share price for KCM Nchanga was K5 and the reserves of Konkola Deep Mines were K15,000, 000. KCM Nchanga has not yet adjusted the books for this transaction. b) At the date of acquisition all the property for Konkola were at their Fair value except for one of the equipment which is still recorded at it's historical cost of K10,000,000. Similar assets are costing K15,000,000 on the market. This asset has a remaining life of 5 years and is being depreciated using declining balance method. c) KCM Nchanga acquired 25% ordinary shares in Nkana Smelter on 1 January 2016 for K30, 000, 000 when the reserves of Nkana Smelter were 10% higher than their net book value at that date. Nkana Smelter are still recorded at their book value. d) KCM Nchanga sold some goods at a markup of 25% to Konkola for K3, 900,000 during the year. Konkola had sold 75% of these goods at 31 December 2016. e) Nkana Smelter sold goods to KCM Nchanga for K600, 000 at a margin of 30%, none of these goods were sold by KCM Nchanga at the year end 31 December 2016. f) The impairment test on Goodwill showed that the good will for Konkola was impaired by 5%, while that for Nkana Smelter by 10%. g) The group uses the Fair value method to account for goodwill. The market value for Konkola Deep Mines shares on acquisition was K1. Requirements: 1) Prepare the necessary adjusting entries for the above additional information (16 marks) show all your workings 2) With reference to IFRS 10,IAS 28 and other relevant financial reporting standards, prepare the KCM group consolidated statement of Financial position (20 Marks). Show all your workings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started