Question

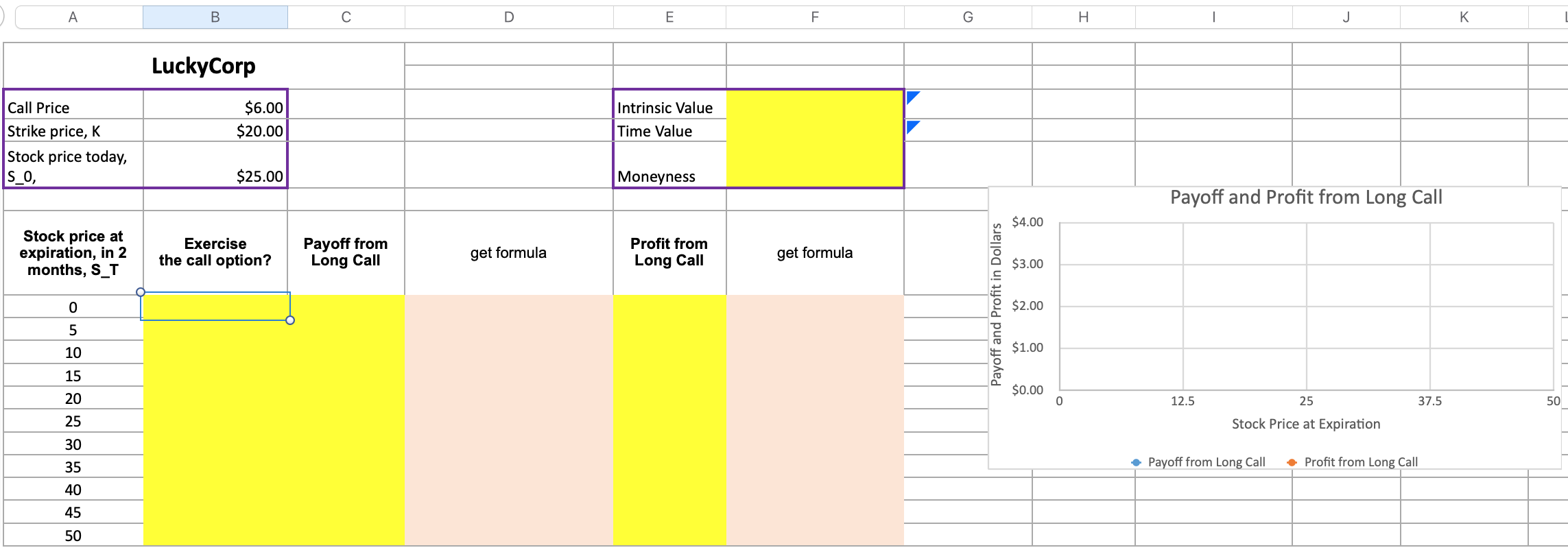

Q1. Today you bought one call option (i.e., long call) on LuckyCorp stock. The option price is $6 with an expiration date in 2 months

Q1. Today you bought one call option (i.e., long call) on LuckyCorp stock. The option price is $6 with an expiration date in 2 months and an exercise price of $20. The current stock price is $25.

(1) What is the Intrinsic Value of this option? What is its Time Value? Is this option At-TheMoney, In-The-Money or Out-of-The-Money? (1point)

(2) LuckyCorp can have a stock price between $0 to $50 in 2 months, with increments of $5. In other words, LuckyCorps stock price can be $0, $5, $10$45 or $50 in 2 months. Decide if you are you going to exercise the call option under each of these possible stock prices. (1 point)

(3) Calculate the Payoff of this long call position at expiration for each possible stock price. (1 point)

(4) Calculate the Profit of this long call position at expiration for each possible stock price. (1 point)

(5) Plot your results from (3) and (4) together on one scatter chart to display Payoff and Profit functions of this long call position. (1 point)

. B D E F G I . | J K LuckyCorp $6.00 $20.00 Intrinsic Value Time Value Call Price Strike price, K Stock price today, S_O, $25.00 Moneyness Payoff and Profit from Long Call $4.00 Stock price at expiration, in 2 months, S_T Exercise the call option? Payoff from Long Call get formula Profit from Long Call get formula $3.00 0 Payoff and Profit in Dollars $2.00 5 10 $1.00 15 $0.00 20 0 12.5 25 37.5 50 25 Stock Price at Expiration 30 35 Payoff from Long Call Profit from Long Call 40 45 50Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started