Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1. Traditional and Alternative Costing Methods - Case No 1 Page 4 of 6 Case 1 Activity Base Costing (ABC) Oman cosmetics LLC . produces

Q1. Traditional and Alternative Costing Methods - Case No 1

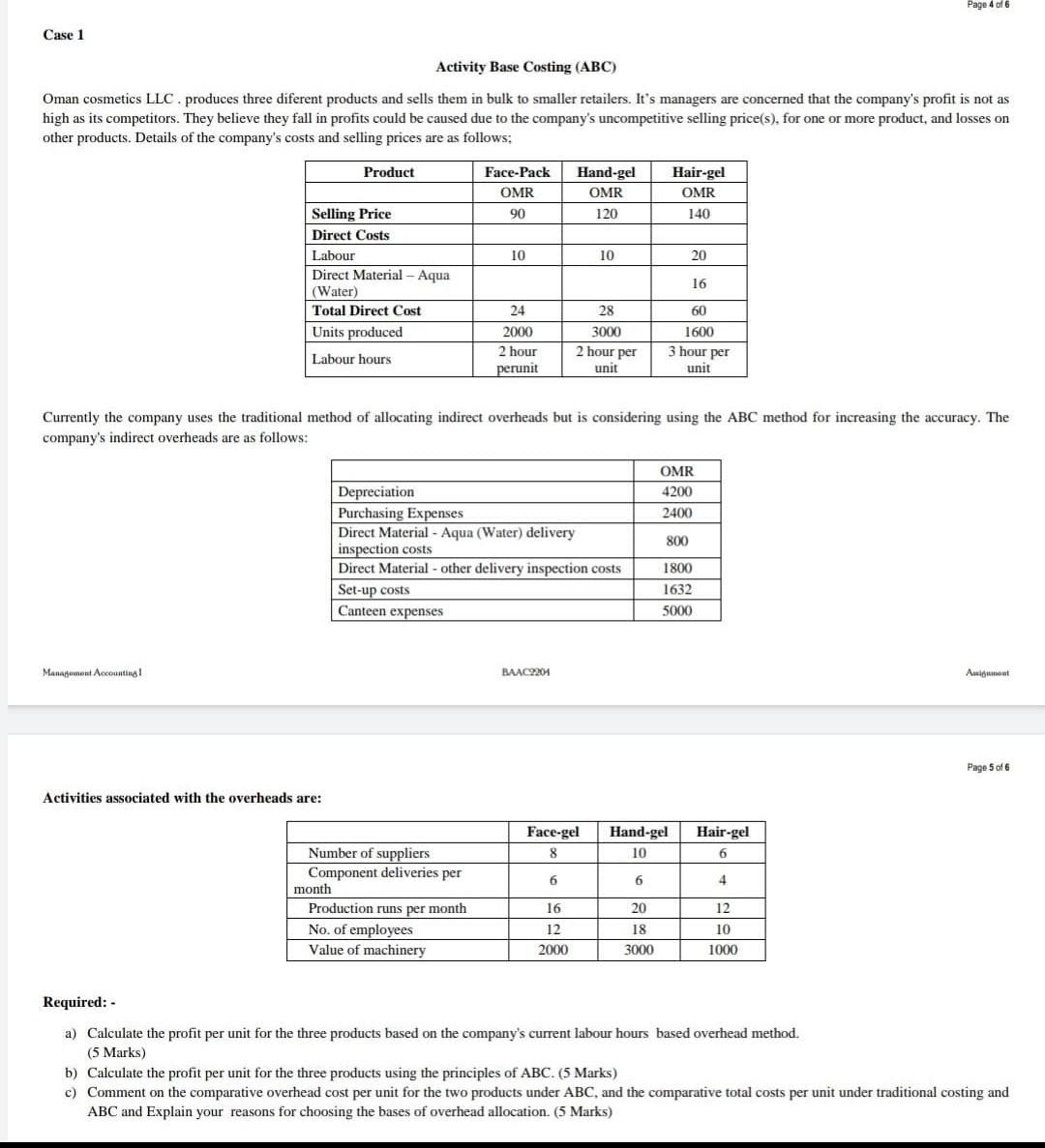

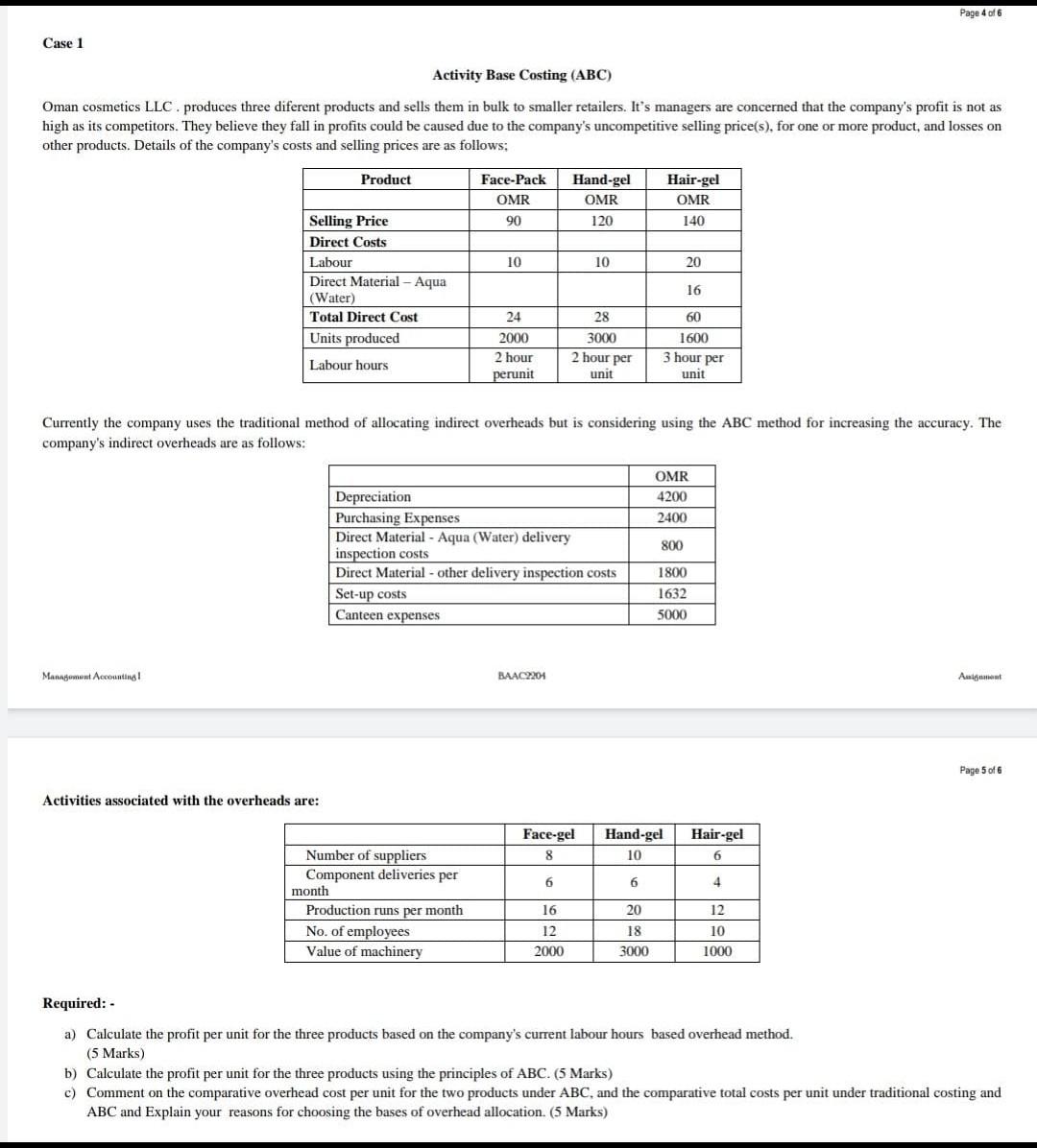

Page 4 of 6 Case 1 Activity Base Costing (ABC) Oman cosmetics LLC . produces three diferent products and sells them in bulk to smaller retailers. It's managers are concerned that the company's profit is not as high as its competitors. They believe they fall in profits could be caused due to the company's uncompetitive selling price(s), for one or more product, and losses on other products. Details of the company's costs and selling prices are as follows: Product Face-Pack OMR 90 Hand-gel OMR 120 Hair-gel OMR 140 10 10 20 Selling Price Direct Costs Labour Direct Material - Aqua (Water) Total Direct Cost Units produced Labour hours 16 24 2000 2 hour perunit 28 3000 2 hour per unit 60 1600 3 hour per unit Currently the company uses the traditional method of allocating indirect overheads but is considering using the ABC method for increasing the accuracy. The company's indirect overheads are as follows: OMR 4200 2400 800 Depreciation Purchasing Expenses Direct Material - Aqua (Water) delivery inspection costs Direct Material - other delivery inspection costs Set-up costs Canteen expenses 1800 1632 5000 Management Accounting! BAAC2201 Page 5 of 6 Activities associated with the overheads are: Face-gel 8 Hand-gel 10 Hair-gel 6 6 6 4 Number of suppliers Component deliveries per month Production runs per month No. of employees Value of machinery 12 16 12 2000 20 18 3000 10 1000 Required: - a) Calculate the profit per unit for the three products based on the company's current labour hours based overhead method. (5 Marks) b) Calculate the profit per unit for the three products using the principles of ABC. (5 Marks) c) Comment on the comparative overhead cost per unit for the two products under ABC, and the comparative total costs per unit under traditional costing and ABC and Explain your reasons for choosing the bases of overhead allocation. (5 Marks) Page 4 of 6 Case 1 Activity Base Costing (ABC) Oman cosmetics LLC. produces three diferent products and sells them in bulk to smaller retailers. It's managers are concerned that the company's profit is not as high as its competitors. They believe they fall in profits could be caused due to the company's uncompetitive selling price(s), for one or more product, and losses on other products. Details of the company's costs and selling prices are as follows: Product Face-Pack OMR Hand-gel OMR 120 Hair-gel OMR 140 90 10 10 20 Selling Price Direct Costs Labour Direct Material - Aqua (Water) Total Direct Cost Units produced 16 28 60 3000 24 2000 2 hour perunit 1600 3 hour per Labour hours 2 hour per unit unit Currently the company uses the traditional method of allocating indirect overheads but is considering using the ABC method for increasing the accuracy. The company's indirect overheads are as follows: OMR 4200 2400 800 Depreciation Purchasing Expenses Direct Material - Aqua (Water) delivery inspection costs Direct Material - other delivery inspection costs Set-up costs Canteen expenses 1800 1632 5000 Management Accounting! BAAC2201 Ang Page 5 of 6 Activities associated with the overheads are: Face-gel 8 Hand-gel 10 Hair-gel 6 6 6 4 Number of suppliers Component deliveries per month Production runs per month No. of employees Value of machinery 20 16 12 2000 18 3000 12 10 1000 Required: - a) Calculate the profit per unit for the three products based on the company's current labour hours based overhead method. (5 Marks) b) Calculate the profit per unit for the three products using the principles of ABC. (5 Marks) c) Comment on the comparative overhead cost per unit for the two products under ABC, and the comparative total costs per unit under traditional costing and ABC and Explain your reasons for choosing the bases of overhead allocation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started