Answered step by step

Verified Expert Solution

Question

1 Approved Answer

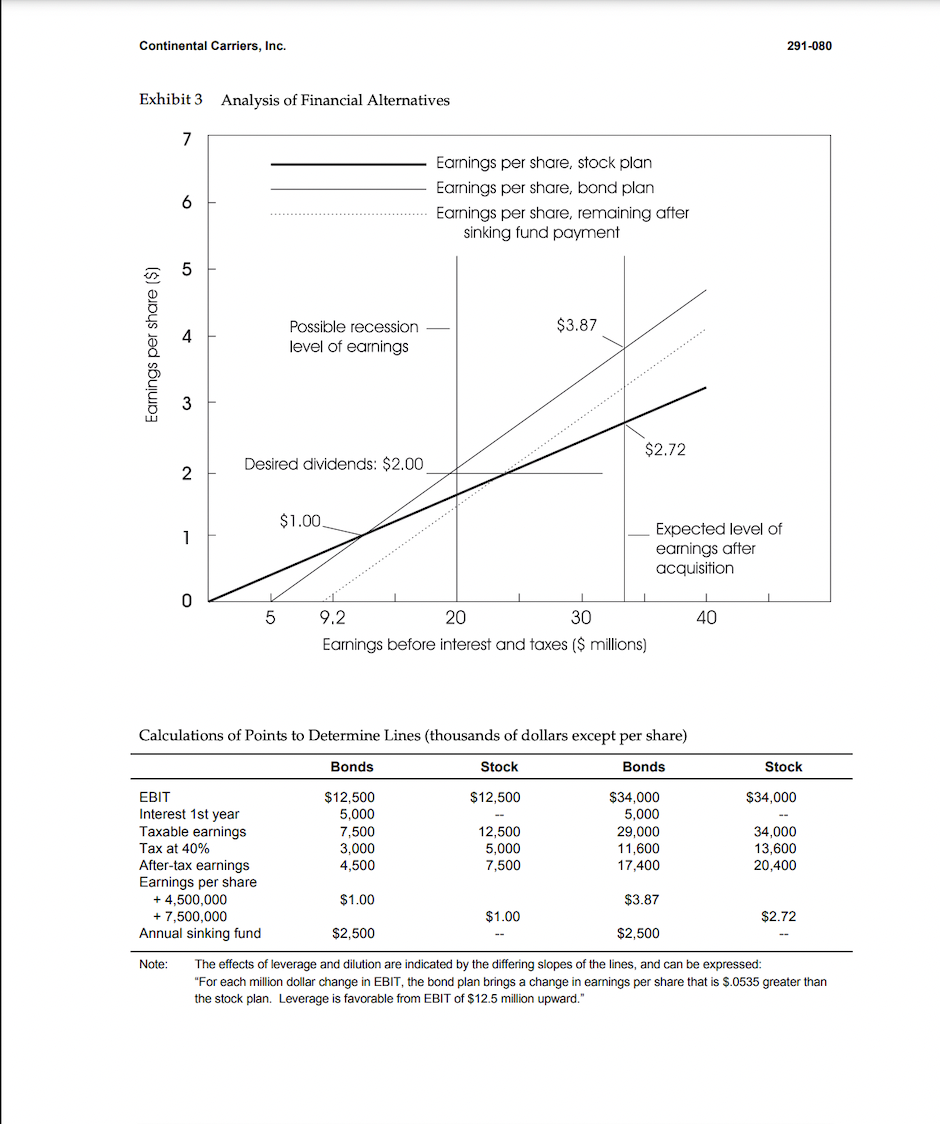

Q1 What is the significance of the intersection at $12.5 million EBIT figure? (2.5 marks) Q2. Why does the stock plan line cut through the

Q1 What is the significance of the intersection at $12.5 million EBIT figure? (2.5 marks)

Q2. Why does the stock plan line cut through the origin whereas the two bond plan lines intersect the x-axis to the right of the origin? (2.5 marks)

Q3. What significance do you attach to the vertical lines at approximately $20 million and $34 million of EBIT? (2.5 marks)

Q4. Why does the line representing the bond plan have a steeper slope than that representing the stock plan? (2.5 marks)

Continental Carriers, Inc. 291-080 Exhibit 3 Analysis of Financial Alternatives 7 6 Earnings per share, stock plan Earnings per share, bond plan Earnings per share, remaining after sinking fund payment $3.87 Earnings per share ($) Possible recession level of earnings 3 $2.72 2 Desired dividends: $2.00 2 $1.00 1 Expected level of earnings after acquisition 0 5 40 9.2 20 30 Earnings before interest and taxes ($ millions) Calculations of Points to Determine Lines (thousands of dollars except per share) Bonds Stock Bonds Stock $12,500 $34,000 EBIT Interest 1st year Taxable earnings Tax at 40% After-tax earnings Earnings per share + 4,500,000 + 7,500,000 Annual sinking fund $12,500 5,000 7,500 3,000 4,500 12,500 5,000 7,500 $34,000 5,000 29,000 11,600 17,400 34,000 13,600 20,400 $1.00 $3.87 $1.00 $2.72 $2.500 $2,500 Note: The effects of leverage and dilution are indicated the differing slopes of the lines, and can be expressed: "For each million dollar change in EBIT, the bond plan brings a change in earnings per share that is $.0535 greater than the stock plan. Leverage is favorable from EBIT of $12.5 million upwardStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started