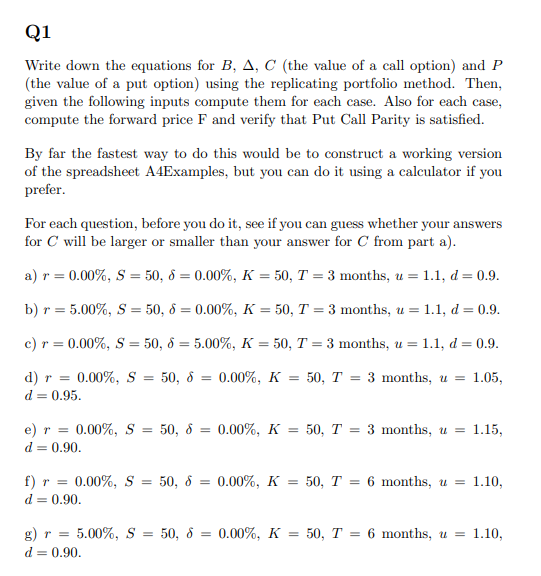

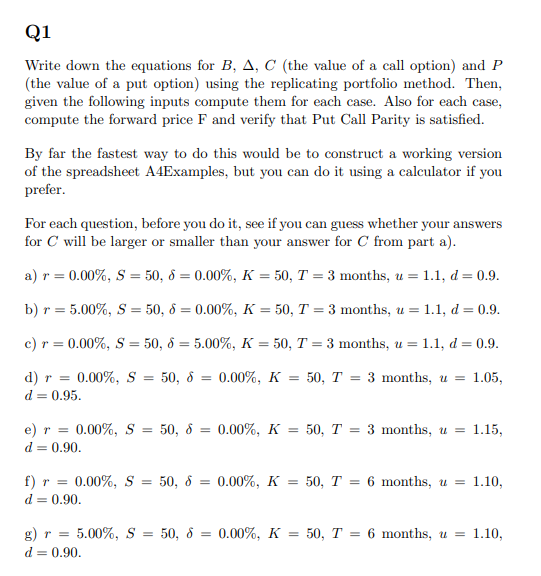

Q1 Write down the equations for B, A, C (the value of a call option) and P (the value of a put option) using the replicating portfolio method. Then, given the following inputs compute them for each case. Also for each case, compute the forward price F and verify that Put Call Parity is satisfied. By far the fastest way to do this would be to construct a working version of the spreadsheet A4Examples, but you can do it using a calculator if you prefer. For each question, before you do it, see if you can guess whether your answers for C will be larger or smaller than your answer for C from part a). a) r = 0.00%, S = 50, 8 = 0.00%, K = 50, T = 3 months, u = 1.1, d=0.9. b) r=5.00%, S = 50, 8 = 0.00%, K = 50, T = 3 months, u = 1.1, d=0.9. c) r=0.00%, S = 50, 8 = 5.00%, K = 50, T = 3 months, u = 1.1, d=0.9. 50, 8 = 0.00%, K = 50, T = 3 months, u = 1.05, d) r = r = 0.00%, S d=0.95. e) r = 0.00%, S d=0.90. 50, 8 = 0.00%, K = 50, T = 3 months, u = u = 1.15, f) r = 0.00%, S = 50, 8 d=0.90. 0.00%, K = 50, T = 6 months, u = 1.10, 5.00%, S = 50, 8 = 0.00%, K d=0.90 50, T = 6 months, u = 1.10, Q1 Write down the equations for B, A, C (the value of a call option) and P (the value of a put option) using the replicating portfolio method. Then, given the following inputs compute them for each case. Also for each case, compute the forward price F and verify that Put Call Parity is satisfied. By far the fastest way to do this would be to construct a working version of the spreadsheet A4Examples, but you can do it using a calculator if you prefer. For each question, before you do it, see if you can guess whether your answers for C will be larger or smaller than your answer for C from part a). a) r = 0.00%, S = 50, 8 = 0.00%, K = 50, T = 3 months, u = 1.1, d=0.9. b) r=5.00%, S = 50, 8 = 0.00%, K = 50, T = 3 months, u = 1.1, d=0.9. c) r=0.00%, S = 50, 8 = 5.00%, K = 50, T = 3 months, u = 1.1, d=0.9. 50, 8 = 0.00%, K = 50, T = 3 months, u = 1.05, d) r = r = 0.00%, S d=0.95. e) r = 0.00%, S d=0.90. 50, 8 = 0.00%, K = 50, T = 3 months, u = u = 1.15, f) r = 0.00%, S = 50, 8 d=0.90. 0.00%, K = 50, T = 6 months, u = 1.10, 5.00%, S = 50, 8 = 0.00%, K d=0.90 50, T = 6 months, u = 1.10