Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1: You have the following information today from the financial markets. The spot exchange rate for the number of Malaysian Ringgit (MYR) per Singapore dollar

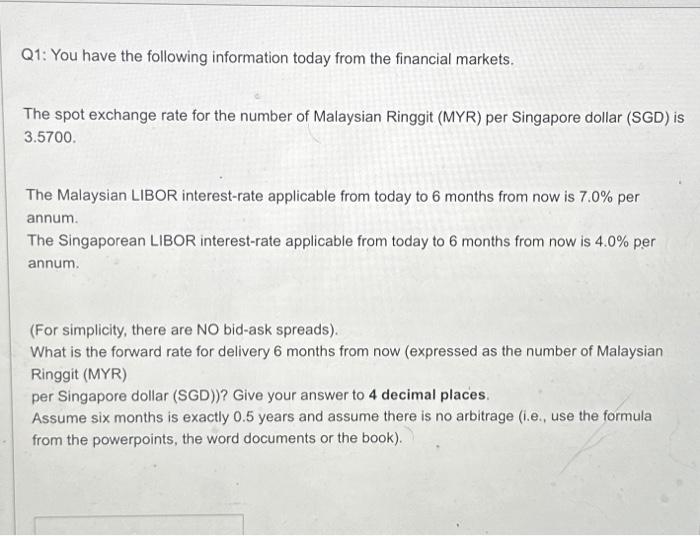

Q1: You have the following information today from the financial markets. The spot exchange rate for the number of Malaysian Ringgit (MYR) per Singapore dollar (SGD) is 3.5700. The Malaysian LIBOR interest-rate applicable from today to 6 months from now is 7.0% per annum. The Singaporean LIBOR interest-rate applicable from today to 6 months from now is 4.0% per annum. (For simplicity, there are NO bid-ask spreads). What is the forward rate for delivery 6 months from now (expressed as the number of Malaysian Ringgit (MYR) per Singapore dollar (SGD))? Give your answer to 4 decimal places. Assume six months is exactly 0.5 years and assume there is no arbitrage (i.e., use the formula from the powerpoints, the word documents or the book).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started