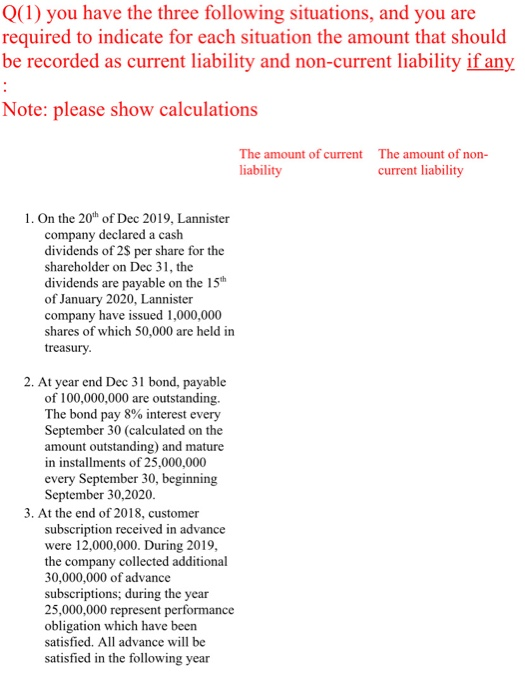

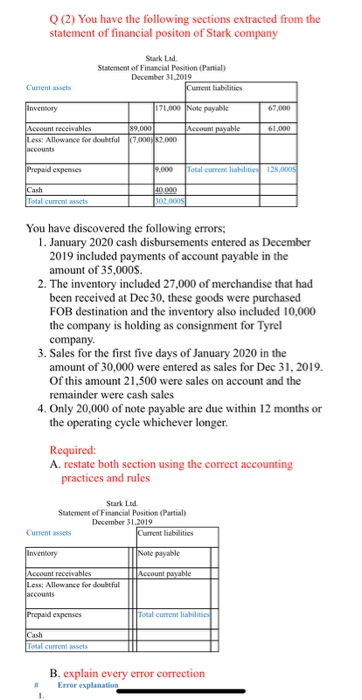

Q(1) you have the three following situations, and you are required to indicate for each situation the amount that should be recorded as current liability and non-current liability if any : Note: please show calculations The amount of current The amount of non- liability current liability 1. On the 20th of Dec 2019Lannister company declared a cash dividends of 2per share for the shareholder on Dec 31, the dividends are payable on the 15th of January 2020, Lannister company have issued 1,000,000 shares of which 50,000 are held in treasury. 2. At year end Dec 31 bond, payable of 100,000,000 are outstanding. The bond pay 8% interest every September 30 (calculated on the amount outstanding) and mature in installments of 25,000,000 every September 30, beginning September 30,2020. 3. At the end of 2018, customer subscription received in advance were 12,000,000. During 2019, the company collected additional 30,000,000 of advance subscriptions; during the year 25,000,000 represent performance obligation which have been satisfied. All advance will be satisfied in the following year Q(2) You have the following sections extracted from the statement of financial positon of Stark company Stark Lad. Statement of Financial Position (Partial December 31.2019 Current assets Current liabilities Inventory 171,000 Note payable 67,000 Account payable 61.000 Account receivables 89.000 Less: Allowance for doubtful 7.000 52.000 accounts Prepaid expenses 0.000 Total current l128,000S Cash Total current assets 400 302.0008 You have discovered the following errors; 1. January 2020 cash disbursements entered as December 2019 included payments of account payable in the amount of 35,000 2. The inventory included 27,000 of merchandise that had been received at Dec 30, these goods were purchased FOB destination and the inventory also included 10,000 the company is holding as consignment for Tyrel company. 3. Sales for the first five days of January 2020 in the amount of 30,000 were entered as sales for Dec 31, 2019. of this amount 21,500 were sales on account and the remainder were cash sales 4. Only 20,000 of note payable are due within 12 months or the operating cycle whichever longer. Required: A. restate both section using the correct accounting practices and rules Stark Lid. Sutement of Financial Position (Partial) December 31, 2019 Current assets Current liabilities Inventory Note payable Account payable Account receivables Less: Allowance for doubtful accounts Prepaid expenses Total current liabilities Total current assets B. explain every error correction Error explanation