Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q10. Fores Forward price is closest to: A. 1042.55 B. 1063.19 C. 1102.11 Q12: Elders FRA price is closest to: A. 3.83% B. 4.02% C.

Q10. Fores Forward price is closest to:

A. 1042.55

B. 1063.19

C. 1102.11

Q12: Elders FRA price is closest to:

A. 3.83%

B. 4.02%

C. 4.79%

Q14: Elders FRA value is closest to:

A. -6730

B. 6730

C. -1002

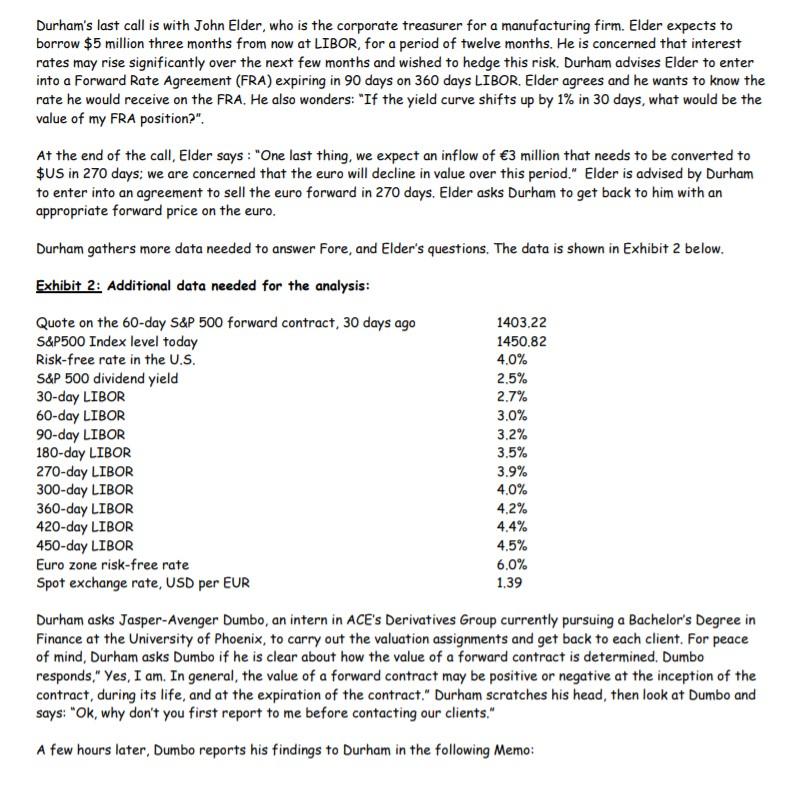

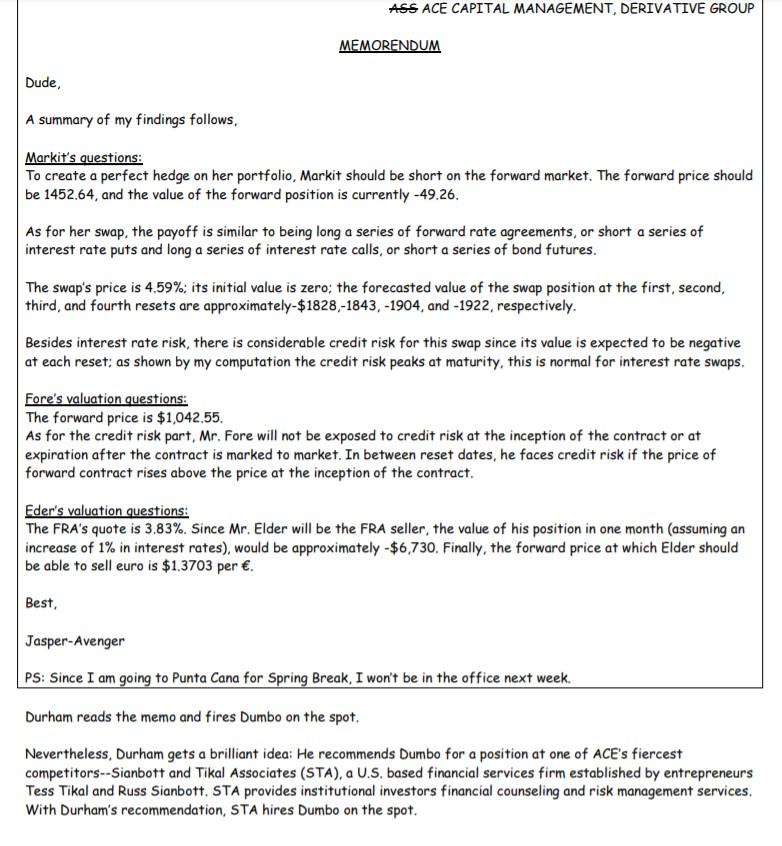

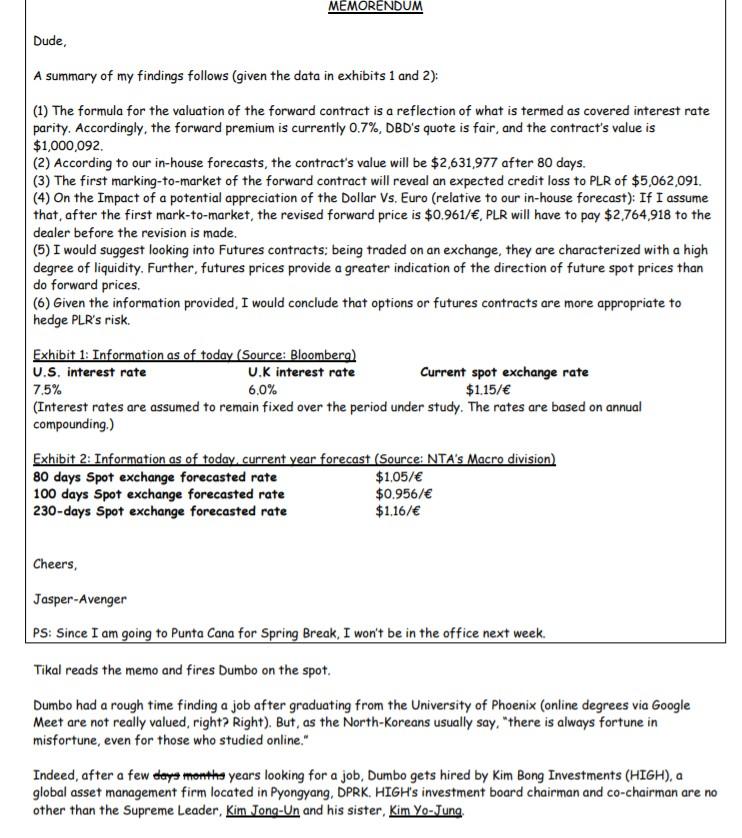

Mike Durham is a Managing Director in the Derivatives branch at ACE Capital Management, an investment management firm. Durham specializes in advising institutional clients on the use of forward contracts in their portfolio management strategies. Durham is preparing to meet with three of the firms U.S. based clients: Anne Markit, Antoine Fore, and John Elder. Anne Markit manages equity and fixed income portfolios for a pension fund. One month ago, Markit had indicated to Durham that the pension fund expected a large inflow of cash in 60 days. In order to hedge against a potential rise in equity values over this period, Durham advised her to enter into a forward contract on the S&P 500 stock index expiring in 60 days. In a follow-up call, Markit asks Durham to update her with the current value of the forward position initiated 30 days ago. During that call, Markit also mentions that her fixed income portfolio could be improved through swaps. Markit is not really clear on how interest rate swaps relate to forward rate agreements or options, but she still plans to establish some minor positions to gain experience before actively using swaps. She knows that the most basic type of swap is the plain vanilla swap, where one counterparty pays LIBOR as the floating rate and the other counterparty pays a fixed rate determined by the swap market. She feels this would be a good place to begin and plans to enter into a 2-year, annual-pay plain vanilla swap with $1M notional principal, where she pays LIBOR and receives the fixed swap rate from the other counterparty. Markit ask Durham for help. After the call, Durham feels uncertain of the level of Markit's familiarity with swaps. He wants to make sure that this instrument is appropriate for Markit; he thinks it would be necessary to provide her with (1) pricing, and valuation information as interest rates change, and (2) an explanation of the risks inherent to swaps. For that matter, he collects market data on current and forecasted LIBOR term structure. The data are shown in exhibit 1. Exhibit 1: Term Structure of Interest Rates Year 0.5 1 Current 3.50% 4,20% 4.45% 4.60% LIBOR RATES Forecast (1year) 3.80% 4,30% 4.50% 4.70% 1.5 2 After his conversation with Markit, Durham receives a call from Antoine Fore, the owner of a local football team. Three month ago, Fore had to purchase 10,000 bonds with a 5% coupon rate and a maturity of 7 years from the date of issuance (the bonds were purchased at the issuance date). The bonds have a face value of $1,000 and pays interest every 180 days from the date of issue, Fore is concerned about a potential increase in interest rate over the next year and has approached Durham for advice on how he can use forward contracts to manage his risk. Durham advises Fore to enter into a forward contract agreement expiring in 360 days. The current price of the bond issue with accrued interest is $1,071,33 per bond, Fore asks Durham to calculate the appropriate price for the forward contract. At the end of the call, Fore asks, "Mike, could you also tell me if there be any credit risk associated with this forward position" Durham's last call is with John Elder, who is the corporate treasurer for a manufacturing firm. Elder expects to borrow $5 million three months from now at LIBOR, for a period of twelve months. He is concerned that interest rates may rise significantly over the next few months and wished to hedge this risk. Durham advises Elder to enter into a Forward Rate Agreement (FRA) expiring in 90 days on 360 days LIBOR. Elder agrees and he wants to know the rate he would receive on the FRA, He also wonders: "If the yield curve shifts up by 1% in 30 days, what would be the value of my FRA position?". At the end of the call, Elder says : "One last thing, we expect an inflow of 3 million that needs to be converted to $US in 270 days, we are concerned that the euro will decline in value over this period." Elder is advised by Durham to enter into an agreement to sell the euro forward in 270 days. Elder asks Durham to get back to him with an appropriate forward price on the euro. Durham gathers more data needed to answer Fore, and Elder's questions. The data is shown in Exhibit 2 below. Exhibit 2: Additional data needed for the analysis: Quote on the 60-day S&P 500 forward contract, 30 days ago 1403.22 S&P500 Index level today 1450.82 Risk-free rate in the U.S. 4.0% S&P 500 dividend yield 2.5% 30-day LIBOR 2.7% 60-day LIBOR 3.0% 90-day LIBOR 3.2% 180-day LIBOR 3.5% 270-day LIBOR 3.9% 300-day LIBOR 4.0% 360-day LIBOR 4,2% 420-day LIBOR 4.4% 450-day LIBOR 4.5% Euro zone risk-free rate 6.0% Spot exchange rate, USD per EUR 1.39 Durham asks Jasper-Avenger Dumbo, an intern in ACE's Derivatives Group currently pursuing a Bachelor's Degree in Finance at the University of Phoenix, to carry out the valuation assignments and get back to each client. For peace of mind, Durham asks Dumbo if he is clear about how the value of a forward contract is determined. Dumbo responds." Yes, I am. In general, the value of a forward contract may be positive or negative at the inception of the contract, during its life, and at the expiration of the contract." Durham scratches his head, then look at Dumbo and says: "Ok, why don't you first report to me before contacting our clients." A few hours later, Dumbo reports his findings to Durham in the following Memo: ASS ACE CAPITAL MANAGEMENT, DERIVATIVE GROUP MEMORENDUM Dude, A summary of my findings follows, Markit's questions: To create a perfect hedge on her portfolio Markit should be short on the forward market. The forward price should be 1452.64, and the value of the forward position is currently -49.26. As for her swap, the payoff is similar to being long a series of forward rate agreements, or short a series of interest rate puts and long a series of interest rate calls, or short a series of bond futures. The swap's price is 4.59%, its initial value is zero: the forecasted value of the swap position at the first second, third and fourth resets are approximately $1828,-1843, -1904, and -1922, respectively. Besides interest rate risk, there is considerable credit risk for this swap since its value is expected to be negative at each reset: as shown by my computation the credit risk peaks at maturity, this is normal for interest rate swaps. Fore's valuation questions: The forward price is $1,042,55. As for the credit risk part, Mr. Fore will not be exposed to credit risk at the inception of the contract or at expiration after the contract is marked to market. In between reset dates, he faces credit risk if the price of forward contract rises above the price at the inception of the contract, Eder's valuation questions: The FRA's quote is 3,83%. Since Mr. Elder will be the FRA seller, the value of his position in one month (assuming an increase of 1% in interest rates), would be approximately - $6,730. Finally, the forward price at which Elder should be able to sell euro is $1.3703 per . Best, Jasper-Avenger PS: Since I am going to Punta Cana for Spring Break, I won't be in the office next week. Durham reads the memo and fires Dumbo on the spot. Nevertheless, Durham gets a brilliant idea: He recommends Dumbo for a position at one of ACE's fiercest competitors--Sianbott and Tikal Associates (STA), a U.S. based financial services firm established by entrepreneurs Tess Tikal and Russ Sianbott, STA provides institutional investors financial counseling and risk management services. With Durham's recommendation, STA hires Dumbo on the spot. Plum Resorts (PLR), owns and operates a vast network of slaughterhouses in the northern part of the U.S. and is one of STA's most profitable clients. During the annual review meeting, PLR's CEO Bernie Molicare stated that due to success in local markets, PLR was planning to go global by opening its first international slaughterhouse in France. Based on current estimates, PLR expects to receive 25 million in profits from the slaughterhouse and related services in about 230 days. During the meeting Molicare states: "We are skeptical about the future path of the euro relative to the dollar and we were looking at possibility to hedge PLR's exposure to the volatility in the Eurodollar exchange rate with forward contracts." He adds: "We want eliminate the exchange rate risk, but we wish to pay no cash up front while o the cash inflow. Further, we do not deem fit to close out or reverse the hedged position before term. However, we would like to mark-to market the position every 100 days." After discussing a few other details, Molicare states that PLR expects a summary of the hedging strategy from STA in a couple of days. As the meeting concludes, Tikal contacts numerous dealers, but ultimately decides to transact with DeadBeat-Dealers (DBD), that quote a price of 1.16 $/ for a contract with the required maturity, Tikal believes that the probability of default with DBD is only 30%, whereas for other dealers with similar quotations, the probability ranges from 40%-60%. Then, Tikal calls Dumbo, the newly hired intern who is still pursuing a bachelor's degree in Finance at the University of Phoenix. She asks him to lay out some guidelines to draft PLR's report and assess the appropriate risk- management technique. A few hours later, Dumbo sends Tikal the following memo: MEMORENDUM Dude, A summary of my findings follows (given the data in exhibits 1 and 2): (1) The formula for the valuation of the forward contract is a reflection of what is termed as covered interest rate parity. Accordingly, the forward premium is currently 0.7%, DBD's quote is fair, and the contract's value is $1,000,092. (2) According to our in-house forecasts, the contract's value will be $2,631,977 after 80 days. (3) The first marking-to-market of the forward contract will reveal an expected credit loss to PLR of $5,062,091. (4) On the Impact of a potential appreciation of the Dollar Vs. Euro (relative to our in-house forecast): If I assume that, after the first mark-to-market, the revised forward price is $0.961/, PLR will have to pay $2,764,918 to the dealer before the revision is made. (5) I would suggest looking into Futures contracts: being traded on an exchange, they are characterized with a high degree of liquidity. Further, futures prices provide a greater indication of the direction of future spot prices than do forward prices (6) Given the information provided, I would conclude that options or futures contracts are more appropriate to hedge PLR's risk. Exhibit 1: Information as of today (Source: Bloomberg) U.S. interest rate U.K interest rate Current spot exchange rate 7.5% 6.0% $1.15/ (Interest rates are assumed to remain fixed over the period under study. The rates are based on annual compounding.) Exhibit 2. Information as of today.current year forecast (Source: NTA's Macro division) 80 days Spot exchange forecasted rate $1,05/ 100 days Spot exchange forecasted rate $0.956/ 230-days Spot exchange forecasted rate $1,16/ Cheers, Jasper-Avenger PS: Since I am going to Punta Cana for Spring Break, I won't be in the office next week. Tikal reads the memo and fires Dumbo on the spot. Dumbo had a rough time finding a job after graduating from the University of Phoenix (online degrees via Google Meet are not really valued, right? Right). But, as the North Koreans usually say, "there is always fortune in misfortune, even for those who studied online." Indeed, after a few days months years looking for a job, Dumbo gets hired by Kim Bong Investments (HIGH), a global asset management firm located in Pyongyang, DPRK. HIGH's investment board chairman and co-chairman are no other than the Supreme Leader Kim Jong-Un and his sister, Kim Yo-JungStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started