Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q10 - Please specify Christine and Maria are each 50% partners in the CMS general partnership. Prior to the following transaction, the CMS partnership had

Q10 - Please specify

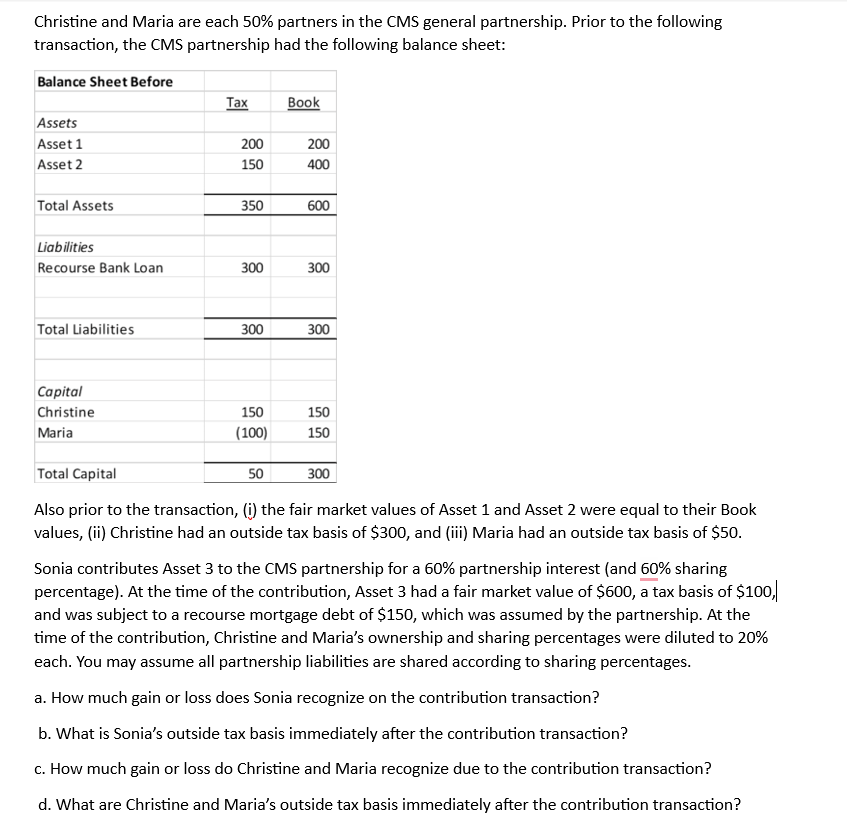

Christine and Maria are each 50\% partners in the CMS general partnership. Prior to the following transaction, the CMS partnership had the following balance sheet: Also prior to the transaction, (i) the fair market values of Asset 1 and Asset 2 were equal to their Book values, (ii) Christine had an outside tax basis of $300, and (iii) Maria had an outside tax basis of $50. Sonia contributes Asset 3 to the CMS partnership for a 60\% partnership interest (and 60\% sharing percentage). At the time of the contribution, Asset 3 had a fair market value of $600, a tax basis of $100, and was subject to a recourse mortgage debt of $150, which was assumed by the partnership. At the time of the contribution, Christine and Maria's ownership and sharing percentages were diluted to 20% each. You may assume all partnership liabilities are shared according to sharing percentages. a. How much gain or loss does Sonia recognize on the contribution transaction? b. What is Sonia's outside tax basis immediately after the contribution transaction? c. How much gain or loss do Christine and Maria recognize due to the contribution transaction? d. What are Christine and Maria's outside tax basis immediately after the contribution transactionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started