Q10 Please state the key learnings from this case study

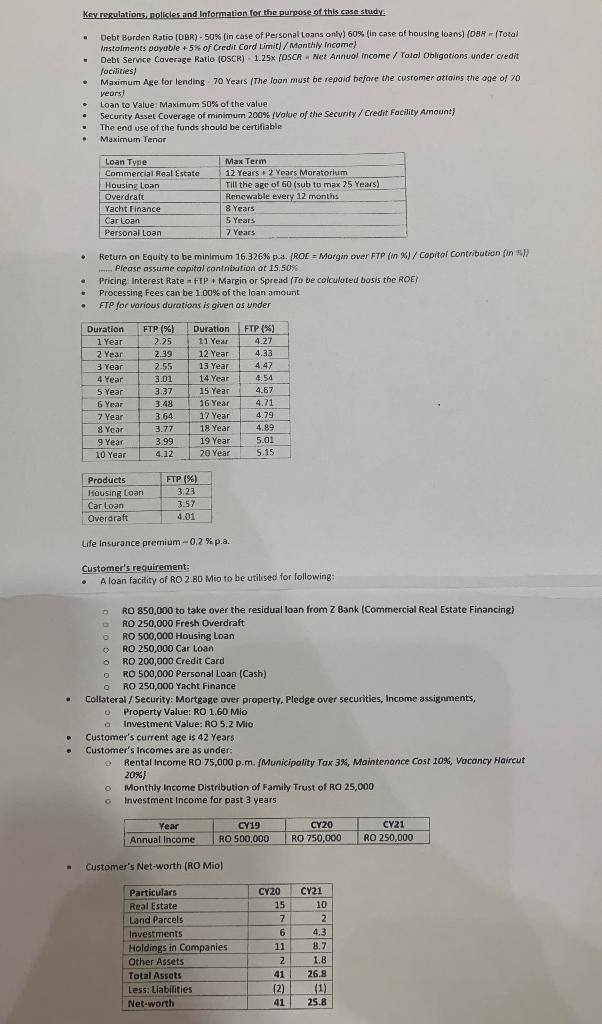

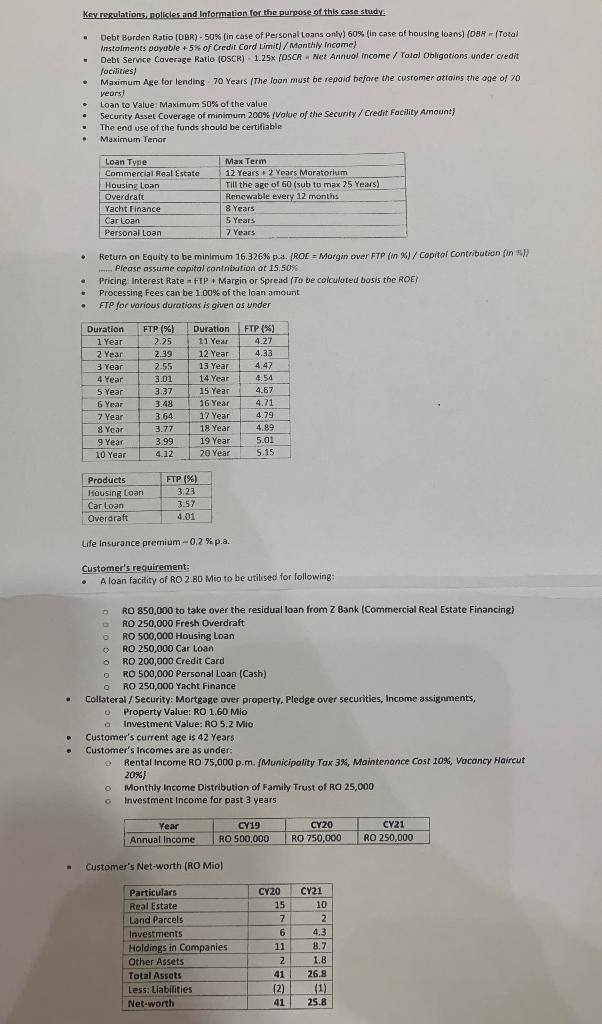

Key regulations, policies and Information for the purpose of this case study Debt Burden Ratio (DBR) - 50% (in case of Personal Loans only) 60% (in case of housing loans) (DBR (Total Instalments payable +5% of Credit Card Limit)/Monthly Income) . Debt Service Coverage Ratio (DSCR) 1.25x (DSCR Net Annual income / Total Obligations under credit. facilities) . Maximum Age for lending 70 Years (The loan must be repaid before the customer attains the age of 70 years) . Loan to Value: Maximum 50% of the value . Security Asset Coverage of minimum 200% (Value of the Security / Credit Facility Amount) . The end use of the funds should be certifiable . Maximum Tenor Loan Type Max Term Commercial Real Estate 12 Years 2 Years Moratorium Till the age of 60 (sub to max 25 Years) Housing Loan Overdraft Renewable every 12 months Yacht Finance 8 Years Car Loan 5 Years Personal Loan 7 Years Return on Equity to be minimum 16.326% p.a. (ROE = Morgin over FTP (in %)/ Capital Contribution (in %)) Please assume capital contribution at 15.50% . Pricing: Interest Rate FTP Margin or Spread (To be colculated basis the ROE) . Processing Fees can be 1.00% of the loan amount FTP for various durations is given as under Duration FTP (%) Duration FTP (%) 1 Year 2.25 11 Year 4.27 2 Year 2.39 12 Year 4.33 3 Year 2.55 13 Year 4,47 4 Year 3.01 14 Year 4.54 5 Year 3.37 15 Year 4.67 6 Year 3.48 16 Year 4.71 7 Year 3.64 17 Year 4.79 8 Year 3.77 18 Year 4.89 9 Year 3.99 19 Year 5.01 10 Year 4.12 20 Year 5.15 Products FTP (%) Housing Loan 3.23 Car Loan 3.57 Overdraft 4.01 Life Insurance premium -0.2 % p.a. Customer's requirement: A loan facility of RO 2.80 Mio to be utilised for following: D RO 850,000 to take over the residual loan from Z Bank (Commercial Real Estate Financing) RO 250,000 Fresh Overdraft O RO 500,000 Housing Loan RO 250,000 Car Loan O RO 200,000 Credit Card 0 RO 500,000 Personal Loan (Cash) 0 RO 250,000 Yacht Finance .. Collateral / Security: Mortgage over property, Pledge over securities, Income assignments, 0 Property Value: RO 1.60 Mio O Investment Value: RO 5.2 Mic Customer's current age is 42 Years Customer's Incomes are as under: 0 Rental Income RO 75,000 p.m. (Municipality Tax 3%, Maintenance Cost 10%, Vacancy Haircut 20%} 0 Monthly Income Distribution of Family Trust of RO 25,000 O Investment Income for past 3 years CY19 CYZO CY21 Year Annual Income RO 500,000 RO 750,000 RO 250,000 Customer's Net-worth (RO Mio) Particulars CY21 Real Estate Land Parcels Investments Holdings in Companies- Other Assets Total Assets Less: Liabilities Net-worth . . CY20 15 7 6 11 2 41 (2) 41 10 2 4.3 8.7 1.8 26.8 (1) 25.8 Key regulations, policies and Information for the purpose of this case study Debt Burden Ratio (DBR) - 50% (in case of Personal Loans only) 60% (in case of housing loans) (DBR (Total Instalments payable +5% of Credit Card Limit)/Monthly Income) . Debt Service Coverage Ratio (DSCR) 1.25x (DSCR Net Annual income / Total Obligations under credit. facilities) . Maximum Age for lending 70 Years (The loan must be repaid before the customer attains the age of 70 years) . Loan to Value: Maximum 50% of the value . Security Asset Coverage of minimum 200% (Value of the Security / Credit Facility Amount) . The end use of the funds should be certifiable . Maximum Tenor Loan Type Max Term Commercial Real Estate 12 Years 2 Years Moratorium Till the age of 60 (sub to max 25 Years) Housing Loan Overdraft Renewable every 12 months Yacht Finance 8 Years Car Loan 5 Years Personal Loan 7 Years Return on Equity to be minimum 16.326% p.a. (ROE = Morgin over FTP (in %)/ Capital Contribution (in %)) Please assume capital contribution at 15.50% . Pricing: Interest Rate FTP Margin or Spread (To be colculated basis the ROE) . Processing Fees can be 1.00% of the loan amount FTP for various durations is given as under Duration FTP (%) Duration FTP (%) 1 Year 2.25 11 Year 4.27 2 Year 2.39 12 Year 4.33 3 Year 2.55 13 Year 4,47 4 Year 3.01 14 Year 4.54 5 Year 3.37 15 Year 4.67 6 Year 3.48 16 Year 4.71 7 Year 3.64 17 Year 4.79 8 Year 3.77 18 Year 4.89 9 Year 3.99 19 Year 5.01 10 Year 4.12 20 Year 5.15 Products FTP (%) Housing Loan 3.23 Car Loan 3.57 Overdraft 4.01 Life Insurance premium -0.2 % p.a. Customer's requirement: A loan facility of RO 2.80 Mio to be utilised for following: D RO 850,000 to take over the residual loan from Z Bank (Commercial Real Estate Financing) RO 250,000 Fresh Overdraft O RO 500,000 Housing Loan RO 250,000 Car Loan O RO 200,000 Credit Card 0 RO 500,000 Personal Loan (Cash) 0 RO 250,000 Yacht Finance .. Collateral / Security: Mortgage over property, Pledge over securities, Income assignments, 0 Property Value: RO 1.60 Mio O Investment Value: RO 5.2 Mic Customer's current age is 42 Years Customer's Incomes are as under: 0 Rental Income RO 75,000 p.m. (Municipality Tax 3%, Maintenance Cost 10%, Vacancy Haircut 20%} 0 Monthly Income Distribution of Family Trust of RO 25,000 O Investment Income for past 3 years CY19 CYZO CY21 Year Annual Income RO 500,000 RO 750,000 RO 250,000 Customer's Net-worth (RO Mio) Particulars CY21 Real Estate Land Parcels Investments Holdings in Companies- Other Assets Total Assets Less: Liabilities Net-worth . . CY20 15 7 6 11 2 41 (2) 41 10 2 4.3 8.7 1.8 26.8 (1) 25.8