Answered step by step

Verified Expert Solution

Question

1 Approved Answer

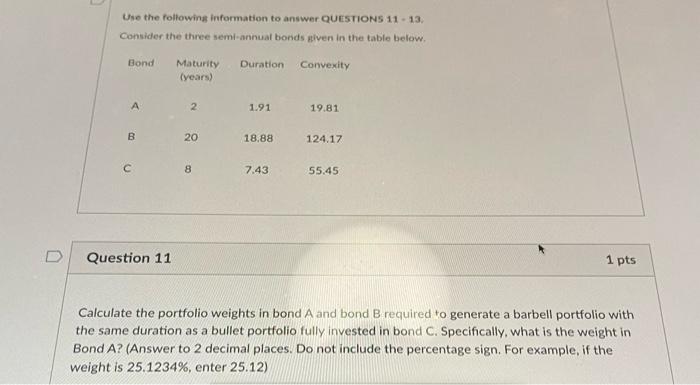

Q11-13 Use the following information to answer QUESTIONS 11-13 Consider the three semi-annual bonds niven in the table below. Bond Maturity (years) Duration Convexity A

Q11-13

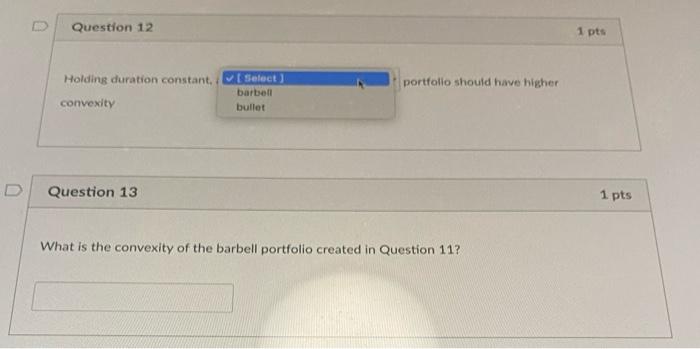

Use the following information to answer QUESTIONS 11-13 Consider the three semi-annual bonds niven in the table below. Bond Maturity (years) Duration Convexity A 2. 1.91 19.81 B 20 18.88 124.17 8 7.43 55.45 Question 11 1 pts Calculate the portfolio weights in bond A and bond B required to generate a barbell portfolio with the same duration as a bullet portfolio fully invested in bond C. Specifically, what is the weight in Bond A? (Answer to 2 decimal places. Do not include the percentage sign. For example, if the weight is 25.1234%, enter 25.12) Question 12 1 pts portfolio should have higher Holding duration constant, Select) barbell convexity bullet D Question 13 1 pts What is the convexity of the barbell portfolio created in Question 11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started