Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q11.a Brian was provided by his employer with a new car with a list price of 15,000 on 6 April 2018. The car emits 126g/km

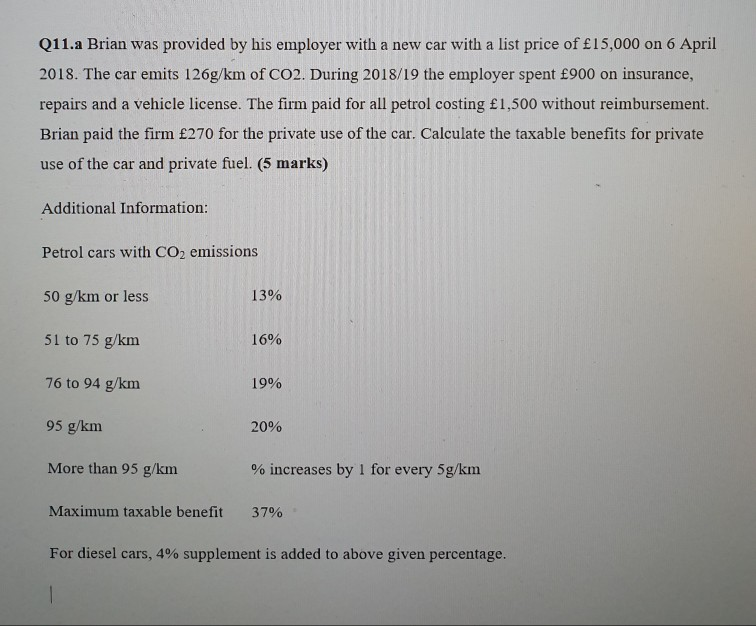

Q11.a Brian was provided by his employer with a new car with a list price of 15,000 on 6 April 2018. The car emits 126g/km of CO2. During 2018/19 the employer spent 900 on insurance, repairs and a vehicle license. The firm paid for all petrol costing 1,500 without reimbursement. Brian paid the firm 270 for the private use of the car. Calculate the taxable benefits for private use of the car and private fuel. (5 marks) Additional Information: Petrol cars with CO2 emissions 50 g/km or less 13% 51 to 75 g/km 16% 76 to 94 g/km 19% 95 g/km 20% More than 95 g/km % increases by 1 for every 5g/km Maximum taxable benefit 37% For diesel cars, 4% supplement is added to above given percentage

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started