Answered step by step

Verified Expert Solution

Question

1 Approved Answer

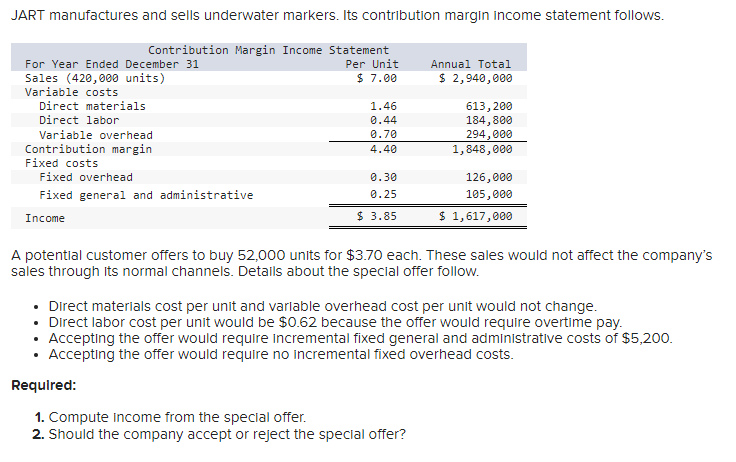

Q12. JART 2. Should the company accept or reject the special offer? JART manufactures and sells underwater markers. Its contribution margin income statement follows. A

Q12. JART

2. Should the company accept or reject the special offer?

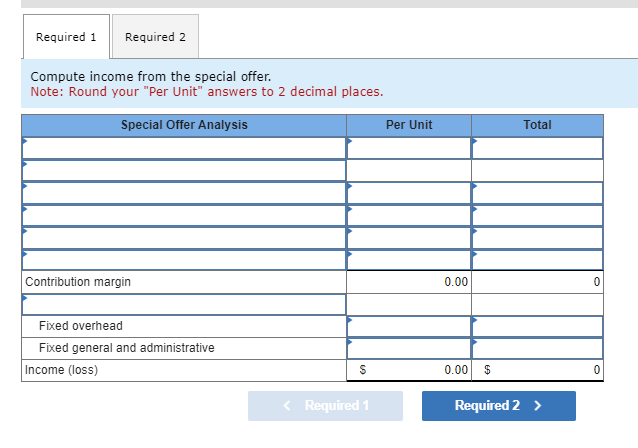

JART manufactures and sells underwater markers. Its contribution margin income statement follows. A potentlal customer offers to buy 52,000 units for $3.70 each. These sales would not affect the company's sales through its normal channels. Detalls about the special offer follow. - Direct materials cost per unit and varlable overhead cost per unit would not change. - Direct labor cost per unit would be $0.62 because the offer would require overtime pay. - Accepting the offer would require incremental fixed general and administrative costs of $5,200. - Accepting the offer would require no incremental fixed overhead costs. Required: 1. Compute income from the special offer. 2. Should the company accept or reject the special offer? Compute income from the special offer. Note: Round your "Per Unit" answers to 2 decimal places. JART manufactures and sells underwater markers. Its contribution margin income statement follows. A potentlal customer offers to buy 52,000 units for $3.70 each. These sales would not affect the company's sales through its normal channels. Detalls about the special offer follow. - Direct materials cost per unit and varlable overhead cost per unit would not change. - Direct labor cost per unit would be $0.62 because the offer would require overtime pay. - Accepting the offer would require incremental fixed general and administrative costs of $5,200. - Accepting the offer would require no incremental fixed overhead costs. Required: 1. Compute income from the special offer. 2. Should the company accept or reject the special offer? Compute income from the special offer. Note: Round your "Per Unit" answers to 2 decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started