Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1-2 Nemji purchased one share of Stock A for $500. Three years later, Nemji exchanged the share of Stock A with their friend for one

Q1-2

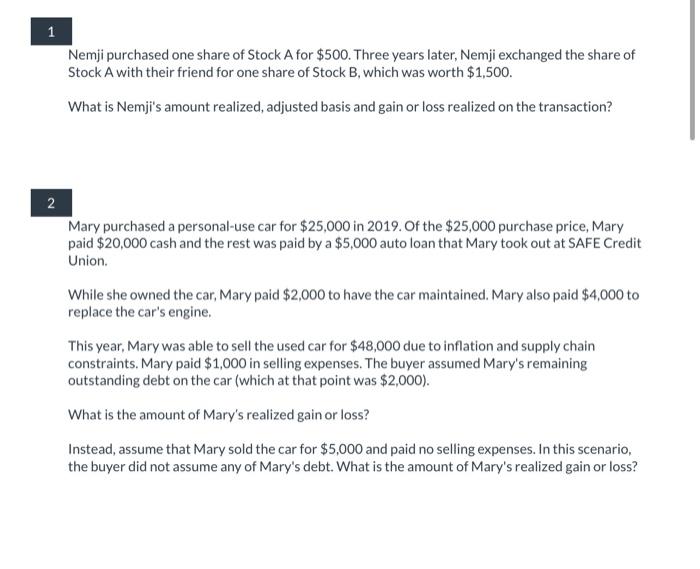

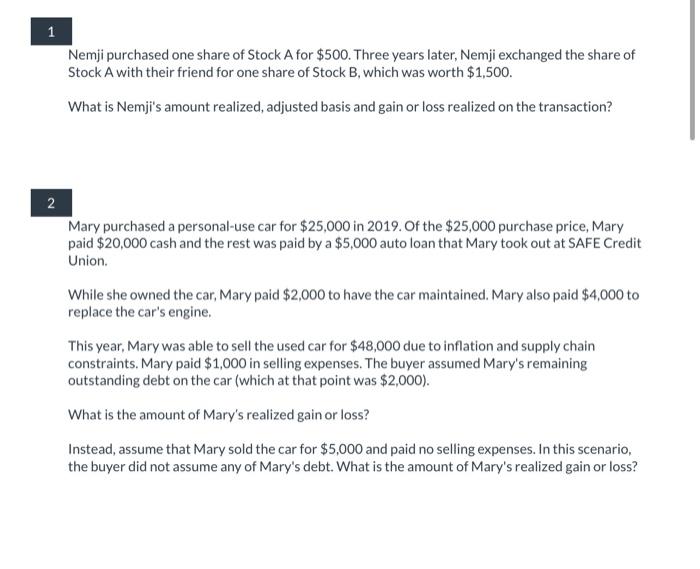

Nemji purchased one share of Stock A for $500. Three years later, Nemji exchanged the share of Stock A with their friend for one share of Stock B, which was worth $1,500. What is Nemji's amount realized, adjusted basis and gain or loss realized on the transaction? Mary purchased a personal-use car for $25,000 in 2019. Of the $25,000 purchase price, Mary paid $20,000 cash and the rest was paid by a $5,000 auto loan that Mary took out at SAFE Credit Union. While she owned the car, Mary paid $2,000 to have the car maintained. Mary also paid $4,000 to replace the car's engine. This year, Mary was able to sell the used car for $48,000 due to inflation and supply chain constraints. Mary paid $1,000 in selling expenses. The buyer assumed Mary's remaining outstanding debt on the car (which at that point was $2,000 ). What is the amount of Mary's realized gain or loss? Instead, assume that Mary sold the car for $5,000 and paid no selling expenses. In this scenario, the buyer did not assume any of Mary's debt. What is the amount of Mary's realized gain or loss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started