Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q15 miscellaneous payments, followed by a 'Remark column. In the miscellaneous (sundry expenses) column, such payments are recorded for which separate columns do not exist

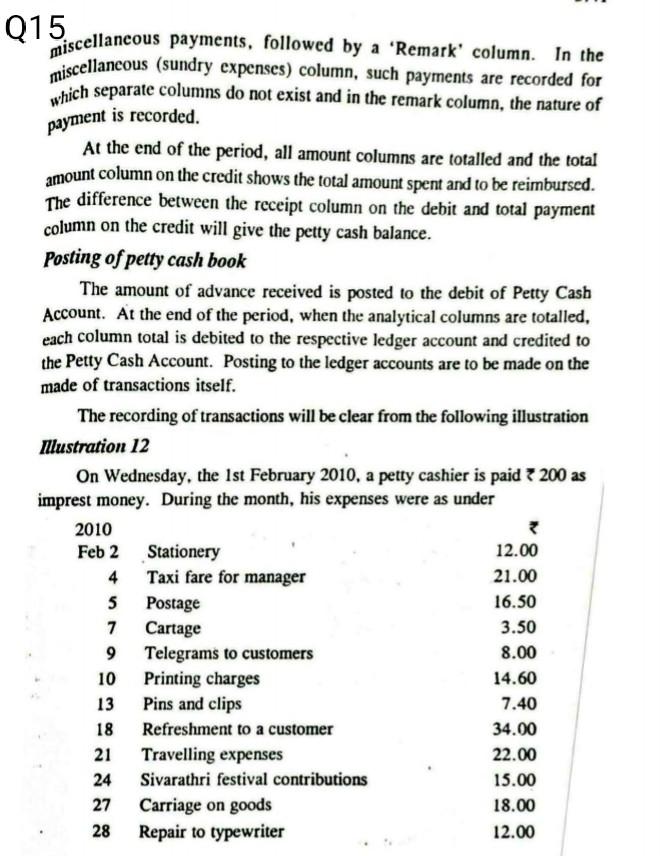

Q15 miscellaneous payments, followed by a 'Remark column. In the miscellaneous (sundry expenses) column, such payments are recorded for which separate columns do not exist and in the remark column, the nature of payment is recorded. At the end of the period, all amount columns are totalled and the total amount column on the credit shows the total amount spent and to be reimbursed. The difference between the receipt column on the debit and total payment column on the credit will give the petty cash balance. Posting of petty cash book The amount of advance received is posted to the debit of Petty Cash Account. At the end of the period, when the analytical columns are totalled, each column total is debited to the respective ledger account and credited to the Petty Cash Account. Posting to the ledger accounts are to be made on the made of transactions itself. The recording of transactions will be clear from the following illustration Ilustration 12 On Wednesday, the 1st February 2010, a petty cashier is paid 7 200 as imprest money. During the month, his expenses were as under 2010 Feb 2 Stationery 12.00 4 Taxi fare for manager 21.00 5 Postage 16.50 7 Cartage 3.50 9 Telegrams to customers 8.00 10 Printing charges 14.60 13 Pins and clips 7.40 18 Refreshment to a customer 34.00 Travelling expenses 22.00 24 Sivarathri festival contributions 15.00 27 Carriage on goods 18.00 28 Repair to typewriter 12.00 21

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started