Answered step by step

Verified Expert Solution

Question

1 Approved Answer

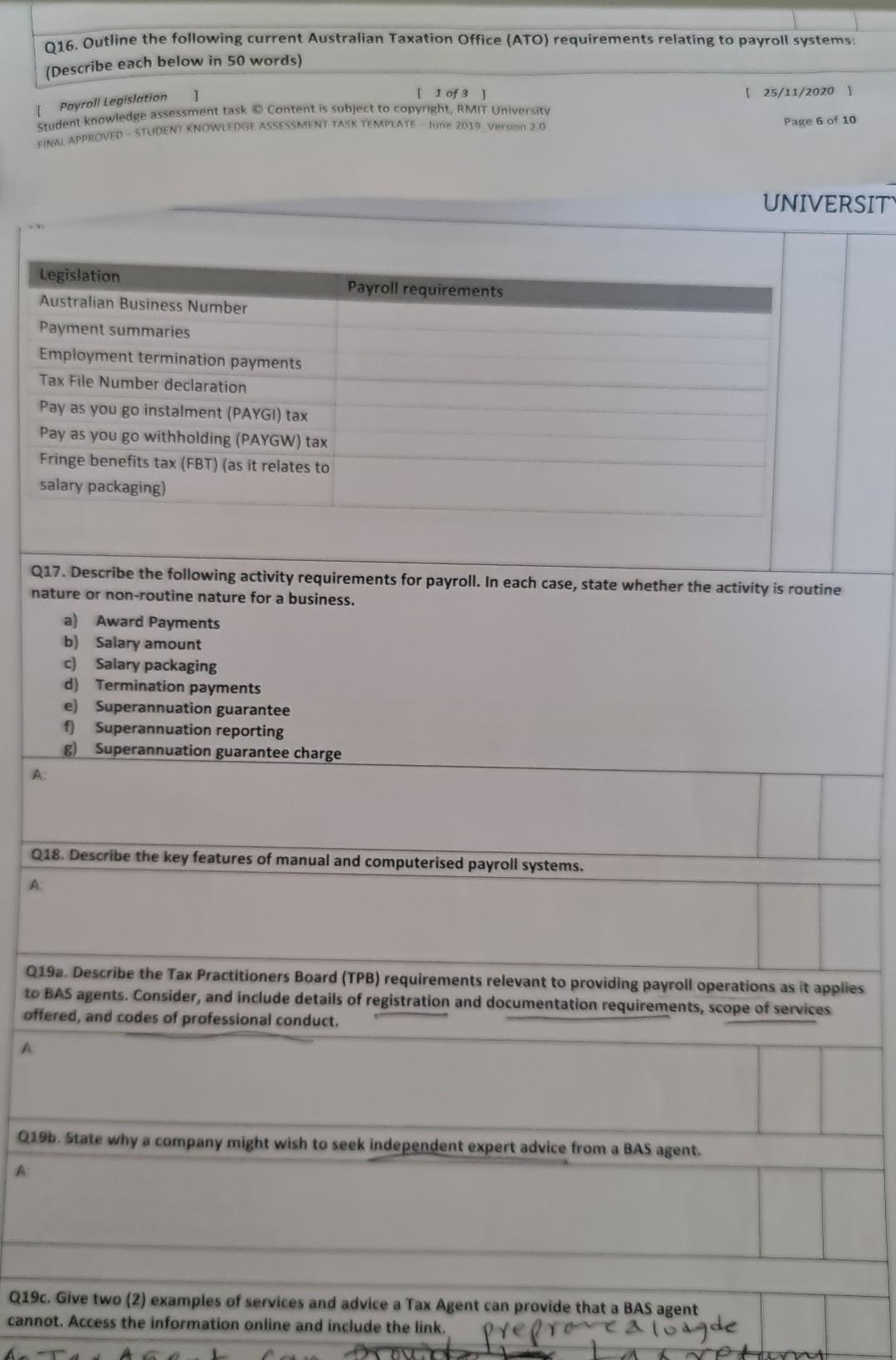

Q16. Outline the following current Australian Taxation Office (ATO) requirements relating to payroll systems: (Describe each below in 50 words) 1 of 3) [25/11/2020 I

Q16. Outline the following current Australian Taxation Office (ATO) requirements relating to payroll systems: (Describe each below in 50 words) 1 of 3) [25/11/2020 I Payroll Legislation 1 Student knowledge assessment task O Content is subject to copyright, RMIT University Page 6 of 10 SINAL APPROVED - STUDENT KNOWLEDGE ASSESSMENT TASK TEMPLATE 2019 Version 2.0 UNIVERSITI Payroll requirements Legislation Australian Business Number Payment summaries Employment termination payments Tax File Number declaration Pay as you go instalment (PAYGI) tax Pay as you go withholding (PAYGW) tax Fringe benefits tax (FBT) (as it relates to salary packaging) Q17. Describe the following activity requirements for payroll. In each case, state whether the activity is routine nature or non-routine nature for a business. a) Award Payments b) Salary amount c) Salary packaging d) Termination payments e) Superannuation guarantee f) Superannuation reporting g) Superannuation guarantee charge A Q18. Describe the key features of manual and computerised payroll systems. . Q19a. Describe the Tax Practitioners Board (TPB) requirements relevant to providing payroll operations as it applies to BAS agents. Consider, and include details of registration and documentation requirements, scope of services offered, and codes of professional conduct. A Q19b. State why a company might wish to seek independent expert advice from a BAS agent. Q19c. Give two (2) examples of services and advice a Tax Agent can provide that a BAS agent cannot. Access the information online and include the link. yet rove a lodgde

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started